...........Regulatory Capture - 2016 Campaign Issue............

Regulatory Capture is a form of political corruption

Regulatory Capture

Wikipedia

Regulatory capture is a form of political corruption that occurs when a

regulatory agency, created to act in the public interest, instead advances the commercial or political concerns of

special interest groups that dominate the industry or sector it is charged with regulating.[1] Regulatory capture is a form

of government failure; it creates an opening for firms or political groups to behave in ways injurious to the public

(e.g., producing negative externalities). The agencies are called "captured agencies".

Lobbyists, Bearing Gifts, Pursue Attorneys General-NYT

____________________________________________________

Study: United States is an oligarchy, not a democracy

____________________________________________________

Study: US is an oligarchy, not a democracy

BBC News

The US is dominated by a rich and powerful elite.

So concludes a recent study by Princeton University Prof Martin Gilens and Northwestern University Prof Benjamin I Page.

This is not news, you say.

Perhaps, but the two professors have conducted exhaustive research to try to present data-driven support for this conclusion. Here's how they explain it:

Multivariate analysis indicates that economic elites and organised groups representing business interests have substantial independent impacts on US government policy, while average citizens and mass-based interest groups have little or no independent influence.

In English: the wealthy few move policy, while the average American has little power.

The two professors came to this conclusion after reviewing answers to 1,779 survey questions asked between 1981 and 2002 on public policy issues. They broke the responses down by income level, and then determined how often certain income levels and organised interest groups saw their policy preferences enacted.

"A proposed policy change with low support among economically elite Americans (one-out-of-five in favour) is adopted only about 18% of the time," they write, "while a proposed change with high support (four-out-of-five in favour) is adopted about 45% of the time."

On the other hand:

When a majority of citizens disagrees with economic elites and/or with organised interests, they generally lose. Moreover, because of the strong status quo bias built into the US political system, even when fairly large majorities of Americans favour policy change, they generally do not get it.

They conclude:

Americans do enjoy many features central to democratic governance, such as regular elections, freedom of speech and association and a widespread (if still contested) franchise. But we believe that if policymaking is dominated by powerful business organisations and a small number of affluent Americans, then America's claims to being a democratic society are seriously threatened.

Eric Zuess, writing in Counterpunch, isn't surprised by the survey's results.

"American democracy is a sham, no matter how much it's pumped by the oligarchs who run the country (and who control the nation's "news" media)," he writes. "The US, in other words, is basically similar to Russia or most other dubious 'electoral' 'democratic' countries. We weren't formerly, but we clearly are now."

This is the "Duh Report", says Death and Taxes magazine's Robyn Pennacchia. Maybe, she writes, Americans should just accept their fate.

"Perhaps we ought to suck it up, admit we have a classist society and do like England where we have a House of Lords and a House of Commoners," she writes, "instead of pretending as though we all have some kind of equal opportunity here." Read more

Link to free PDF of the study by Martin Gilens and Benjamin I. Page, Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens.

US Is an Oligarchy Not a Democracy, says Scientific Study, Common Dreams

Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens

Oligarchy

Wikipedia

Oligarchy is a form of power structure in which power effectively rests with a small number of people. These people might be distinguished by royalty, wealth, family ties, education, corporate, religious or military control. Such states are often controlled by a few prominent families who typically pass their influence from one generation to the next, but inheritance is not a necessary condition for the application of this term. Read more

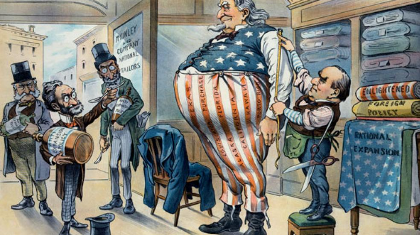

Presidency of Theodore Roosevelt

Wikipedia

The Presidency of Theodore Roosevelt was the executive branch of the United States government from September 14, 1901 to March 4, 1909....

...Owing to his charismatic personality, his extremely high energy levels and span of interests, and his reformist policies, which he called the "Square Deal", Roosevelt is considered one of the ablest presidents and an icon of the Progressive Era...

...He distrusted wealthy businessmen and dissolved 44 monopolistic corporations as a "trust buster." He took care, however, to show that he did not disagree with trusts and capitalism in principle, but was only against their corrupt, illegal practices...Read more on PBS

TR Center - Theodore Roosevelt - The Sherman Anti-Trust Act of 1890 became law while Theodore Roosevelt was serving on the U.S. Civil Service Commission, but it played a large and important role during his presidency.

Opinion: We also live in a Republic, not a Democracy. Recall your Pledge of Allegiance:

I pledge allegiance to the Flag of the United States of America, and to the Republic for which it stands, one Nation under God, indivisible, with liberty and justice for all.

We Americans currently live in a Republican Oligarchy.

Banks Got Bailed Out, Homeowners Got Sold Out — and the Feds Made a Killing

Banks Got Bailed Out, Homeowners Got Sold Out — and

the Feds Made a Killing

The Fiscal Times

By David Dayen

March 11, 2016

You wouldn’t think that anyone could look at the calamity of the foreclosure crisis, where fraudulent mortgage origination, fraudulent securitizations, fraudulent loan servicing and fraudulent evictions combined to dispossess 6 million Americans from their homes, and see it as a money-making opportunity. Well, nobody except for perhaps Donald Trump. But a news investigation into the aftermath of the crisis shows that the U.S. government did turn a profit on after-the-fact enforcement of these interlocking frauds, without distributing those profits to the homeowner victims. We can add a clause to the famed Occupy Wall Street chant: Banks got bailed out, we got sold out and the government made a killing. Read more

Capitalism at the Crossroads - Hernando de Soto

An Honest Legal System Matters: Trickle-up Economics

Judicial Discipline Reform

Dr. Richard Cordero, Esq.

If you believe that judges’ are held unaccountable and risklessly dispense with due process and equal protection of the law for their convenience and gain, depriving you, your family, friends, and the rest of us in our country of our property, liberty, and the rights and duties that shape our lives, forward this email to both candidates. Read more

Has a Federal Judgeship Become a Safe Haven for Coordinated Wrongdoing? By Dr. Richard Cordero, Esq. Judicial Discipline Reform

To Fear the Fed or Not, Wharton Magazine Winter 2016

Wharton Magazine

By Peter Conti-Brown

The Federal Reserve’s authority over the financial system and the money supply is expansive. That power deserves a better public understanding—even

engagement.

There is an old story, perhaps apocryphal, in which a newly appointed member of the Board of Governors of the U.S. Federal Reserve System was greeted by the Fed Chair with an apologetic explanation of the new governor’s status. The chair predicted that when the man introduced himself back home to his friends and family as a "governor of the Federal Reserve," they were likely to think he was the administrator of the U.S. government’s unexplored Western forests.

There was a time when that story was funny. The Fed used to be an obscure, backwater government agency. The general public didn’t really know what the Fed was about—and probably didn’t much care. Even for those who paid attention to the economy, until roughly the early 1960s, the prevailing view was that the president and his administration were the first and last stop for economic policy.

Central banking was the hinterland; fiscal policy—the stuff of taxes and budgets and spending and deficits—the seat of power.

Bankers cared about the Fed’s obscure activities. The rest of the country wasn’t paying attention.

That story used to work. It doesn’t any more. Today, it’s not just bankers who are paying attention. Over the last 30 years—and especially since the global financial crisis of 2008—the Fed has become the target of an extraordinary proliferation of scrutiny, praise and condemnation. Read more

Saving Capitalism From Death - Wharton Magazine

Essay: Saving Capitalism From Death Wharton Magazine

By Anthony W. Orlando

Economic inequality is the great business challenge of our time.

American business leaders rallied around Franklin Delano Roosevelt in 1932 during his candidacy for the presidency, after which he immediately embarked on the most progressive legislative agenda in U.S. history to tackle the Great Depression. From today’s vantage point, it may seem surprising that titans of industry, executives from General Electric to Standard Oil to IBM, not only contributed to Roosevelt’s campaign but helped author many of his famous New Deal reforms. To the men who ran these companies, it was a simple matter of fiduciary responsibility—to current shareholders and to future ones—that they should ensure a more equitable distribution of prosperity, lest their own wealth be dashed to bits on the jagged rocks of a shrinking economy.

Today, we face a similar predicament. The great challenge of business in our time is reversing the destabilizing threat of inequality. While at first this may seem anathema to our profit-maximizing mission, distribution of income lies at the very heart of sustainable capitalism. Read more

........Why America Should Declare Bankruptcy Now.......

Why America Should Declare Bankruptcy Now

The Fiscal Times

By Peter Schiff

May 22, 2012

If the U.S. government were a private company being audited by standard practices, it would be considered much further in the red than official national debt figures show. It would, in fact, be shut down and its key executive prosecuted for fraud.

The national debt is $15 trillion. Let me try to put that huge number in perspective.

All federal tax revenue in 2011 was $2.2 trillion — less than one sixth of the total national debt. The $15 trillion debt amounts to $133,000 per taxpayer. The richest person in America, Bill Gates, has a total net worth of $59 billion. If he donated every dime to the U.S. Treasury in order to pay down the national debt, he couldn’t even retire one half of one percent of the debt. Put another way, he could pay two months’ of interest.

In fiscal year 2011, taxpayers paid $454 billion in interest. That’s 20 percent of all federal receipts. It’s more than twice as much as Washington collected through the corporate income tax.

National Debt: America’s Declaration of Dependence

National Debt: America’s Declaration of Dependence

The Fiscal Times

By Edward Morrissey

February 2, 2012

How bad have our budget woes become? The Congressional Budget Office announced earlier this week that the US will incur its fourth straight trillion-dollar-plus

annual budget deficit … and the media treated it as good news. The Newsday headline read, "Budget deficit to dip to $1.1T, CBO says." The Washington Post informed readers that the 2012

deficit would be the "smallest since ’09."

It’s tempting to say that I can remember a time when a $500 billion budget deficit was greeted with shock, anger, and criticism, but it’s not saying much. My nine-year-old granddaughter can

remember that time, too.

That does not mean that the CBO report had nothing but bad news. The report does project that annual budget deficits will "decline markedly" in the next ten years after this budget cycle, to as little as $200 billion a year and 1.5 percent of GDP, both very manageable levels of deficit spending. How will this miracle occur? According to current law, which is the only guide that the CBO can use, the Bush-era tax rates will expire across the board, and the Alternative Minimum Tax will not be restrained from reaching far into the middle class. The latter change will increase the number of American households subject to the AMT from four million in tax year 2011 to thirty million in tax year 2012. If readers can imagine any Congress subjecting middle-class voters to that kind of a tax shock in a single year, then this will sound like very good news indeed. Otherwise, this is an exercise in irony. Read more

The Unstoppable March Toward National Bankruptcy: Who's To Blame? Forbes, by Mark Hendrickson

The Unstoppable March Toward National

Bankruptcy: Who's To Blame?

Forbes/Opinion

Mark Hendrickson, Contributor

Oct 11, 2012

The opening line of the Beatles’ iconic "Sergeant Pepper’s" album is echoing in my thought: "It was 20 years ago today…" Well, not quite to the day, but 20 years ago I published an article titled, "$4 Trillion and Counting." In it, I despaired at the rapid increase in the national debt from its first-ever crossing of the $1 trillion mark during the Reagan presidency to four times that gargantuan amount in only a decade.

Today, a mere two decades later, we have quadrupled the national debt again, to $16 trillion. (That figure represents the official national debt, but if you add the many "off-budget" items and all the liabilities that are conveniently omitted from government "accounting," then it’s multiples of the official number.)

Who is to blame? Read more

Debt jubilee: Revolutionary change or reform to stabilize capitalism?

Debt jubilee: Revolutionary change or reform to stabilize capitalism?

By Systemic Disorder

“Quantitative easing” is a government program of massive buying of assets from banks in an effort to promote increased lending and liquidity through increasing the money supply. A “quantitative easing for the public” would give money to everybody. Those with no debt would be free to spend it as they wish, and those who received more money than the size of their debt would similarly have no obligations once they wiped out their debt. Read more

Jubilee Debt Campaign - jubileedebt.org.uk/

Economic Justice

Jubilee Debt.org

Inspired by the ancient idea of jubilee, a time when debts were cancelled, slaves were freed and land was redistributed, we are calling for a new debt jubilee in response to today’s global economic crisis: a Jubilee for Justice. Read more

Vulture Funds are financial speculators looking to profiteering from countries in debt crisis. From Zambia to Congo to Peru, they’ve swooped to demand full payment plus interest for debts they’ve bought up for pennies in the pound. But we’re winning the global fight to clip the vultures’ wings. Join us. Read more

The Tax Justice Network is an independent international network launched in 2003. We are dedicated to high-level research, analysis and advocacy in the area of international tax and the international aspects of financial regulation. We map, analyse and explain the role of tax and the harmful impacts of tax evasion, tax avoidance, tax competition and tax havens. The world of offshore tax havens is a particular focus of our work. Read more

War on Want - fighting global poverty

War on Want fights against the root causes of poverty and human rights violation, as part of the worldwide movement for global justice. Read more

We believe that everyone has the right to feed their families, make a decent living and protect their environment. But the rich and powerful are pursuing trade policies that put profits before the needs of people and the planet. To end poverty and protect the environment we need Trade Justice, not free trade. Read more

Global Justice Now is a democratic social justice organisation working as part of a global movement to challenge the powerful and create a more just and equal world. Read more

Scarcity: Why having too little means so much

Not only are the poor disproportionately exploited, the very fact of being poor creates extraordinary vulnerability to countless major and minor daily roadblocks. Recent research by Sendhil Mullainathan of Harvard and Eldar Shafir of Princeton demonstrates that there is a strong connection between scarce resources and cognition: The more a person struggles financially, the less he or she can channel brain processes to completing other tasks. When you can’t make ends meet, the weight of worry occupies a large portion of the mind. Read more

Scarcity: Why Having Too Little Means So Much, Harvard link