Wesley Snipes income tax trial Ocala, Florida

Wesley Snipes Gets 3 Years for Not Filing Tax Returns

Wesley Snipes Gets 3 Years for Not Filing Tax Returns

NEW YORK TIMES REGIONAL NEWSPAPERS

Published: April 25, 2008

OCALA, Fla. — A federal judge on Thursday sentenced the actor Wesley Snipes to three years in prison for willfully failing to file tax returns.

Mr. Snipes, who was convicted in February, received one year for each count, to be served consecutively, and an additional year of probation. The sentence was handed down by Judge William Terrell Hodges of Federal District Court.

Mr. Snipes, who apologized for his actions before the sentence was announced, showed no immediate reaction to the verdict.

Judge Hodges allowed Mr. Snipes and a co-defendant, Douglas Rosile, to remain free on bond until they were summoned by either the United States Marshals Service or the Federal Bureau of Prisons.

The sentencing came at the end of a daylong hearing in which lawyers for Mr. Snipes argued for leniency while federal prosecutors sought the maximum penalty possible.

The case was the most prominent tax prosecution since the billionaire hotelier Leona Helmsley was convicted of tax fraud in 1989. Mr. Snipes, who has built a worldwide following acting in films like the "Blade" vampire trilogy, must pay up to $17 million in back taxes plus penalties and interest.

In a prepared statement, Mr. Snipes said: "I’m very sorry for my mistakes. I acknowledge that I have failed myself and others." But in the statement, which ran to nearly 10 minutes, Mr. Snipes never mentioned the words "tax" or "taxes."

"He never stated he didn’t pay his taxes or show any remorse for it," said Robert O’Neill, the acting United States attorney for the Middle District of Florida, the lead prosecutor on the case.

Mr. Snipes even tried to make a down payment on his taxes before sentencing; his legal team offered Judge Hodges three checks totaling $5 million.

Judge Hodges refused the checks, saying he did not have the authority to accept them. Prosecutors also declined to accept the checks. An Internal Revenue Service employee eventually accepted the checks on behalf of the Treasury Department. Read more

Wesley Snipes Gets 3 Years for Not Filin[...]

Adobe Acrobat document [43.1 KB]

Judge sentences Snipes to 3 years for tax convictions

Judge sentences Snipes to 3 years for tax convictions

By Travis Reed

Associated Press Writer

April 25, 2008

U.S. District Judge William Terrell Hodges saw in Snipes "a history of contempt" for U.S. tax laws, the judge said at sentencing.

OCALA, Fla. — Wesley Snipes called on famous friends to vouch for him, highlighted his clean criminal record and even wrote the government $5 million in checks — all

in an effort to convince a judge that his conviction on tax charges should cost him nothing more than home detention and some public service announcements.

None of it worked. The Blade actor is doing hard time.

Snipes was sentenced to three years in prison Thursday for failing to file tax returns, the maximum penalty — and a victory for prosecutors who sought to make an example

of the action star.

Snipes' lawyers had spent much of the day in court offering dozens of letters from family members, friends — even fellow actors Woody Harrelson and Denzel Washington —

attesting to his good character. His attorneys recommended he be given home detention and ordered to make public service announcements because his three convictions were all misdemeanors and the

actor had no previous criminal record.

But U.S. District Judge William Terrell Hodges said Snipes exhibited a "history of contempt over a period of time" for U.S. tax laws, and granted prosecutors the

three-year sentence they requested — one year for each of Snipes' convictions of willfully failing to file a tax return from 1999-2001.

"In my mind these are serious crimes, albeit misdemeanors," Hodges said. Read more

Judge sentences Snipes to 3 years for ta[...]

Adobe Acrobat document [110.2 KB]

Wesley Snipes - American actor, film producer

Wesley Snipes

Wikipedia

Wesley Trent Snipes (born July 31, 1962) is an American actor, film producer and martial artist.

He is best known for his role as the Marvel Comics character Blade in the Blade film trilogy. He formed a production company, Amen-Ra Films, in 1991, and a subsidiary,

Black Dot Media, to develop projects for film and television. He has been training in martial arts since the age of 12, earning a 5th dan black belt in Shotokan

Karate and 2nd dan black belt in Hapkido.[1]. Read

more

Wesley Snipes acquitted of federal tax fraud

Wesley Snipes acquitted of federal tax fraud

Associated Press

February 1, 2008

Actor also not guilty of conspiracy but convicted for failing to file returns

OCALA, Fla. — Action star Wesley Snipes was found not guilty of federal tax-fraud and conspiracy charges Friday, but was convicted on three misdemeanor counts of failing

to file a tax return.

Snipes had faced up to 16 years in prison if convicted on all charges, but can now only get up to three years. The "Blade" star and two co-defendants had been indicted in

2006 after Snipes stopped paying, using tax protest arguments long rejected by the courts.

Snipes sat emotionless as his verdict was read, then nodded in relief. He refused to talk with reporters after the verdict, and is still liable for millions in taxes

likely to be pursued in civil court.

"Mr. Snipes has always been committed to doing the right thing, and after this trial is over he’ll make whatever amends are required," defense attorney Robert Bernhoft

said. "But this is a man of integrity."

Snipes’ lawyers argued that he was a victim of crooked advisers, and the jury seemed to believe it. Co-defendants Eddie Ray Kahn, the founder of a tax protest group, and

Douglas P. Rosile, an accountant who lost his licenses, were convicted Friday by the same panel of tax fraud and conspiracy. Both face up to 10 years in prison.

The government said Snipes failed to file tax returns from 1999 to 2004, a period in which he signed two contracts for more than $10 million on sequels in the "Blade"

trilogy.

The actor, who also appeared in "White Men Can’t Jump," is among the most famous targets of an IRS criminal investigation, and his prosecution was key for the

government.

"We thought there was sufficient evidence for a conviction on all counts, but obviously the jury disagreed," U.S. Attorney Robert O’Neill said. Read more

Wesley Snipes acquitted of federal tax f[...]

Adobe Acrobat document [113.0 KB]

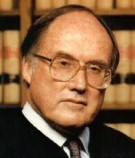

William Terrell Hodges - Wikipedia

William Terrell Hodges

Wikipedia

William Terrell Hodges (born April 28, 1934) is an American lawyer and federal judge.[1]

Hodges was born in 1934 in Lake Wales, Florida. He received his Bachelor of Science in Business Administration degree from the University of Florida in 1956 and his J.D. from the University of Florida College of Law in 1956.

Hodges was in private practice in Tampa from 1958 to 1971. He served as an instructor in business at the University of South Florida from 1961 to 1966.

President Richard Nixon nominated Hodges on December 8, 1971 to the United States District Court for the Middle District of Florida, to a seat vacated by Joseph P. Lieb. Confirmed by the Senate on December 11, 1971, he received commission four days later.

Hodges served as chief judge from 1982 to 1989 and assumed senior status on May 2,

1999.

Hodges presided over the 2008 trial of celebrity actor Wesley Snipes for failure to file personal income tax returns (Not to be confused with tax evasion). Snipes was convicted on three misdemeanor charges, however Judge Hodges sentenced Snipes to three years in prison and an additional year of probation. Hodges controversial decision raises a number a legal questions in light of ignored facts and evidence related to the case.[2]

Hodges was the chair of the Judicial Panel on Multidistrict Litigation until June 13, 2007 when his term on that body ended. The current chairman of the Judicial Panel on Multidistrict Litigation is Judge John G. Heyburn II of the Western District of Kentucky. Read more

External links

1. Judicial Conference of the United States. Bicentennial Committee (1978). Judges of the United States. The Committee : for sale by the Superintendent of Documents, U.S. Government Printing Office. Retrieved 2014-10-12.

2. http://www.nytimes.com/2008/04/25/business/25snipes.html

William Terrell Hodges at the Biographical Directory of Federal Judges, a public domain publication of the Federal Judicial Center.

Letter to Chairman Bob Goodlatte (R-Va.), and Ranking Member John Conyers (D-Mich.), January 12, 2015

January 12, 2015

Re: Judicial Conduct & Disability, U.S. Eleventh Circuit, Middle District FL, SCOTUS

Dear Chairman Goodlatte, and Ranking Member Conyers:

This letter concerns corruption in the U.S. Eleventh Circuit Court of Appeals, and the Middle District of Florida, that apparently corrupted my 2 petitions to the U.S. Supreme Court. I read your letter to Chief Judge Ed Carnes and Judge Gerald Tjoflat; that just scratches the surface.

Of immediate concern is an Order June 25, 2013 authorizing a petition under 28 USC 1651, the all writs act, in Case 13-11585-B, Reverse Mortgage Solutions v Neil J. Gillespie et al. Please find enclosed my letter today to Chief Judge Ed Carnes, and getting this case back in federal court. Currently the case is in Marion County Florida, 42-2013-CA-000115-AXXX-XX

I properly removed case 42-2013-CA-000115-AXXX-XX to the Middle District of Florida, Ocala Division, February 4, 2013, case 5:13-cv-00058-WTH-PRL, Judge Hodges presiding.

Judge William Terrell Hodges, a shareholder in Bank of America, refused to disqualify himself as required under 28 U.S.C. § 455(a) in the wrongful foreclosure of my home on a HECM reverse mortgage owned by Bank of America. Judge Hodges then proceeded to deny me due process in a case properly removed from Marion County Florida to the District Court.

This is the third case where Judge Hodges has acted with bias against me as a person with a disability. Judge Hodges and The Florida Bar have poisoned the Eleventh Circuit against me. I did not get a fair hearing in No. 12-11028-B and No. 12-11213 when Circuit Judge Charles R. Wilson failed to disqualify himself as required under 28 U.S.C. § 455(a). Judge Wilson, Duty Station Tampa Florida (13th Judicial Circuit Florida) made rulings in my case against the 13th Judicial Circuit Florida, sometimes as the only judge, a panel of one, that is against the rules.

- Enclosed is a letter from Unit Chief Brian J. Nadeau, FBI Headquarters, April 11, 2014. I have been providing information to Paul Wysopal Special Agent in Charge, FBI Tampa Field Office, and Michelle S. Klimt, Special Agent in Charge, FBI Jacksonville Field Office.

- Florida Judge Stancil’s judicial misconduct, and deprivation of my rights under color of law, shows a situation exists under 10 U.S.C. § 333, Interference with State and Federal law:

- See enclosed my letter to U.S. Attorney Arthur Lee Bentley, December 24, 2014. No reply.

- See enclosed my letter to the Senate Judiciary Committee September 4, 2014. No reply.

- See enclosed my records request to Chief Judge Manuel Menendez, Jr. November 17, 2014 about Judge Hodges’ Order of Dismissal (Doc. 64), Case 5:10-cv-00503-WTH-DAB and bribery of Florida judges and other state actors in my case. No Reply.

- See enclosed my letter to The Honorable John G. Roberts, Jr. March 5, 2014. No Reply.

- See enclosed my letter to Robin Ashton, OPR Counsel and Deputy Secretary-General Eliasson.

- See enclosed my records request to the United Nations May 18, 2014. No Reply.

A story published November 13th, 2012 by Richard Goldstein on FlaLawOnline would cause a reasonable person to conclude federal judges of the Eleventh Circuit and Middle District Florida routinely violate the civil rights of ordinary people, and fail to uphold their oath of office, fail to administer justice without respect to persons, and fail to do equal right to the poor and to the rich, and fail to faithfully and impartially discharge and perform all the duties incumbent upon them as a federal judge, and routinely disregard the Constitution and laws of the United States.

See, Judge Hodges honored at reception, by Richard Goldstein, paper copy enclosed.

http://www.law.ufl.edu/flalaw/2012/11/judge-hodges-honored-at-reception/

Still, one story of the way Hodges exercised power elicited knowing laughter from the audience that included UF Law students.

Judge Gerald Bard Tjoflat of the 11th U.S. Circuit Court of Appeals explained that Tampa maintained a bus stop immediately in front of the courthouse steps while Hodges was chief judge of the middle district during the 1980s.

"The city of Tampa had a bus system and they had a monstrous bus stop at the base of the old federal courthouse in Tampa. All the buses came there and the jurors would have trouble getting up there" to the courthouse, Tjoflat said.

Hodges sent a letter to the mayor demanding that the bus stop be moved. When no action ensued, Tjoflat said, federal marshals dismantled the offending public transportation facility with blow torches.

Sitting on a dais with Tjoflat, Hodges accepted laconically the stories and praise offered during the "Toast to Judge Hodges" event.

"That was the result of deputies who volunteered; no order was given so it was unappealable," Hodges deadpanned.

I rode that bus when I lived in Tampa. People like me who ride the bus are held in contempt by Judge Hodges, Judge Tjoflat, and the UF Law students. Public records provided by the bus company include the correspondence of Judge Hodges. Contemporaneous news accounts also confirm the story is factual. Therefore, there is evidence that Judge Hodges engaged in bad behavior, and under Article III should be removed from office.

Additional evidence in other matters also shows Judge Hodges should be removed from office, but there is a limit physically and financially to the amount of paper I can send you by UPS.

I am disabled with traumatic brain injury, diabetes, and other issues, see enclosed readings from my diabetes meter last week showing evidence of disabling levels of blood glucose, and:

- Social Security Admin disability notice letter August 23, 1993

- Social Security Admin disability letter August 1, 2012, no review needed

- ER report Hahnemann U. Hospital Phila, Aug-20-1988, 661k

- C.A.11-No.12-11213-C Amended Disability Motion-Aug-06-2012, PDF

- ABA Journal, Brain injury suspension for lawyer; couldn't stick to tasks (comp)

I am willing to communicate with the House Judiciary Committee, and I request an email address to do so. I am indigent and limited in the paper documents I can ship to you. Thank you.

Sincerely,

Neil J. Gillespie

House-Judiciary-Committee-January-12-201[...]

Adobe Acrobat document [899.9 KB]

Judge Hodges letter March 22, 1985 to GS[...]

Adobe Acrobat document [55.5 KB]

Judge Hodges letter May 1, 1985 to HART[...]

Adobe Acrobat document [17.6 KB]

In Neil J. Gillespie v. HSBC North America Holdings, Judge Hodges found I stated a cause of action, see the Order at the link and below in PDF.

ORDER, Case 5:05-cv-00362-WTH-GRJ Document 32 Filed 09/25/06 Page 1 of 22.

I take that ruling as evidence of my white privilege in court. The case shows my inability to competently manage money and credit cards, which I believe is due to disability. Eventually I prevailed, but only at a great expense of time, money and energy. That is the nature of my disability, eventually I may succeed, but with extraordinary costs.

ORDER, Case 5.05-cv-00362-WTH-GRJ Docume[...]

Adobe Acrobat document [66.0 KB]

However I did not get a white privilege ruling from Judge Hodges in his Order of Dismissal (Doc. 64), Case 5:10-cv-00503-WTH-DAB and bribery of Florida judges and other state actors in my case. Tellingly Judge Hodges' Order of Dismissal failes to acknowledge my case as a section 1983 civil rights lawsuit. See my records request to Chief Judge Manuel Menendez, Jr. November 17, 2014.

Records-Request-Chief-Judge-Manuel-Menen[...]

Adobe Acrobat document [1.1 MB]

Notice of Hunger Strike, Gillespie v. Thirteenth Judicial Circuit Florida et al., Case No. 5:11-cv-00539-WTH-TBS, United States District Court, Middle District, Florida, Ocala Division.

U.S. Judge William Terrell Hodges, Senior Status, presiding, with referral to U.S. Magistrate Judge Thomas B. Smith

Wesley Snipes to Go on Trial in Tax Case

Actor Wesley Snipes with his press assistant Judy Smith in December 2006. The 45-year-old action star is set to go on trial Monday, Jan. 14, 2008, on tax fraud and conspiracy charges.

Actor Wesley Snipes with his press assistant Judy Smith in December 2006. The 45-year-old action star is set to go on trial Monday, Jan. 14, 2008, on tax fraud and conspiracy charges.

Wesley Snipes to Go on Trial in Tax Case

The New York Times

By DAVID CAY JOHNSTON

Published: January 14, 2008

Correction Appended

From 1999 to 2004, the actor Wesley Snipes earned $38 million appearing in more than half a dozen movies, including two sequels to his popular vampire thriller "Blade."

The taxes he paid in the same period? Zero.

But unlike other celebrities who find themselves on the wrong side of the Internal Revenue Service, Mr. Snipes has a flamboyant explanation: he argues that he is not actually required to pay taxes.

Mr. Snipes, who is scheduled to go on trial Monday in Ocala, Fla., has become an unlikely public face for the antitax movement, whose members maintain that Americans are not obligated to pay income taxes and that the government extracts taxes from its citizens illegally.

His trial has become the most prominent income tax prosecution since the 1989 conviction of the billionaire New York hotelier, Leona Helmsley, who went to prison for improperly billing personal expenses to her business. Read more

Wesley Snipes to Go on Trial in Tax Case[...]

Adobe Acrobat document [45.4 KB]

Jim FAIR v. W. T. HODGES, Petition no. 71-6883 SCOTUS

Jim FAIR v. W. T. HODGES et al., respondents.

Petition No. 71-6883 U.S. Supreme Court.

Fair v Hodges was a 1971 citizen challenge to the investiture of William Terrell Hodges as federal judge with a lifetime appointment.

Below is the text from Petition No. 71-6883

6_18_72

71-6883 RECEIVED

Jun 21 1972

IN THE SUPREME COURT, U.S. Office of the Clerk

Supreme Court, U.S.

JIM FAIR, PETITIONER,

VS.

W.T.HODGES, AND

U.S. GOVERNMENT,

RESPONDENTS. APPEAL, OR

PETITION FOR A WRIT OF CERTIOARI

TO THE U.S. COURT OF APPEALS, 5TH CIRCUIT

AND TO THE U.S. DISTRICT COURT, MID. FLA., TAMPA DIV.

Pro Se, Petitioner prays that a writ of Certiorari issue to review the U.S. Court of Appeals, Fifth Circuit, order denying pauperis proceedings and, thereby, review the U.S. District Court, Middle District of Florida, Tampa Division, order, said orders being unreported. They are appended. Or he appeals.

Jurisdiction is here sustained, as said Appeals Court Order was entered Mar. 24, 1972; and as such is allowed by 28 U.S.C. ss-1254(I); 2 U.S.C. ss 1 & 7; ss 1981, 1983, & 1988; 28; ss 1331, 1343(3) & (4), 2201 & 2202 & 2281; and 42, ss 1988 – or other un-known to lay person petitioner. This action was brought below by plaintiff-petitioner maintaining he was denied due process and equal protection of laws. and a Republican form of Gov’t. U.S. Constitution, 14th Amend. and Art. IV, Sec. 4. Also, he is maintaining he was denied his 1st Amendment right to petition for redress of grievance.

QUESTIONS PRESENTED - I. Whether U.S. Supreme Court Justice nominees should be inflicted by greater, lengthier public exposure than U.S. District Court judge nominees?

2. Whether three days or three months between President’s nomination and Senate’s confirmation of such judge protects Constitutional rights?

3. Whether a class action as to citizens and judges maintains?

4. Whether a citizen’s sincere action seeking guidelines as to minimum time between a judge’s nomination and confirmation is meritless?

5. Whether in forma pauperis proceedings are a right?

2. 6_18_72

The case arose out of President Nixon’s nomination of respondent W.T. Hodges to be judge of the U.S. District Court, Middle District of Florida, Tampa Division. In 1971, he nominated him Dec. 8th and the U.S. Senate confirmed him Dec. 11th - for a life - time job.

Upon learning of said nomination the petitioner, Jim Fair,

who works solely within the system pursuing social justice

and who looks to judges for relief from vested interests "unjust

laws," phoned one U.S. Senator in deep concern about the appointee, as set out in complaint made part hereof, appended, but by the hasty confirmation was prevented further petitioning for redress of

his grievances. As the swearing in of said nominee was upcoming, petitioner sued in the concerned District Court which denied a temporary restraining order and dismissed the action, one naming as

respondent the U.S. Government.

Petitioner sought to proceed and to appeal in forma pauperis,

and in good faith, only to be denied this right of due process.

He established federal jurisdiction in the court of first instance

by setting forth denials of due process, equal protection and

Republican form of government, and therein naming as defendant the U.S. Government. He paid for docketing and for service, though

he could not afford to do so, as in good faith he seeks needed

guidelines "prospectively in future nominations," as prayed below.

REASONS FOR GRANTING THE WRIT ARE MANIFEST. I. The Court

should decide whether only U.S. Supreme Court justices should be subject to public investigations, while District Court judges

go relatively unexposed, even uncriticized, by rubber-stamp,

cooperative U.S. senators protective of their own patronage-plum

proposals to life-time judgeships? This Court in instant case

can bring into the sunshine such young plants as will grow and

bear fruit, for a historical harvest the pride of present and future

generations of layman and lawyers alike. This Court, the

high to which lesser appointees aspire, can now show its bigness

by upholding petitioner’s contention that said proposals should

be of such quality as to withstand the elements of investigation

for a reasonable time of germination.

2. The decisions below seriously limit the intended efficacy

3. 6_18_72

of a judicial system wherein lawyers and lawyer-judges conceal

criticisms by rushing through approvals, for over four out of five

U.S. Senators are attorneys, all considered obligated more to campaign contributors than constituents in general. The decisions eliminate even outspoken criticisms across party lines, for loyalty

to

Brothers-at-the-Bar exceeds loyalty to law. Said decisions merit

from this Court and enlargement of time between President’s nomination and Senate’s confirmation, for three days’ time negates a Republican form of government, denies a right to petition the

government for a redress of grievance, and denies equal protection of law and due process rights. U.S. Con. Art. IV, Sec. IV; 1st, 14th Amend.

3. This case raises important questions as to an American’s

right as a class to judge who will become the checks and balances

against police power of the Chief Executive, against Fascist or

other legislation. It shows the need for judges to be recognized

as a class not above criticism but welcoming public scrutiny for

wholesomeness and respect it produces. It merits recognition

as a class action productive of enduring guidelines, for minimal

time of public view.

4. The plaintiff-petitioner was verbally lashed unnecessarily

within the District Court’s order, though he sincerely litigated

in the public interest from righteous indignation against unchallengeable appointment, which appeared hasty and against the people’s interest. He maintains his plea should be applauded

for intent, if not for content. (He corrects now a part, having

heard another "W.T.Hodges" has the larger property on the same

lake!) He asks this Court to hold that the case has merit.

5. As a lay person striving for reasonable guidelines and

working within the system, he felt so strongly the need to enlarge nomination confirmation time, that he paid to

docket and to make service, but he could not afford appeal costs. To go on, he filed motions and affidavits in both lower courts

only to have pauperis proceedings denied. As a rich person could

4. 6_18_72

climb the ladder here, he claims he has like rights on grounds

pled below and here, by his pauperis motion-affidavit made part

hereof by reference thereto. He asks this Court to protect his

14th-Amendment rights to due process and equal protection rights, seemingly granted or denied below. Not on his insolvency status but on Court’s attitude as to issues.

Thus, petition should be granted.

Respectfully,

Jim Fair

Fair v Hodges-Petition 71-6883-SCOTUS-Ju[...]

Adobe Acrobat document [496.5 KB]

Fair v Hodges-Petition 71-6883-SCOTUS-Ju[...]

Adobe Acrobat document [372.5 KB]

Jim Fair, 1917-1991

Poor Man's Friend

WWII Navy Veteran, Annapolis Grad

Jim Fair of Tallahassee was born James Searcy Farrior on December 19, 1917 to a prominent Tampa family. Jim owned an elaborate used variety store in downtown Tampa and

advertised as the "Poor Man's Friend." He ran for various government offices and finally won as Hillsborough County Supervisor of Elections. He took off all the dead voters who kept re-electing the

'courthouse gang' and registered all comers. An Annapolis graduate who was in many Naval engagements including suffering kamikaze attacks at Okinawa. He died of leukemia June 2, 1991.

Jim Fair, Tampa Bay Legend

Every town has at least one...Jim Fair counted for ten. This decorated World War II hero returned to Tampa after the war to start Tampa's premier discount "Get It For You Wholesale" Center on South

Franklin Street, just north of where the Crosstown Expressway would eventually pass by. That was long before skyscrapers made their appearance downtown. read more

Fair-v-Hodges-1971-citizen-challenge-to-[...]

Adobe Acrobat document [3.0 MB]

Judge Hodges' Courtroom Calendar May 21, 2012

On the afternoon of May 21, 2012

I happened to be in the Golden-Collum Memorial Federal Building on business with my case, and noticed rare activity in the Ocala Division courthouse, which is usually empty, except for staff.

Judge Hodges Courtroom Calendar Monday M[...]

Adobe Acrobat document [110.9 KB]

2:00 P.M. SENTENCING

5:11-cr-34-0c-10TBS

United States of America - Phil Lammens

Claudio Salas (custody) - Rick Carey

Leonel Hernandez-Echeverria (custody) - Christine Bird

Marvin Andres Hernandez (bond) - Jeff Dowdy

Case No. 511-cr-34-0c-10TBS (4 defendants)

Docket, US v Hernandez-Echeverria, 511-c[...]

Adobe Acrobat document [82.1 KB]

3:30 P.M. SENTENCING

5:12-cr-6-0c-10TBS

United States of America - Sam Armstrong

Jose Hernandez-Santamaria (custody) - Rick Carey

Interpreter: Veronica Arenas

Case No. 512-cr-6-0c-10TBS

Docket, US v Hernandez-Santamaria, 512-c[...]

Adobe Acrobat document [24.5 KB]

4:00 P.M. SENTENCING (white privilege for white defendant)

5:11-cr-30-0c-10TBS

United States of America - Phil Lammens

Theodore Thomas Thornell, Jr. (custody) - Rick Carey

Case No. 511-cr-30-0c-10TBS

Docket, US v Theodore Thomas Thornell, 5[...]

Adobe Acrobat document [30.2 KB]

Judge Hodges ruling will likely lead to prison for Snipes

Ruling will likely lead to prison for Snipes

By Suevon

Lee

Staff writer

November 19, 2010

‘Blade' actor had appealed conviction on tax charges

Free on bail for two and a half years after being sentenced to prison on federal tax charges, Wesley Snipes was issued another edict Friday that could soon close the

walls in around him.

Snipes' appeal for a new trial and motion to interview the jurors who sealed his fate were denied. Senior U.S. District Judge William Terrell Hodges also revoked Snipes'

bail and ordered the actor to surrender to federal officials to begin serving his sentence.

"The Defendant Snipes had a fair trial; he has had a full, fair, and thorough review of his conviction and sentence by the Court of Appeals; and he has had a full, fair,

and thorough review of his present claims, during all of which he has remained at liberty," Hodges wrote in his 17-page ruling. "The time has come for the judgment to be enforced." read more

Ruling will likely lead to prison for Sn[...]

Adobe Acrobat document [32.5 KB]

Can federal juror's comment in deliberations be used to

show voir-dire dishonesty? SCOTUS to decide

ABA Journal Law News Now

By Debra Cassens Weiss

Posted Mar 04, 2014 02:45 pm CST

The U.S. Supreme Court has agreed to consider whether a federal juror’s statements during deliberations can be used to show dishonesty during voir dire.

The court agreed to hear the case on Monday, report SCOTUSblog

and the Associated Press. The plaintiff in the case is a South Dakota man who lost his leg when a truck passed him and clipped the motorcycle he was riding, according to

the cert petition (PDF). The jury found for the truck

driver.

The motorcyclist is seeking a new trial because of a juror’s revelation during deliberations that her daughter had been at fault in a similar case. The juror, who was

elected foreperson, said a suit against her daughter would have "ruined her life," another juror reported after the trial.

During voir dire, the woman had said she could be impartial.

At issue is whether statements made during deliberations are admissible under the Federal Rules of Evidence. Rule 606(b) generally bars testimony about deliberations in an inquiry about the validity of a verdict, but includes three exceptions. Two of them are at issue in the case. First,

testimony is allowed about extraneous prejudicial information that was improperly brought to the jury’s attention. Second, testimony is allowed about any outside influence brought to bear on any

juror.

The lawyer for the motorcyclist argues that the juror’s statements were being introduced to demonstrate that she had lied during voir dire, rather than to inquire into

the validity of the verdict. The lower courts disagreed, and also found that none of the exceptions allowed admission of the evidence.

The case is Warger v. Shauers. CASE UPDATE

Adjudged to be AFFIRMED. Sotomayor, J., delivered the opinion for a unanimous Court. Dec 9, 2014.

WARGER v. SHAUERS, 13-517_7l48 SCOTUS Op[...]

Adobe Acrobat document [122.6 KB]

Warger v. Shauers, petition for writ of [...]

Adobe Acrobat document [242.9 KB]

Rule 606(b) was at issue in the Wesley Snipes income tax trial, see United States v. Wesley Trent Snipes, Case 5:06-cr-00022-WTH-PRL Document 563 Filed 11/19/10 Page 1 of 17 PageID 4050, Order On Defendant’s Pending Motions, page 3,

"Late on the evening of the very day that the Court of Appeals issued its widely publicized opinion, July 16, 2010, two and a half years after the verdict, and over two

years after the imposition of sentence, defense counsel received an email from one of the jurors, stating:...Subject: I was on his jury, maybe I can help

I served on the jury in Ocala that found him guilty on 3 counts of failing to file taxes. It was a deal that had to be made because of certain jurors that had

already presumed he was guilty before the trail [sic] started and we only found this out in the last few days of deliberation. We thought we were making the right deal because we did not think he

would go to jail for not filing taxes. There were 3 on the jury that felt this way and told us he was guilty before they even heard the first piece of evidence going against what the judge had said.

If I can be of any help feel free to call me at..."

"This message, according to the defense motions, was [fn2] followed two weeks later, on July 31, 2010, by a second email from another juror. The second message read:...

Mr. Meachum,

I read an article pertaining to the trial. I also was on the jury for his case. If you would like to contact me, you can reach me at this email address [redacted]

Like the other email suggested, most of us didn’t believe he would have received the jail time. Thank you,....................."

[fn2] The Court has no reason to doubt the veracity of defense counsel as officers of the Court, and their representations concerning receipt of these messages are

accepted without further proof. Copies of the unredacted messages were presented at the hearing as Exhibits 2 and 3.

"The email presents, to be sure, a troubling set of circumstances, but further pursuit of the issue is clearly foreclosed by Federal Rule of Evidence 606(b) and well established law." (page 4)

"Upon due consideration, for the reasons explained below, the Court has determined that each of the Defendant’s foregoing motions should be, and will be, Denied. The

judgment of commitment will be enforced." (page 2) Read Judge Hodges Order

Doc 563 ORDER ON DEFENDANT’S PENDING MOT[...]

Adobe Acrobat document [131.9 KB]

Fortune 500 Companies Paid No Federal Income Taxes

Fortune 500 Companies Paid No Federal Income Taxes

15 Fortune 500 Companies Paid No Federal Income Taxes in

2014

The Fiscal Times

By Eric Pianin

April 9, 2015

Amid calls for a major overhaul of the federal tax system, a new study shows that 15 major Fortune 500 companies avoided paying taxes on $23 billion in profits in 2014.

Moreover, these companies -- including CBS Corporation, Mattel, Prudential and Ryder System -- paid almost no federal income tax on $107 billion over the past five years.

According to the study by Citizens for Tax Justice, all but two of the companies received federal tax rebates last year. And almost all paid exceedingly low effective tax rates over five years.

There was nothing illegal or improper about what these companies did. They were merely taking advantage of major corporate tax loopholes and provisions long part of the fabric of the U.S. tax code.

"While recent policy discourse has focused on multinational corporations that use offshore tax havens to minimize their tax liability, the companies profiled here appear to be using a diverse array of other tax breaks to zero out their federal income taxes," the new study stated. Read more

15corporations0315.pdf

Adobe Acrobat document [38.7 KB]

policyoptions2014.pdf

Adobe Acrobat document [133.8 KB]

G.E.’s Strategies Let It Avoid Taxes Altogether

G.E.’s Strategies Let It Avoid Taxes Altogether

The New York Times

By DAVID KOCIENIEWSKI

Published: March 24, 2011

General Electric, the nation’s largest corporation, had a very good year in 2010. The company reported worldwide profits of $14.2 billion, and said $5.1 billion of the

total came from its operations in the United States. Its American tax bill? None. In fact, G.E. claimed a tax benefit of $3.2 billion.

That may be hard to fathom for the millions of American business owners and households now preparing their own returns, but low taxes are nothing new for G.E. The

company has been cutting the percentage of its American profits paid to the Internal Revenue Service for years, resulting in a far lower rate than at most multinational companies.

Its extraordinary success is based on an aggressive strategy that mixes fierce lobbying for tax breaks and innovative accounting that enables it to concentrate its

profits offshore. G.E.’s giant tax department, led by a bow-tied former Treasury official named John Samuels, is often referred to as the world’s best tax law firm. Indeed, the company’s slogan

"Imagination at Work" fits this department well. The team includes former officials not just from the Treasury, but also from the I.R.S. and virtually all the tax-writing committees in

Congress....read more

30 Major U.S. Corporations Paid More to Lobby Congress Than Income Taxes 2008-2010

30 Major U.S. Corporations Paid More to Lobby Congress Than Income Taxes, 2008-2010

International Business Times

By Ashley Portero

December 9, 2011

By employing a plethora of tax-dodging techniques, 30 multi-million dollar American corporations expended more money lobbying Congress than they paid in federal income

taxes between 2008 and 2010, ultimately spending approximately $400,000 every day -- including weekends -- during that three-year period to lobby lawmakers and influence political elections,

according to a new report from the non-partisan Public Campaign. read more

For Hire: Lobbyist or the 99%?

How Corporations Pay More for Lobbyists Than in Taxes.

Public Campaign Report, Executive Summary, December 2011

How Corporations Pay More for Lobbyists Than in Taxes

ReportTaxDodgerLobbyingDec6.pdf

Adobe Acrobat document [740.2 KB]

Tax Increases? Why Facebook's Billion Dollar Income Isn't Taxed (At All) By IRS - Got $429 Million Refund

Tax Increases? Why Facebook's Billion Dollar Income Isn't Taxed

(At All) By IRS

Forbes Magazine online

Robert W. Wood, Contributor

February 19, 2013

Mark Zuckerberg commands attention even if Facebook’s much hyped IPO was lackluster. As a visionary billionaire, when Mr. Zuckerberg speaks, people listen. Having $1.1

billion in profits must feel pretty good. Paying no taxes to the IRS and even to revenue starved California? Priceless. See Facebook Paid No Income Taxes In 2012.

Facebook’s first Form 10-K filed with the SEC since its face-plant public offering shows $1.1 billion in profits and a complete pass on federal and state income taxes. In fact, Facebook says it is getting back tax refunds of $429 million. See Facebook Gets a Multibillion-Dollar Tax Break. Is this legal, you might ask? Read more

The Florida Bar Does Not Pay Income Taxes

The Florida Bar Financial Statement Jun-30-2010-2009 prepared by Carr, Riggs & Ingram, LLC.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(page 14)

The Florida Bar is an administrative agency of the Supreme Court and is not subject to federal or state income tax. The Florida Bar Building Corporation, Florida Lawyers Association for the Maintenance of Excellence, Inc., and The Florida Attorneys Charitable Trust have been granted exemption from federal and state income taxes except on unrelated business income under Sections 501 (c)(25), 501 (c)(6), and 501 (c)(3), respectively, of the Internal Revenue Code. Read more

Rural Electric Cooperatives are Tax-Exempt

Is It Time to Revoke the Tax-Exempt Status of Rural Electric Cooperatives?

Abstract

Rural electric cooperatives (RECs) were created with government assistance in the mid-1930s as part of a campaign to bring electricity to rural areas in an effort to improve economic output and quality of living. By the early 1950s, the entirety of America had access to electricity, fulfilling the federal government’s mission. Today, these cooperatives strongly resemble their for-profit counterparts, but remain tax-exempt under § 501(c)(12) of the Internal Revenue Code. This note will argue that, in light of the changes that RECs have undergone and the environment in which they now operate, their tax-exempt status is no longer warranted and in fact works against REC member interests. This note will then explore the impact of taxing RECs as regular cooperatives, which are subject to taxation under Subchapter T of the Internal Revenue Code.

Recommended Citation

W. G. Beecher, Is It Time to Revoke the Tax-Exempt Status of Rural Electric Cooperatives?, 5 Wash. & Lee J. Energy, Climate & Env’t. 221 (2014), http://scholarlycommons.law.wlu.edu/jece/vol5/iss1/7

GE, Facebook, The Florida Bar, and Rural Electric Cooperatives don't pay taxes. But Snipes gets prison for not paying taxes? Is that White Supremacy Racism?

Wesley Snipes railroaded into prison

Alan Bock's Blog

December 4, 2010

You wouldn't know it from the mainstream media coverage, but it looks, as I had sort of intuited without knowing much, as if actor Wesley Snipes is getting a raw deal in

his tax case against the IRS. I hadn't followed the case all that closely, but in fact he was

acquitted on the serious charge of tax evasion and convicted only on misdemeanor failure to file in a timely fashion. Yet the judge is throwing him in the slammer for three years, much more than would normally be warranted for a misdemeanor. Apparently his real crime is contempt of government, and

judges paid with tax money extracted by force from innocent victims like to remind us that from the perspective of the government's system, that is a crime far more serious than anything you might do

to a mere fellow citizen. It's nice to see the the Libertarian Party is taking his side. He doesn't seem

to have many friends in this matter. Given that Turbo Tim Geithner filed fraudulent returns, you can see just how selective the enforcement is.

This is hardly unprecedented. Years ago I got to know tax resister Irwin Schiff fairly well and

listened to his theories. I became convinced that the income tax really is, according to statute, voluntary, and that Irwin, perhaps the closest student of the tax code of anyone I ever met, had

broken no actual law by not sending in his pound of flesh. But he served several terms in prison. When it comes to taxes, the system loves to make examples so as to keep the sheeple in line.

Read more here

Wesley Snipes cites Klan fear in Ocala trial venue

Wesley Snipes cites Klan fear in Ocala trial venue

Orlando Sentinel

By Sarah Langbein, Sentinel Staff Writer

November 9, 2007

Actor Wesley Snipes wants his upcoming tax-evasion trial moved out of a federal courtroom in Ocala, calling the community a "hotbed" for Ku Klux Klan activity.

In a motion filed earlier this week, Snipes asked that his case be heard in a more diverse area, such as his hometown of Orlando or in New York City, where he lived from October 2000 to April 2005.

The black actor's defense team called Ocala the "most racially discriminatory venue available . . . with the best possibility of an all-white Southern jury."

His attorneys maintain that the majority of people in Ocala are good-hearted and fair -- but said they fear that pockets of racism will taint the jury pool. Read more

Wesley Snipes cites Klan fear in Ocala t[...]

Adobe Acrobat document [210.1 KB]

Chapter 5 Lethal Punishment 39p.pdf

Adobe Acrobat document [3.7 MB]

FDLE: 2 Fruitland Park police officers in KKK

FDLE: 2 Fruitland Park police officers in

KKK

Bay News 9

By Dave D'Marko, Lake County Reporter

July 14, 2014

FRUITLAND PARK --

Two officers with the Fruitland Park Police Department are off the job after an investigation linked them to the Ku Klux Klan.

An investigation by the FBI named Deputy Chief David Borst and Cpl. George Hunnewell as members of the Klan.

Borst resigned, and Hunnewell was terminated Friday following a brief internal investigation, Fruitland Park Police Chief Terry Isaacs said.

Hunnewell had been demoted from corporal in 2013 for five write-ups for conduct, attitude, performance and timeless, Isaacs said.

The Florida Department of Law Enforcement presented an investigative summary from an FBI source to Isaacs on Wednesday, stating the officers were associated with a "subversive organization."

The investigation found no criminal wrongdoings.

"We are here, we are in place, and I want the public to know this type of conduct will not even be remotely tolerated," Isaacs said.

Isaacs said he plans to interview every police officer within the department and ask them about potential ties to subversive groups, which are against department policy.

Every case that Borst and Hunnewell worked will now be turned over for review by the State Attorney's Office, Isaacs said. more

FDLE_ 2 Fruitland Park police officers i[...]

Adobe Acrobat document [272.8 KB]

Ocala Rejects 'Prejudice' - The Tampa Tribune - TBO

Ocala Rejects 'Prejudice'

The Tampa Tribune

THOMAS W. KRAUSE

The Tampa Tribune Staff

Published: January 13, 2008

Updated: June 1, 2013 at 06:02 AM

OCALA - Conversations about race never seem far from the surface in Ocala.

In a barbershop off the downtown square, on a porch stoop across the railroad tracks and on a sandy riverbank, Marion County residents are discussing the validity of statements made by a movie star who recently called into question the area's racial morality.

Actor Wesley Snipes, whose federal tax-fraud trial begins Monday, has argued that Ocala is not a suitable location for a black man to receive justice. His attorneys have tried, unsuccessfully, to move the trial to much larger venues such as Orlando or New York.

"While many Ocala jurors may be fair, substantial pockets of prejudice persist in the Ocala area," Snipes argued in a court document. The document also says Ocala is a "hotbed" of activity for the Ku Klux Klan.

Locals are suspicious of Snipes' motives for such comments.

"I've never seen not one gentleman riding around with a white hood pointed up on his head," said Ernest Nunn, 34, a black man and the owner of Kingdom Kuts barbershop. "I haven't seen anything of that sort."

Matthew "Lincoln" Johnson, a 37-year-old barber at the shop, isn't so quick to discount Snipes' contention.

"Some people will say he's 100 percent right," he said. "You'll get other people who say the courthouse is a magical place and they go for law and order, justice prevails, the scales are even and it's the American way."

The truth, Johnson said, is probably somewhere in the murky middle ground.

Asked whether the Snipes trial has been a topic readily at hand, Johnson let out a laugh.

"Of course," he said. "This is a barbershop." Read more

Ocala Rejects 'Prejudice' _ TBO.pdf

Adobe Acrobat document [86.3 KB]

Snipes' tax evasion trial stays in Ocala

Snipes' tax evasion trial stays in Ocala

BY RICK CUNDIFF

STAR-BANNER

December 27, 2007

JUDGE DENIES DEFENSE MOTION

Case is set to start in January

OCALA - In a Christmas Eve ruling, a federal judge delivered mostly coal to Wesley Snipes' legal team, rejecting motions to delay the actor's trial on tax evasion

charges or move it out of Marion County.

Senior U.S. District Judge William Terrell Hodges, in a 13-page order, rejected Snipes' lawyers previous claims that Ocala was too racist for the black actor to get a

fair trial. Hodges also denied a motion to postpone the trial, scheduled to start Jan 14.

"We're pleased with the judge's decision and we're ready to go to trial," Steve Cole, a spokesman for the U.S. Attorney's Office in Tampa, said Wednesday. Snipes lawyers

Robert Bernhoft and Robert Barnes could not be reached for comment Wednesday.

Snipes and co-defendants Eddie Ray Kahn and Douglas Rosile are each charged with one count of conspiracy to defraud and one count of aiding and abetting the making of a

false and fraudulent claim as part of an alleged tax fraud scheme. Snipes also is charged with six counts of willfully failing to timely file federal income tax returns.

Snipes' legal team sought to have the trial moved to the Southern District of New York, saying the potential jury pool was far more racially diverse than Ocala's and

that Marion County was a "hotbed of Klan activity."

But Hodges ruled that the comparison between Manhattan and Ocala was faulty, saying the accurate question was whether the potential jury pool is any less diverse than

the local population.

Hodges noted Snipes made "numerous accusations of prejudice and bigotry on the part of the residents of the Ocala [court] division."

"Comparison between different venues is not appropriate," he wrote. "Given the lack of any evidence of a constitutionally relevant racial disparity in the Ocala

Division's jury [pool], Defendant Snipes' motion is due to be denied." Read more

Snipes' tax evasion trial stays in Ocala[...]

Adobe Acrobat document [39.5 KB]

Confronting racism face-to-face - BBC News

Published on May 17, 2014 YouTube

Mo Asumang, daughter of a black Ghanaian father and a white German mother, talks to BBC News about her experiences making her new documentary, The Aryans, in which she confronts racists, both in Germany and among the Ku Klux Klan in America. Link to Facebook

Link to Wikipedia (German) Link to BBC News

Will Golden-Collum Memorial Federal Building stay underused?

Ocala Star-Banner

By Suevon Lee, Staff writer

October 15, 2010

Unlike its state counterpart directly across Northwest Second Street, the federal courthouse in Ocala is seeing little foot traffic these days.

It has no full-time magistrate judge.

Its one senior district judge recently reduced his caseload by half.

All three of its courtrooms, including a $1.75 million new one on the ground level, sit empty for the most part, save for the rare hearing or trial.

Some in the local legal community have privately expressed concerns about the future of the federal judicial stamp in Ocala.

They point to troubling signs, such as the frequent reassignment of Ocala-based criminal and civil cases to judges who sit elsewhere within the 350-mile-wide Middle

District.

In September, Gary R. Jones — the one full-time federal magistrate judge in Ocala who handled initial appearance hearings, change of pleas and preliminary proceedings

for the past 10 years — left to assume the same position in the Gainesville division of Florida's Northern District.

Meantime, Senior U.S. District Judge William Terrell Hodges, who in recent years has experienced some health issues, has relinquished half his caseload. Read more

Will Golden-Collum Memorial Federal Buil[...]

Adobe Acrobat document [45.7 KB]

Judge Hodges honored at reception in Gainesville Fla.

Judge William Terrell Hodges (JD 58) was honored Nov. 2 at the Thomas Center in Gainesville. (Photos by Haley Stracher)

Judge William Terrell Hodges (JD 58) was honored Nov. 2 at the Thomas Center Gainesville. (Haley Stracher)

Judge William Terrell Hodges (JD 58) was honored Nov. 2 at the Thomas Center Gainesville. (Haley Stracher)

Judge Hodges honored at reception

FlaLawOnline

By Richard Goldstein

November 2, 2012

When U.S. District Judge William Terrell Hodges (JD 58) was nominated to the federal bench in 1971, he assumed his robes in the middle district of Florida before the

age of 40, and 41 years later he holds the same job, now as a federal judge on senior status in Ocala.

A remarkably stable career one might conclude.

But it was clear during a Nov. 2 reception at the Thomas Center in Gainesville sponsored by the North Central Chapter of the Federal Bar Association that Hodges did not

stand still during his long tenure.

As protégé of former Chief

Justice William Rehnquist, Hodges rose to lead policymaking body for the administration of justice in the federal courts, becoming chair of the Judicial Conference of the United States. Hodges

and District Judge Anthony Alaimo lodged the complaint that would result in the impeachment and removal from office of U.S. District Judge Alcee Hastings, who had been acquitted by a jury of

soliciting a bribe in a mob case. And he mentored decades worth of law clerks.

Those clerks were present in force at the Thomas Center to praise their former boss.

Scott L. Whitaker (JD 76), who clerked for Hodges from 1976 to 1978, said Hodges took seriously his duty to dispense justice and to guard against abuse of

power.

"I watched him struggle every time he had to pass sentence," Whitaker said. "His humility in all things is beyond anything I’ve ever seen. He always used to say, every

time you use a little power, you lose a little power. I’ve never seen him abuse it once."

Still, one story of the way Hodges exercised power elicited knowing laughter from the audience that included UF Law students.

Judge Gerald Bard Tjoflat of the 11th U.S. Circuit Court of Appeals explained that Tampa maintained a bus stop immediately in front of the courthouse steps while Hodges

was chief judge of the middle district during the 1980s.

"The city of Tampa had a bus system and they had a monstrous bus stop at the base of the old federal courthouse in Tampa. All the buses came there and the jurors would

have trouble getting up there" to the courthouse, Tjoflat said.

Hodges sent a letter to the mayor demanding that the bus stop be moved. When no action ensued, Tjoflat said, federal marshals dismantled the offending public

transportation facility with blow torches.

Sitting on a dais with Tjoflat, Hodges accepted laconically the stories and praise offered during the "Toast to Judge Hodges" event.

"That was the result of deputies who volunteered; no order was given so it was unappealable," Hodges deadpanned.

Last year Hodges served as the Peter T. Fay Jurist-in-Residence at UF Law speaking with students and faculty about judicial clerkships, trial advocacy and legal

careers.

Hodges was appointed by President Richard Nixon in 1971. He served as chief judge from 1982 to 1989 and has maintained senior status since 1999. Read more

Judge Hodges honored at reception » FlaL[...]

Adobe Acrobat document [113.8 KB]

Judge Wm Terrell Hodges letter to David [...]

Adobe Acrobat document [1.2 MB]

Law Clerk Rehnquist and Separate-But-Equal Ruling

Did Then-Law Clerk Rehnquist

Support Separate-But-Equal Ruling? Article Cites Summary of Lost Letter

ABA Journal Law News Now

By Debra Cassens Weiss

March 22, 2012

A new law review article considers whether William H. Rehnquist was citing his own views in 1952 when he wrote a memo as a Supreme Court law clerk supporting the 1896 decision upholding the separate-but-equal doctrine.

"I realize it is an unpopular and unhumanitarian position, for which I have been excoriated by ‘liberal’ colleagues," Rehnquist wrote to his boss, Justice Robert H. Jackson, "but I think Plessy v. Ferguson was right and should be reaffirmed."

During his confirmation hearing, Rehnquist said he had prepared the memo as a statement of Jackson’s tentative views, and they were not his own opinion, the New York Times reports. Now a new law review article (PDF) seeks to debunk Rehnquist’s pre-confirmation claim.

Jackson was part of the unanimous opinion striking down the separate-but-equal doctrine in Brown v. Board of Education, and Rehnquist appeared angry with his boss in the aftermath, according to the authors of the article, Brad Snyder and John Q. Barrett. The cite Rehnquist’s apparent criticisms of his boss in a 1955 letter written to Justice Felix Frankfurter after Jackson’s death. Read more

by Brad Snyder and John Q. Barrett

05_snyder_barrett.pdf

Adobe Acrobat document [206.5 KB]