...........Banking, Banks and Financial Institutions.............

In 156 government cases against big banks, only 47 people have been charged - ABA Journal

In 156 government cases against big banks, only 47 people have been charged

ABA Journal Daily News

By Debra Cassens Weiss

Posted May 27, 2016

Only 47 people have been charged in 156 criminal and civil cases filed by the government since 2009 against the nation’s 10 largest banks, according to a newspaper analysis.

Most of those charged had junior or midlevel jobs at the banks, according to the findings by the Wall Street Journal (sub. req.). The newspaper examined cases filed by the U.S. Justice Department, the Securities and Exchange Commission and the Commodity Futures Trading Commission.

In 81 percent of the cases, no employees were charged. "The analysis shows not only the rarity of proceedings brought against individual bank employees," the newspaper says, "but also the difficulty authorities have had winning cases they do bring."

Most of those who were charged either pleaded guilty or settled. Eleven people went to a trial or sought dismissal of the charges, and six were found not liable or won case dismissal. The government won five cases against the other individuals, but one of them succeeded in getting her penalty overturned on Monday in a ruling that also handed a victory to Bank of America.

The Wall Street Journal offers several reasons for the results. Much of the conduct during the financial crisis didn’t break the law. And much of the wrongdoing was by lower-level employees, according to University of Michigan law professor Adam Pritchard.

"The typical scenario is not that the bank has this plan for world domination being cooked up by the chairman and CEO," Pritchard told the Wall Street Journal. "It’s some midlevel employee trying to keep his job or his bonus, and as result the bank gets into trouble." Read online

Will those who led the financial system into crisis ever face charges? ABA Journal

Will those who led the financial system into crisis ever face charges?

ABA Journal Daily News

By Terry Carter

Posted Feb 01, 2016 04:10 am CST

When federal prosecutors presented their evidence against real estate agent Yevgeniy Charikov and three others accused of bank fraud and money laundering in Sacramento, California, they had every reason to believe they had a pretty good case. They wove a story of brazen criminal greed, piecing together a scam in which the four lied on mortgage documents, set up straw buyers to purchase homes at inflated prices, and then walked away from the residential loans, leaving lenders $710,000 in the hole.

Then Bill Black took the stand for the defense and he made the jury laugh.

It was August 2014, and by then many if not most potential jurors likely knew that major financial institutions had been implicated in residential mortgage-backed securities fraud that played a big role in the global collapse of financial markets in 2008. But now the bankers themselves were in effect put on trial. Defense lawyers projected a flier on the screen in the courtroom that indicated the mortgage company the conspirators were accused of bilking was itself involved in the overall scheme.

The flier had been circulated by the alleged fraud victim, GreenPoint Mortgage Funding. A subsidiary of Capital One Financial Corp., GreenPoint specialized in making loans without verifying a borrower’s ability to pay—"stated income loans" in the language of regulators; "liar’s loans" in the wake of the 2008 financial collapse.

Under a drawing of the proverbial three wise monkeys, the ad’s text paralleled the original message of willful ignorance. But it did so touting the lack of scrutiny prospective borrowers could expect in getting a loan: "Hear no income, speak no asset, see no employment: Don’t disclose your income, assets or employment on this hot, new, flexible adjustable rate mortgage!"

As an expert witness for the defense, Black went straight at GreenPoint and the bankers behind them on direct examination. He was asked about the intended audience for the flier. "They were using it for subprime [borrowers], and that means people who have known credit defects, which means they have a history of not repaying their loans," Black told the jury.

That got the laughs.

Black’s expertise long preceded the scandal at hand, making his defense testimony in U.S. v. Charikov all the more ironic. He made his bones prosecuting fraud back in the savings and loan crisis during the 1980s and early ’90s. As a senior financial regulator, he was a leader in bringing criminal and civil cases against individuals to clean up a then-unprecedented scandal involving officials looting their own financial institutions, largely through self-dealing and extreme risk-taking. More than 1,000 were convicted, many of them high-level. Read more

Will those who led the financial system [...]

Adobe Acrobat document [145.2 KB]

Elizabeth Warren and Bank Regulators At First

Hearing

Huffington Post

by Ryan Grimm

February 14, 2013

WASHINGTON -- Bank regulators got a sense Thursday of how their lives will be slightly different now that Elizabeth Warren sits on a Senate committee overseeing their

agencies.

At her first Banking, Housing and Urban Affairs Committee hearing, Warren questioned top regulators from the alphabet soup that is the nation's financial regulatory

structure: the FDIC, SEC, OCC, CFPB, CFTC, Fed and Treasury.

The Democratic senator from Massachusetts had a straightforward question for them: When was the last time you took a Wall Street bank to trial? It was a harder question

than it seemed. Read more

My letter to Sen. Warren, as filed in Petition No. 12-7747

Appeals court overturns $1.27 billion penalty for Countrywide's sale of risky mortgages

Appeals court overturns $1.27 billion penalty for Countrywide's sale of risky mortgages

ABA Journal Daily News

By Debra Cassens Weiss

Posted May 24, 2016 02:20 pm CDT

A federal appeals court has overturned a $1.27 billion civil penalty against Bank of America for risky loans sold to Fannie Mae and Freddie Mac by its Countrywide unit.

The New York-based 2nd U.S. Circuit Court of Appeals ruled on Monday that the government had failed to prove Countrywide acted with fraudulent intent when contracting with Fannie and Freddie for the mortgage sales, report the New York Times DealBook blog and the Wall Street Journal Law Blog. How Appealing links to the opinion (PDF) and additional coverage.

A claim of fraudulent misrepresentations in a contract requires proof of fraudulent intent at the time contract execution, the appeals court said. Evidence of a subsequent, intentional breach is not sufficient.

"The trial evidence fails to demonstrate the contemporaneous fraudulent intent necessary to prove a scheme to defraud through contractual promises," the appeals court said.

The suit had claimed the Countrywide loan program rewarded employees based on the quantity of loans, then sold the risky loans knowing they didn’t match the quality represented in contractual agreements. Bank of America says the mortgage program ended when it acquired Countrywide in 2008.

The New York Times calls the ruling "a disappointment" for Manhattan U.S. Attorney Preet Bharara, who intervened in the whistle-blower suit alleging fraud and sought penalties for alleged violations of mail and wire fraud statutes.

The Wall Street Journal Law Blog, meanwhile, focuses on the defeat for the federal judge who imposed the penalty in the civil-fraud trial, U.S. District Judge Jed Rakoff.

Rakoff has also been reversed in a challenge to a state law banning surcharges on credit card purchases, and in his decision to block a fraud settlement between the Securities and Exchange Commission and Citigroup.

Bank of America’s appeal had alleged that Rakoff displayed bias and he should be removed from the case. The appeals court didn’t address the issue. Rakoff told the Law Blog he is "disappointed that the fine lawyers who represent Bank of America would question my impartiality." Read more

U.S. Senator Elizabeth Warren queries Federal Reserve Chair Yellen about the Fed's duty and authority to break-up Too Big To Fail banks that lack a plan for Orderly Liquidation under Dodd-Frank.

Senator Warren cited Dodd-Frank, SEC. 165 of Public Law 111-203 July 21, 2010, which is the same text as 12 U.S. Code § 5325

- Title 12 U.S. Code - BANKS AND BANKING

- 12 U.S. Code Chapter 3 - FEDERAL RESERVE SYSTEM

- 12 U.S. Code Chapter 53 - Dodd Frank Wall Street Reform

- 12 U.S. Code Subchapter II - Orderly Liquidation Authority

- 12 U.S. Code Subchapter V - Consumer Financial Protection

- 12 U.S. Code Subchapter VI - Federal Reserve Provisions

- Title 31 U.S. Code - MONEY AND FINANCE (GPO) PDF

Elizabeth Warren: Too Big To Fail is alive and well

Elizabeth Warren Has Basically Had It With Paul Krugman’s Big Bank

Nonsense

Huffington Post

By Zach Carter

April 13, 2016

Too Big To Fail is alive and well.

WASHINGTON — Sen. Elizabeth Warren (D-Mass.) appeared to offer a thinly veiled rebuke of liberal economist Paul Krugman on Wednesday by highlighting a "scary" too-big-to-fail ruling from federal bank regulators.

The Federal Reserve and the FDIC said Wednesday that five of the biggest banks in the country cannot credibly be unwound safely without bailout money from taxpayers.

"This announcement is a very big deal. It’s scary," Warren said in a written statement. "After an extensive, multi-year review process, federal regulators concluded that five of the country’s biggest banks are still — literally — too big to fail. They officially determined that five U.S. banks are large enough that any one of them could crash the economy again if they started to fail and were not bailed out."

The banks — Bank of America, Wells Fargo, JPMorgan Chase, State Street and Bank of New York Mellon — were all given until Oct. 1 to present more credible plans for how they’d enter bankruptcy, or face penalties from regulators. If they continue to fail to present credible "living wills," regulators will eventually be required to break them up.

But Warren directed her sharpest words at an unnamed set of people who have recently downplayed the role of big banks in the financial crisis and questioned the value of breaking up big banks — an apparent reference to the Nobel Prize-winning Krugman.

"There’s been a lot of revisionist history floating around lately that the Too Big to Fail banks weren’t really responsible for the financial crisis," Warren said. That talk isn’t new. Wall Street lobbyists have tried to deflect blame for years. But the claim is absolutely untrue."

"There would have been no crisis without these giant banks," Warren continued. "They encouraged reckless mortgage lending both by gobbling up an endless stream of mortgages to securitize and by funding the slimy subprime lenders who peddled their miserable products to millions of American families. The giant banks spread that risk throughout the financial system by misleading investors about the quality of the mortgages in the securities they were offering."

On Friday, Krugman argued that the financial crisis wasn’t really a problem of too big to fail, but rather a failure to regulate so-called shadow banks — a broad term including just about every financial activity beyond traditional loans and deposits.

"The crisis itself was centered not on big banks but on ‘shadow banks’ like Lehman Brothers that weren’t necessarily that big," Krugman wrote.

"Revisionist history is dangerous because it can blind us in the present - and bind us in the future," Warren countered. "Today’s announcement should remind us of the central role that the big banks played in the last crisis - and it is a giant, flashing sign warning us about the central role they will play in the next crisis unless both Congress and our regulators show some backbone. ... Today, our top regulators warned us about the danger of the biggest banks - and we would be foolish to ignore their warnings."

- Agencies Announce Determinations and Provide Feedback on Resolution Plans of Eight Systemically Important, Domestic Banking Institutions

Joint Press Release

Board of Governors of the Federal Reserve System

Federal Deposit Insurance Corporation

April 13, 2016

The Federal Deposit Insurance Corporation and the Federal Reserve Board on Wednesday jointly announced determinations and provided firm-specific feedback on the 2015 resolution plans of eight systemically important, domestic banking institutions.

The agencies have jointly determined that each of the 2015 resolution plans of Bank of America, Bank of New York Mellon, JP Morgan Chase, State Street, and Wells Fargo was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code, the statutory standard established in the Dodd-Frank Wall Street Reform and Consumer Protection Act. The agencies have issued joint notices of deficiencies to these five firms detailing the deficiencies in their plans and the actions the firms must take to address them. Each firm must remediate its deficiencies by October 1, 2016. If a firm has not done so, it may be subject to more stringent prudential requirements.

The agencies jointly identified weaknesses in the 2015 resolution plans of Goldman Sachs and Morgan Stanley that the firms must address, but did not make joint determinations regarding the plans and their deficiencies. The FDIC determined that the plan submitted by Goldman Sachs was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code, and identified deficiencies. The Federal Reserve Board identified a deficiency in Morgan Stanley's plan and found that the plan was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code. Read more

JOINT PRESS RELEASE - Board of Governors[...]

Adobe Acrobat document [37.2 KB]

‘Living Wills’ For 5 Big Banks Fail U.S. Regulators’ Test

‘Living Wills’ For Five Big Banks Fail U.S.

Regulators’ Test

Huffington Post

By Lisa Lambert

April 13, 2016

None of the eight systemically important banks, which the U.S. government considers "too big to fail," fared well in the evaluations.

WASHINGTON (Reuters) - Five out of eight of the biggest U.S. banks do not have credible plans for winding down operations during a crisis without the help of public money, federal regulators said on Wednesday, saying the institutions could face stricter oversight if they do not fix their plans.

The "living wills" that the Federal Reserve and Federal Deposit Insurance Corporation jointly agreed were not credible came from Bank of America <BAC.N>, Bank of New York Mellon <BK.N>, J.P. Morgan Chase <JPM.N>, State Street <STT.N>, Wells Fargo <WFC.N>.

The requirement for a living will was part of the Dodd-Frank Wall Street reform legislation passed in the wake of the 2007-2009 financial crisis, when the U.S. government spent billions of dollars on bailouts to keep big banks from failing and wrecking the U.S. economy.

"The FDIC and Federal Reserve are committed to carrying out the statutory mandate that systemically important financial institutions demonstrate a clear path to an orderly failure under bankruptcy at no cost to taxpayers," FDIC Chairman Martin Gruenberg said in a statement. "Today’s action is a significant step toward achieving that goal."

None of the eight systemically important banks, which the U.S. government considers "too big to fail," fared well in the evaluations. However, a bank has to fix deficiencies only if the two regulators jointly determine its plan does not have the potential to work.

The FDIC alone determined that the plan submitted by Goldman Sachs <GS.N> was not credible, while the Federal Reserve Board on its own found Morgan Stanley’s plan not credible. Citigroup’s <C.N> living will did pass, but the regulators noted it had "shortcomings."

"Each plan has shortcomings or deficiencies," said FDIC Vice Chairman Thomas Hoenig in a statement. "No firm yet shows itself capable of being resolved in an orderly fashion through bankruptcy. Thus, the goal to end too big to fail and protect the American taxpayer by ending bailouts remains just that: only a goal."

Banks whose living wills are deficient can be subject to more stringent regulation such as requirements to have more capital or restrictions on growth. If they do not fix the identified problems within two years, they can be forced to divest assets.

The regulators continue to assess plans for four foreign banks labeled "systemically important," Barclays PLC <BARC.L>, Credit Suisse Group <CSGN.S>, Deutsche Bank AG <DBKGN.DE>, and UBS. Read more

To Fear the Fed or Not, Wharton Magazine Winter 2016

Wharton Magazine

By Peter Conti-Brown

The Federal Reserve’s authority over the financial system and the money supply is expansive. That power deserves a better public understanding—even

engagement.

There is an old story, perhaps apocryphal, in which a newly appointed member of the Board of Governors of the U.S. Federal Reserve System was greeted by the Fed Chair with an apologetic explanation of the new governor’s status. The chair predicted that when the man introduced himself back home to his friends and family as a "governor of the Federal Reserve," they were likely to think he was the administrator of the U.S. government’s unexplored Western forests.

There was a time when that story was funny. The Fed used to be an obscure, backwater government agency. The general public didn’t really know what the Fed was about—and probably didn’t much care. Even for those who paid attention to the economy, until roughly the early 1960s, the prevailing view was that the president and his administration were the first and last stop for economic policy.

Central banking was the hinterland; fiscal policy—the stuff of taxes and budgets and spending and deficits—the seat of power.

Bankers cared about the Fed’s obscure activities. The rest of the country wasn’t paying attention.

That story used to work. It doesn’t any more. Today, it’s not just bankers who are paying attention. Over the last 30 years—and especially since the global financial crisis of 2008—the Fed has become the target of an extraordinary proliferation of scrutiny, praise and condemnation. Read more

The Power and Independence of the Federal Reserve, by Peter Conti-Brown. Princeton University Press. Link to Introduction PDF.

To Fear the Fed or Not, Wharton Magazine[...]

Adobe Acrobat document [423.7 KB]

Banks Got Bailed Out, Homeowners Got Sold Out — and the Feds Made a Killing

Banks Got Bailed Out, Homeowners Got Sold Out — and

the Feds Made a Killing

The Fiscal Times

By David Dayen

March 11, 2016

You wouldn’t think that anyone could look at the calamity of the foreclosure crisis, where fraudulent mortgage origination, fraudulent securitizations, fraudulent loan servicing and fraudulent evictions combined to dispossess 6 million Americans from their homes, and see it as a money-making opportunity. Well, nobody except for perhaps Donald Trump. But a news investigation into the aftermath of the crisis shows that the U.S. government did turn a profit on after-the-fact enforcement of these interlocking frauds, without distributing those profits to the homeowner victims. We can add a clause to the famed Occupy Wall Street chant: Banks got bailed out, we got sold out and the government made a killing.

Rigged Justice: 2016 How Weak Enforcement Lets Corporate Offenders off Easy

Press Release. Senator Warren Releases "Rigged Justice," First Annual Report Detailing How Weak Federal Enforcement Lets Corporate Offenders Off Easy

Jan 29, 2016.

A PDF copy of the report is available here

Washington, DC - United States Senator Elizabeth Warren today released a report titled Rigged Justice: How Weak Enforcement Lets Corporate Offenders Off Easy. The report, the first in an annual series on enforcement, highlights 20 of the most egregious civil and criminal cases during the past year in which federal settlements failed to require meaningful accountability to deter future wrongdoing and to protect taxpayers and families. Read more

Rigged_Justice_2016.pdf

Adobe Acrobat document [1.1 MB]

Who Regulates Whom and How? CRC - R43087

Congressional Research Service:

An Overview of

U.S. Financial Regulatory Policy

January 30, 2015

Edward V. Murphy

Specialist in Financial Economics

Who Regulates Whom and How - R43087.pdf

Adobe Acrobat document [622.1 KB]

Saving Capitalism From Death - Wharton Magazine

Essay: Saving Capitalism From Death Wharton Magazine

By Anthony W. Orlando

Economic inequality is the great business challenge of our time.

American business leaders rallied around Franklin Delano Roosevelt in 1932 during his candidacy for the presidency, after which he immediately embarked on the most progressive legislative agenda in U.S. history to tackle the Great Depression. From today’s vantage point, it may seem surprising that titans of industry, executives from General Electric to Standard Oil to IBM, not only contributed to Roosevelt’s campaign but helped author many of his famous New Deal reforms. To the men who ran these companies, it was a simple matter of fiduciary responsibility—to current shareholders and to future ones—that they should ensure a more equitable distribution of prosperity, lest their own wealth be dashed to bits on the jagged rocks of a shrinking economy.

Today, we face a similar predicament. The great challenge of business in our time is reversing the destabilizing threat of inequality. While at first this may seem anathema to our profit-maximizing mission, distribution of income lies at the very heart of sustainable capitalism. Read more

Saving Capitalism from a Painful Demise,[...]

Adobe Acrobat document [309.0 KB]

NY Fed Fired Examiner Who Took on Goldman

NY Fed Fired Examiner Who Took on Goldman

by Jake Bernstein

ProPublica, Oct. 10, 2013

Left: Carmen Segarra outside the Federal Reserve Bank of New York, on Oct. 10, 2013. In a wrongful termination lawsuit, Segarra says she was fired by the Fed after she refused to change a finding Goldman Sachs had inadequate controls over conflicts of interest.

In the spring of 2012, a senior examiner with the Federal Reserve Bank of New York determined that Goldman Sachs had a problem.

Under a Fed mandate, the investment banking behemoth was expected to have a company-wide policy to address conflicts of interest in how its phalanxes of dealmakers handled clients. Although Goldman had a patchwork of policies, the examiner concluded that they fell short of the Fed’s requirements.

That finding by the examiner, Carmen Segarra, potentially had serious implications for Goldman, which was already under fire for advising clients on both sides of several multibillion-dollar deals and allegedly putting the bank’s own interests above those of its customers. It could have led to closer scrutiny of Goldman by regulators or changes to its business practices.

Before she could formalize her findings, Segarra said, the senior New York Fed official who oversees Goldman pressured her to change them. When she refused, Segarra said she was called to a meeting where her bosses told her they no longer trusted her judgment. Her phone was confiscated, and security officers marched her out of the Fed’s fortress-like building in lower Manhattan, just 7 months after being hired.

"They wanted me to falsify my findings," Segarra said in a recent interview, "and when I wouldn’t, they fired me." Read more

So Who is Carmen Segarra? A Fed Whistleblower Q&A

So Who is Carmen Segarra? A Fed Whistleblower Q&A

by Jake Bernstein

ProPublica, Oct. 28, 2013

Left: Carmen Segarra outside the Federal Reserve Bank of New York on Oct. 10, 2013. (Nabil Rahman for ProPublica)

Former bank examiner Carmen Segarra vaulted into public consciousness earlier this month when she filed a wrongful termination lawsuit alleging that the Federal Reserve Bank of New York fired her after she refused to go soft on investment banking behemoth Goldman Sachs.

As ProPublica has reported, the Fed hired Segarra in late 2011 as part of a group of examiners brought on to monitor systemically important banks in the aftermath of the Dodd-Frank regulatory overhaul. The Fed wanted experts in key areas — such as operations, compliance and credit risk — to examine the "Too Big To Fail" financial institutions.

Segarra's career path seemed to make her a perfect fit. Segarra, 41, was born in Indiana, raised mostly in Puerto Rico and graduated from Harvard. Her father, a doctor, encouraged a life-long love of learning. She is a polyglot, fluent in Spanish and French, conversant in German and Italian. Even in the midst of preparing her lawsuit, she continued with classes in Dutch, which she says is "totally messing up my German."

After getting a master's degree in French cultural studies at Columbia's campus in Paris, she went on to law school at Cornell. She then spent 13 years working at different financial firms, including Citigroup and Société Générale. Outside of the office, she held leadership positions in the Hispanic National Bar Association. Hired by the Fed as a legal and compliance specialist, she was told to pay particular attention to how Goldman was complying with the Fed's requirements on conflicts of interest. Read more

Is Federal Reserve Central Planning, Communism?

The Economic Collapse blog

Michael T. Snyder, Esq.

March 23, 2011

Most Americans believe that we still live in a capitalist system and that free markets primarily determine the growth and development of our economy. But is that really the case? No, sadly it is not.

The truth is that the U.S. Federal Reserve does a tremendous amount of central economic planning. So what makes the central economic planning that the Federal Reserve does different from the central

economic planning that communist China does? Yes, in China it is the government that does the central planning and in the United States it is a private central bank that does the central planning,

but other than that are there any huge differences? And if our economy is centrally planned, then how can we continue to claim that we still have a free market capitalist system? Read more

_____________________________________________________________

19 Reasons Why The Federal Reserve Is At The Heart Of Our Economic Problems The Economic Collapse blog, by Michael T. Snyder, Esq., March 30, 2011

Trillion dollar coin

Wikipedia

The trillion dollar coin is a concept that emerged during the United States debt-ceiling crisis in 2011, as a proposed way to bypass any necessity for the United States Congress to raise the country's borrowing limit, through the minting of very high-value platinum coins. The concept gained more mainstream attention by late 2012 during the debates over the United States fiscal cliff negotiations and renewed debt-ceiling discussions. After reaching the headlines during the week of January 7, 2013, use of the trillion dollar coin concept was ultimately rejected by the Federal Reserve and the Treasury.[1] Five days later, Senate Minority Whip John Cornyn announced that Senate Republicans would end their threat to block an increase in the debt ceiling.[2]

Legal basis

The issuance of paper currency is subject to various accounting and quantity restrictions that platinum coinage is not. According to the United States Mint, coinage is accounted for as follows:[3]

Since Fiscal Year (FY) 1996, the Mint has operated under the United States Mint Public Enterprise Fund (PEF). As authorized by Public Law 104-52 (codified at 31 U.S.C. § 5136), the PEF eliminates the need for appropriations. Proceeds from the sales of circulating coins to the Federal Reserve Banks (FRB), bullion coins to authorized purchasers, and numismatic items to the public and other customers are paid into the PEF and provide the funding for Mint operations. All circulating, bullion and numismatic operating expenses and capital investments incurred for the Mint's operations and programs are paid out of the PEF. By law, all funds in the PEF are available without fiscal year limitation. Revenues determined to be in excess of the amount required by the PEF are transferred to the United States Treasury General Fund as off-budget and on-budget receipts. Off-budget receipts consist of seigniorage, the difference between the receipts from the Federal Reserve System from the sale of circulating coins at face value and the full costs of minting and distributing circulating coins. Seigniorage is deposited periodically to the General Fund where it reduces the government's need to borrow.

The concept of striking a trillion dollar coin that would generate one trillion dollars in seigniorage, which would be off-budget, or numismatic profit, which would be on-budget, and be transferred to the Treasury, is based on the authority granted by Section 31 U.S.C. § 5112 of the United States Code for the Treasury Department to "mint and issue platinum bullion coins" in any denominations the Secretary of the Treasury may choose. Thus, if the Treasury were to mint one trillion dollar coins, it could deposit such coins at the Federal Reserve's Treasury account instead of issuing new debt.[4][5][6][7]

31 U.S.C. 5112(k) as originally enacted by Public Law 104-208 in 1996:

The Secretary may mint and issue bullion and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary's discretion, may prescribe from time to time.

In 2000, the word "bullion" was replaced with "platinum bullion coins".[8]

Philip N. Diehl, former director of the United States Mint and with Republican Congressman Michael Castle co-author of the platinum coin law, has said the procedure would be permitted by the statute.[5] However, Castle says he never intended such a use. The platinum coinage provision was eventually passed by a Republican Congress over the objections of a Democratic Treasury in 1996.[8][9][10]

Laurence Tribe, a constitutional law professor at Harvard Law School, said the legal basis of the trillion dollar coin is sound and that the coin could not be challenged in court as no one would have standing to do so.[11] Professor Jonathan H. Adler of the Case Western Reserve University School of Law has said that he believes the legality of the trillion dollar coin to be dubious.[12]

John Perkins: Enslavement By Debt, Not By Force

The Extended Confessions Of An Economic Hit Man Zero

Hedge

by Tyler Durden

May 20, 2011

The book " Confessions of an Economic Hit Man" by John Perkins is easily one of the most engrossing pieces of non-fiction one can read to learn about the true drivers

behind globalization, espionage, corporate cronyism, the emergence of such "artificial" organizations as the World Bank and the IMF, and most importantly, debt "enslavement", all as seen from an

insider's view. It explains in simple words why over the past 40 years the developing world paradigm has been exploited as heavily as it has, why the BRIC concept was instrumental as a Red Herring to

perpetuating the myth of endless growth, and why credit must always flow no matter what to keep the status quo in power. For those who have read the book, and for those who are on the fence about

reading it, below we present the three part presentation by John Perkins at the 2006 Veterans for Peace National Convention in which he expounds on all the key ideas in his book, and does an extended

Q&A covering topics not discussed previously. We urge everyone to spend at least a few minutes listening to Perkins who gives a unique and non-conflicted expert opinion on the primary force for

why the the modern equivalent of enslavement is not by force, but by debt. Read more

Stabilization Won’t Save Us

The New York Times

By NASSIM NICHOLAS TALEB

December 23, 2012

THE fiscal cliff is not really a "cliff"; the entire country won’t fall into the ocean if we hit it. Some automatic tax cuts will expire; the government will be forced

to cut some expenditures. The cliff is really just a red herring.

Likewise, any last-minute deal to avoid the spending cuts and tax increases scheduled to go into effect on Jan. 1 isn’t likely to save us from economic turmoil. It would

merely let us continue the policy mistakes we’ve been making for years, allowing us only to temporarily stabilize the economy rather than address its deep, systemic failures.

Stabilization, of course, has long been the economic playbook of the United States government; it has kept interest rates low, shored up banks, purchased bad debts and

printed money. But the effect is akin to treating metastatic cancer with painkillers. It has not only let deeper problems fester, but also aggravated inequality. Bankers have continued to get rich

using taxpayer dollars as both fuel and backstop. And printing money tends to disproportionately benefit a certain class. The rise in asset prices made the superrich even richer, while the median

family income has dropped.

Overstabilization also corrects problems that ought not to be corrected and renders the economy more fragile; and in a fragile economy, even small errors can lead to

crises and plunge the entire system into chaos. That’s what happened in 2008. More than four years after that financial crisis began, nothing has been done to address its root causes. Read more

End the Fed - book by Ron Paul, Author

End the Fed - Ron Paul, Author

Publisher Comments: During the 2008 presidential campaign, over 4,000 students gathered at the University of Michigan to hear Republican Party candidate Ron Paul speak.

As he began to address the topics of monetary policy and the coming depression, a chant came from the crowd, End the Fed End the Fed As dollar bills were lit on fire and thrown into the night skies,

it became clearer than ever that the real problem, one that nobody in the media was talking about, was the central bank-an unconstitutional entity and a political, economic, and moral

disaster.

Most people think of the Federal Reserve as an institution that has always been there (it hasn't) and isn't going anywhere. But in END THE FED, Ron Paul draws on

American history, economics, and fascinating stories from his own long political life to argue that the Federal Reserve is both corrupt and unconstitutional. It is inflating currency today at nearly

a Weimar or Zimbabwe level, a practice that threatens to put us into an inflationary depression where $100 bills are worthless. What most people don't realize is that the Fed — created by the Morgans

and Rockefellers at a private club off the coast of Georgia — is actually working against their own personal interests. Ron Paul's urgent appeal to all citizens and officials tells us where we went

wrong and what we need to do fix America's economic policy for future generations.

BookTV: End the Fed, Ron Paul

C-Span2 September 18, 2009

Valley Forge Convention Center

King of Prussia, PA

Representative Ron Paul talked about his book, End the Fed (Grand Central Publishing; September 16,

2009). In the book, Representative Paul looks at the history of the Federal Reserve and argues that the institution should be held accountable for the economic crisis being experienced by Americans.

He responded to questions from members of the audience. Ron Paul, a physician, has represented Texas' 14th congressional district for 11 terms. He is the author of

The Revolution: A Manifesto. Read

more

End the Fed? Ron Paul Is Wrong for All the Right Reasons: Books

Bloomberg

by James Pressley

September 17, 2009

Sept. 17 (Bloomberg) -- "The bank is trying to kill me," President Andrew Jackson declared. "But I will kill it!"

And throttle it he did, thwarting a bid by the second Bank of the United States to extend its charter beyond 1836. The U.S. would go without a central bank until the

Federal Reserve System was established in 1913.

A battle over the place and power of a central bank in America has rumbled throughout U.S. history, pitting capitalists against populists who feared the wealthy few would

hog power and crush liberty. The skirmishing has resurfaced amid our own credit crackup, with book after book faulting the Federal Reserve for allowing Americans to run up some $34 trillion in domestic non-financial debt.

Can the Fed be fixed? Don’t bother, writes U.S. Congressman Ron Paul in "End the Fed," a blistering libertarian broadside from a firm believer in Austrian

economics.

Can the Fed be fixed? Don’t bother, writes U.S. Congressman Ron Paul in "End the Fed," a blistering libertarian broadside from a firm believer in Austrian

economics.

Paul, a Republican from Texas, wants to abolish the Fed, freeze the money stock, and reintroduce a gold standard. His book lays out his arguments in blunt rhetoric

pitched to the surly mood of an understandably disillusioned electorate. He attributes his title to a catchphrase he heard University of Michigan students chanting in October 2007.

"All around the country, people are gathering outside Federal Reserve buildings to protest against the power, secrecy and operations of the Fed, and chanting this great

slogan," he writes. "Their goal is not reform but revolution."

Many of Paul’s assertions ring true. Inflation amounts to taxation, he says. Correct. Central bankers are central economic planners, he asserts. Absolutely. Wall Street

likes "privatized profits and socialized losses." No surprise there. He’s right, yet draws the wrong conclusions.

Utopian Promises

Like many clever politicians, Paul has a knack for mixing sound observations with Utopian promises. Without the Fed, he says, we would enjoy "all the privileges of modern

economic life without the downside of business cycles, bubbles, inflation, unsustainable trade imbalances and the explosive growth of the government that the Fed has fostered."

No wonder the jacket carries a written endorsement from folkie Arlo Guthrie, who says the book has

"decisively changed my mind."

Hold on, though. Wasn’t America’s Fed-less 19th-century history punctuated with recurring booms, busts and banking panics? Paul dismisses such talk.

"Most of the tales of 19th-century banking are mythical," he says, blaming the upheavals on government meddling.

Paul’s position is that commercial banks should again be subjected to the full blast of the free market, like any other business. Central banks, in this view, make

markets inefficient.

Inefficient Markets

There are two snags. The first is that financial markets aren’t as efficient as economic theorists have hypothesized. If you don’t believe me, read Justin Fox’s history,

"The Myth of the Rational Market" (HarperBusiness).

The other hitch is that banks play a unique role in society -- a role that even Adam Smith recognized, as Henry Kaufman writes in "The Road to Financial Reformation" (Wiley).

"The great champion of laissez-faire recognized the special character of banks as custodians of wealth, and the risks to society if they are left in irresponsible hands," says Kaufman, a former Salomon Brothers Inc. managing director.

If we’re stuck with the Fed, we had better find a way to fix it. And that means understanding the muddled thinking that underpins central-banking decisions, as George Cooper has explained in "The Origin of Financial Crises" (Vintage).

Schizophrenic Fed

Cooper, a fixed-income fund manager at BlueCrest Capital Management Ltd. in London, argues that central bankers are schizophrenic. When the economy is bubbling, they

behave like Friedmanites, leaving the market to do its thing. Come a slowdown, though, they turn Keynesian, rushing to stimulate the economy with rate cuts. That’s how the Fed allowed excess credit

to build up, cycle after cycle, inflating asset prices into what George Soros calls a "super bubble."

Cooper’s solution: Oblige central banks to prick such bubbles by occasionally withdrawing liquidity from the market in what he calls "fire drills."

This is unlikely to satisfy Paul, who deplores the "scoundrels at the Fed." So perhaps he should reflect on the Panic of 1907, which ultimately led to the Fed’s

founding.

When massive gold shipments drained into the U.S. from London after the San Francisco earthquake of 1906, the Bank of England moved to stanch the outflow by raising

its benchmark interest rate to 6 percent from 3.5 percent, as Barry Ritholtz of research firm FusionIQ writes in "Bailout Nation" (Wiley). Other European banks followed suit.

To Ritholtz, the moral is clear:

"Unless all nations agree to do so simultaneously, the dissolving of a central bank amounts to the economic equivalent of unilateral disarmament."

"End the Fed" is from Grand Central (212 pages, $21.99).

- (James Pressley writes for Bloomberg News. The opinions expressed are his own.)

- To contact the writer on the story: James Pressley in Brussels at jpressley@bloomberg.net.

- To contact the editor responsible for this story: Mark Beech at mbeech@bloomberg.net.

Goldman Sachs VP explains why he quit

CBS News 60 Minutes

Anderson Cooper

October 21, 2012

The following is a script from "Resignation" which aired on Oct. 21, 2012. Anderson Cooper is the correspondent. Andy Court and Anya Bourg,

producers.

Many of us have, at some point in our lives, dreamed of quitting our jobs very loudly and telling our bosses exactly what we really think. Very few of us ever do it. But

seven months ago, a vice president at the legendary investment bank Goldman Sachs did just that, resigning in an article on the op-ed page of The New York Times. The article caused a sensation -- not

just because its author Greg Smith was saying, three-and-a-half years after the financial crisis, that the bank was headed on the wrong ethical course, but also because it's so unusual to learn

anything at all about the inner workings of Goldman Sachs. Read more

Why I Am Leaving Goldman Sachs

The New York Times, Op-Ed

By GREG SMITH

March 14, 2012

TODAY is my last day at Goldman Sachs. After almost 12 years at the firm — first as a summer intern while at Stanford, then in New York for 10 years, and now in London —

I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I

have ever seen it.

To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money. Goldman Sachs

is one of the world’s largest and most important investment banks and it is too integral to global finance to continue to act this way. The firm has veered so far from the place I joined right out of

college that I can no longer in good conscience say that I identify with what it stands for.

Read more See related stories and video below

- Reacting to Goldman Executive’s Resignation Letter, by Eric Owles, New York Times

- Public Exit From Goldman Raises Doubt Over a New Ethic, by Nelson D. Schwartz, New York Times

- The Good, Bad and Ugly of Capitalism, by Joe Nocera, NYT

David Stockman on Crony Capitalism

David Stockman on Crony Capitalism

Bill Moyers & Company

March 9, 2012

Moyers & Company explores the tight connection between Wall Street and the White House with David Stockman, former budget director for President Reagan.

Now a businessman who says he was "taken to the woodshed" for telling the truth about the administration’s tax policies, Stockman speaks candidly with Bill Moyers about

how money dominates politics, distorting free markets and endangering democracy. "As a result," Stockman says, "we have neither capitalism nor democracy. We have crony capitalism."

Stockman shares details on how the courtship of politics and high finance have turned our economy into a private club that rewards the super-rich and corporations,

leaving average Americans wondering how it could happen and who’s really in charge.

"We now have an entitled class of Wall Street financiers and of corporate CEOs who believe the government is there to do… whatever it takes in order to keep the game

going and their stock price moving upward," Stockman tells Moyers. Read more

U.S. Drops Fraud Charges Against David Stockman, NYT Jan-09-09

Gretchen Morgenson on Corporate Clout in Washington

Gretchen Morgenson on Corporate Clout in Washington

Bill Moyers & Company

March 9, 2012

Moyers talks with Pulitzer Prize-winning New York Times reporter and columnist Gretchen Morgenson on how money and political clout enable industries to escape regulation

and ensure high compensation for executives at the top. Read more

Is Banking Bad?

The New York Times

By NICHOLAS D. KRISTOF

January 18, 2012

When I spoke at Swarthmore College recently, I was startled by one question: Is it immoral for students to seek banking jobs?

The corollary question, with Mitt Romney’s business career under attack even by staunch Republicans, is this: Is it unethical to make millions in private

equity?

My answer to both questions: no.

I’ve been sympathetic to the Occupy Wall Street movement, but, look, finance is not evil. Banking has contributed immensely to modern civilization. By allocating capital

to more efficient uses, banking laid the groundwork for the industrial revolution and the information revolution.

Likewise, the attacks on private equity seem over the top. Private equity firms like Bain Capital, where Romney worked, aren’t about destroying companies and picking

over the carcasses. Rather, the aim is to acquire poorly managed companies, make them more efficient (sometimes by firing people but often by rejiggering the business model) and then resell them at a

profit. That’s the merciless, rugged nature of capitalism.

Liberals should also be wary of self-selecting out of certain occupations. After Vietnam and revelations of C.I.A. abuses in the 1970s, many university students avoided

the military and the intelligence agencies. So slots were filled disproportionately by ideological conservatives in a way that undermined everyone’s interests. We would have been better off if more

Swarthmore idealists had become generals and C.I.A. officers — and we may be better off if some idealists become bankers as well.

Now for my caveats. Read more

In Aftermath of Financial Crisis, Who's Being Held Responsible?

PBS News Hour

by Ray Suarez

November 24, 2011

As anger over the financial crisis lingers, questions remain as to who has been held accountable for their role in creating the conditions that led to the meltdown ...

and who has not. Ray Suarez reports. Read more

Kyle Bass Destroys The Ponzi-Prone Debt Sustainability Arguments Of The Status Quo...And Why Germany Can't Save The World

Kyle Bass Destroys The Ponzi-Prone Debt

Sustainability Arguments Of The Status Quo Zero Hedge

November 20, 2011

Another noteworthy Kyle Bass moment as he discusses debt sustainability among major global sovereign nations. Simply and proficiently, the hedge fund manager describes

how a dwindling current account surplus in Japan, US welfare economics, and the peripheral-to-core European stressors are all Madoff-like and unsustainable. Switching from broad-brush terms to the

idiosyncratic complexities of each region, Bass offers his inimitable take - in a mere six minutes - on how the status quo is quivering under its own self-deception. His rightful conclusions remain

extremely worrisome and should be required reading/watching for every central banker and politician trying to keep the dream alive. Read more

The 2011 University of Virginia Investing Conference was held November 10th & 11th at the Darden School of Business. This year's theme was "The Political Cycle, Political Change and Investing". In this video, Kyle Bass, Managing Partner of Hayman Capital Management LP, is interviewed by Darden Professor Ken Eades. Kyle spoke at the conference on "Debt Sustainability: Which Countries Are Beyond the Point of Return and Why".

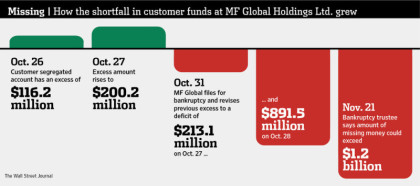

3 Months After The MF Global Bankruptcy, We Find That $1.2 Billion (Or More) In Client Money Has "Vaporized"

3 Months After The MF Global Bankruptcy, We Find

That $1.2 Billion (Or More) In Client Money Has "Vaporized"

Zero Hedge

by Tyler Durden

January 29, 2012

On the three month bankruptcy anniversary of the company whose rehypothecation gimmicks will one day be seen as a harbinger of everything that is broken with the

multi-trillion ponzi system, but not just yet despite loud warnings otherwise, we are getting close to a final verdict of where the $1.2 billion (and possibly more as originally predicted by Zero

Hedge - see below) in commingled client money may have gone. Note the use of the passive voice because using the active, as in money that MF Global executives stole from clients, is prohibited in a

legal system in which nobody goes to jail for something as modest as $1.2 billion in theft. That verdict? "Vaporized." No really (and yes, in the passive voice of course). From the WSJ: "As the sprawling probe that includes regulators, criminal and congressional

investigators, and court-appointed trustees grinds on, the findings so far suggest that a "significant amount" of the money could have "vaporized" as a result of chaotic trading at MF Global during

the week before the company's Oct. 31 bankruptcy filing, said a person close to the investigation." Uh huh... Because money simply vaporizes. more

Anger rises as MF Global clients see billions frozen

Insight: Anger rises as MF Global clients see billions frozen

Reuters

by David Sheppard and Jeanine Prezioso

November 20, 2011

(Reuters) - Three weeks after MF Global's collapse, furious former customers are still fighting for access to billions of dollars as they question why as much as

two-thirds of their money is still frozen.

While authorities have touted the fact that they are returning 60 percent of the collateral and cash that had been frozen in the wake of the broker's October 31

bankruptcy, a closer look shows that in fact only about 40 percent of customers' total funds have been authorized for release so far.

The remainder, more than $3 billion, ostensibly remains on hand to cover a shortfall originally estimated by MF Global to regulators at just $600 million.

Because the bankruptcy trustee, regulators and exchanges have made no comment on the missing funds in weeks -- and have given no information as to how much cash they are

retaining -- customers are left guessing exactly how much might end up in the creditors' process of the bankruptcy. Read more

MF Global May Have Used

Customer Funds In The Losing $6.3 Billion Trade Without Informing Clients

by Robert Lenzner

November 8, 2011

After an intense day of investigation, I have just discovered that a CFTC rule(1.29) allowed Jon Corzine’s MF Global to use the margin and cash in customers heretofore

segregated accounts to amass a risky $6.3 billion investment in European sovereign debt that backfired. Nor did Corzine have the obligation to inform any of these customers he was gambling with their

money. Or that he was intending to keep all the profits for himself and his troubled firm. Nothing for the customers.

The language of Rule1.29 allows "The investment of customer funds in instruments described in 1.29 shall not prevent the futures commission merchant (MF Global) or

clearing organization so investing such funds and retaining as its own any increment or interest resulting therefrom." Increment refers to any trading profits or gains. Read more

The United States: An Openly Corrupt Legal System

As Wall St. Polices Itself, Prosecutors Use

Softer Approach

The New York Times

by Gretchen Morgenson

and Louise Story

July 7, 2011

As the financial storm brewed in the summer of 2008 and institutions feared for their survival, a bit of good news bubbled through large banks and the law firms that

defend them.

Federal prosecutors officially adopted new guidelines about charging corporations with crimes — a softer approach that, longtime white-collar lawyers and former federal

prosecutors say, helps explain the dearth of criminal cases despite a raft of inquiries into the financial crisis. Read more

____________________________________________________

Naming Culprits in the 2008 Financial Crisis

Naming Culprits in the Financial Crisis

The New York Times

Gretchen Morgenson

Louise Story

April 13, 2011

A voluminous report on the financial crisis by the United States Senate — citing internal documents and private communications of bank executives, regulators, credit ratings agencies and investors —

describes business practices that were rife with conflicts during the mortgage mania and reckless activities that were ignored inside the banks and among their federal regulators.

The 650-page report, "Wall Street and the Financial Crisis: Anatomy of a Financial Collapse," was released Wednesday by the Senate Permanent Subcommittee on Investigations, whose cochairmen are Carl

Levin, a Michigan Democrat, and Tom Coburn, a Republican of Oklahoma. The result of two years’ work, the report focuses on an array of institutions with central roles in the mortgage crisis:

Washington Mutual, an aggressive mortgage lender that collapsed in 2008; the Office of Thrift Supervision, a regulator; the credit ratings agencies Standard & Poor’s and Moody’s Investors

Service; and the investment banks Goldman Sachs and Deutsche Bank.

"The report pulls back the curtain on shoddy, risky, deceptive practices on the part of a lot of major financial institutions," Mr. Levin said in an interview. "The overwhelming evidence is that

those institutions deceived their clients and deceived the public, and they were aided and abetted by deferential regulators and credit ratings agencies who had conflicts of interest."

Read more

The press release has links to the report and related documents

On the Financial Crisis, April 13, 2011

Press Release, Levin-Coburn Report On th[...]

Adobe Acrobat document [86.2 KB]

The Financial Crisis Inquiry Commission

The Financial Crisis Inquiry Commission

The Financial Crisis Inquiry Commission determined that the 2008 financial crisis was an "avoidable" disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according to a story in the New York Times January 25, 2011 ‘Financial Crisis Was Avoidable, Inquiry Finds’. The Times wrote "[T]he report is harsh on regulators. It finds that the Securities and Exchange Commission failed to require big banks to hold more capital to cushion potential losses and halt risky practices, and that the Fed "neglected its mission."

Final Report Conclusions

FCIC, Final Report Conclusions.pdf

Adobe Acrobat document [106.4 KB]

Credit Segregation Report, February 2011

Credit Segregation Report, February 2011

NATIONAL PEOPLE’S ACTION

Three years into the massive financial crisis, the economic fallout has clearly not impacted all areas of the nation equally. As this report documents, sharp racial

divides exist in terms of the prevalence of mainstream, wealthbuilding credit and the availability of high-priced, subprime loan products such as "payday" loans. This report examines the recent

availability of consumer credit in African-American and Latino communities in five major Midwestern metropolitan areas: Chicago, IL, Detroit, MI, Kansas City, MO-KS, Peoria, IL, and St. Louis MO-IL.

This report focuses on two consumer loan products at the opposite ends of the credit spectrum: home mortgage refinance loans and cash advance or payday loans.

Together the disparate availability of these products paints a disturbing picture of consumer credit conditions in the areas where most African-Americans and Latinos live during this third year of

financial crisis. Read more

National People's Action (NPA) is a Network of community power organizations from across the country that work to advance a national economic and racial justice agenda.

National People’s Action

credit-segregation-npa-report-feb-2011.p[...]

Adobe Acrobat document [2.8 MB]

Letting the Banks Off the Hook

The New York Times

By JOE NOCERA

April 18, 2011

Judging by last week’s performance, it sure looks as though the country’s top bank regulator is back to its old tricks.

Though, to be honest, calling the Office of the Comptroller of the Currency a "regulator" is almost laughable. The Environmental Protection Agency is a regulator. The O.C.C. is a coddler, a

protector, an outright enabler of the institutions it oversees.

Back during the subprime bubble, for instance, it was so eager to please its "clients" — yes, that’s how O.C.C. executives used to describe the banks — that it steamrolled anyone who tried to stop

lending abuses. States and cities around the country would pass laws requiring consumer-friendly measures such as mandatory counseling for subprime borrowers, or the listing of the fees the banks

were going to charge for the loan. The O.C.C. would then use its power to either block or roll back the legislation.

It relied on the doctrine of pre-emption, which holds, in essence, that federal rules pre-empt state laws. More than 20 times, states and municipalities passed laws aimed at making subprime loans

less predatory; every time, the O.C.C. ruled that national banks were exempt. Which, of course, rendered the new laws moot.

__________________________________________________________

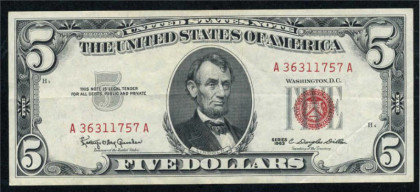

United States Note vs. Federal Reserve Note

The Economic Collapse Blog

by Michael T. Snyder, Esq.

December 19, 2011

Most Americans have no idea that the U.S. government once issued debt-free money directly into circulation. America once thrived under a debt-free monetary system,

and we can do it again. The truth is that the United States is a sovereign nation and it does not need to borrow money from anyone. Back in the days of JFK, Federal Reserve Notes were not

the only currency in circulation. Under JFK (at at various other times), a limited number of debt-free United States Notes were issued by the U.S. Treasury and spent by the U.S. government

without any new debt being created. In fact, each bill said "United States Note" right at the top. Unfortunately, United States Notes are not being issued today. If you stop right

now and pull a dollar out of your wallet, what does it say right at the top? It says "Federal Reserve Note". Normally, the way our current system works is that whenever more Federal

Reserve Notes are created more debt is also created. This debt-based monetary system is systematically destroying the wealth of this nation. But it does not have to be this way. The

truth is that the U.S. government still has the power under the U.S. Constitution to issue debt-free money, and we need to educate the American people about this. Read

more

________________________________________________________

Nixon's Colossal Monetary Error: Verdict 40 Years Later

Nixon's Colossal Monetary Error: The Verdict 40 Years Later

Forbes

by Charles Kadlec

August 15, 2011

Today, Aug. 15, 2011, is the 40th anniversary of President Richard Nixon's colossal error: severing the final link between the dollar and gold. No other single action by

Nixon has had a more profound and deleterious effect on the American people. In the end, breaking the solemn promise that a dollar was worth 1/35th of an ounce of gold doomed his Presidency, and

marked the beginning of the worst 40 years in American economic history.

The announcement itself was dramatic, contained in a Sunday evening address to the nation from the Oval Office. The promises made were profound and reflected the

received wisdom of that day and today: unshackling the U.S. government from the requirement of maintaining the dollar's value in terms of gold would empower able men and women at the Federal Reserve

to use monetary policy to increase the general prosperity of the American people.

Domestically, we were promised that the manipulation of quantity and value of a paper dollar would avoid costly recessions, provide high employment, and produce strong

economic growth. Internationally, we were promised that the devaluation of the dollar would reduce our trade deficit and improve the international competitiveness of American workers and businesses.

And, because trade was only one-tenth of the U.S. economy, all of this could be done while maintaining price stability.

Each and every one of these promises has been broken. more

___________________________________________________________

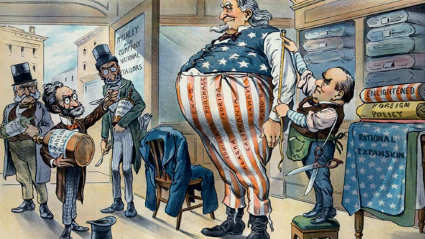

Zip Code 10036. How important is this issue worldwide?

One zip code in this country spends nearly half of all the special interest lobbying money used to influence Congress. It’s 10036, the upper east side of Manhattan. That’s where the Mayor of New York City lives. That’s where the Wall Street bankers live. They control the money, they control the mass media, they control Congress. They get the bailouts – other Americans get the bill (in higher taxes to pay the ever-growing interest on the National debt, and in fewer services). See The Money Masters website.

Link to The Secret of Oz by Bill Still on YouTube. The Money Masters Wikipedia page is gone. Below is a PDF of the old page.

The_Money_Masters Wikipedia.pdf

Adobe Acrobat document [75.3 KB]

The concentration of the world’s money by the One Percent, and impoverishment of billions of our fellow human beings, 1/3rd of whom make less that $2 a day, over 1/2 in abject poverty while the One Percent grow fabulously richer daily, is a moral outrage.

____________________________________________________