Florida Lawyer Scandal

Order of Disbarment, 765880_123.pdf

Adobe Acrobat document [29.3 KB]

Disbarment on Consent, 765880_122.pdf

Adobe Acrobat document [116.0 KB]

Federal Detention Order.pdf

Adobe Acrobat document [184.4 KB]

Florida Lawyer Rothstein Gets 50 Years for

Ponzi Scheme

ABA Journal Law News Now

By Debra Cassens Weiss

June 9, 2010

Disbarred South Florida lawyer Scott Rothstein has been sentenced to 50 years in prison for a $1.2 billion Ponzi scheme, a sentence that is 10 years longer than prosecutors requested.

U.S. District Judge James Cohn imposed the sentence this morning, Bloomberg, the Associated Press, Reuters and the Miami Herald report. Rothstein was sentenced for selling investors discounted stakes in phony

legal settlements.

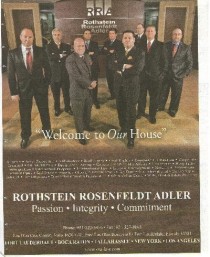

According to the Herald, "Rothstein will go down in South Florida history as a one-man wrecking ball who destroyed his own 70-attorney law firm, Rothstein Rosenfeldt Adler, and used it to prop

himself up as a flashy player among wealthy investors, society types, trendy entrepreneurs and prominent politicians."

Rothstein had sought a 30-year sentence based on his cooperation, telling the court in a 12-page letter than his scheme was "all in the name of ego and

greed." He talked about his drive to succeed after growing up in a family that struggled financially, and his thoughts of suicide when his wrongdoing was discovered. Rothstein wrote that he felt

"overwhelming remorse and self-loathing" for harming his victims. Rothstein's cooperation reportedly included wearing a wire to help implicate a

reputed mafia figure. Read more

Scott W. Rothstein directory listing, The Florida Bar

Florida Lawyer Rothstein Personally Stole $168 Millon

Lawyer: Rothstein Personally Stole $168 Million

Bob Normans blog

Broward Palm Beach New Times

Fort Lauderdale attorney Bill Scherer, who is suing numerous alleged Scott Rothstein co-conspirators in civil court, said today that after examining bankruptcy documents, his firm has determined that

Rothstein stole a grand total of $168 million out of what was a $1.4 billion Ponzi scheme. Also today we learn that Rothstein friend Ted Morse allegedly made millions off the Ponzi scheme. Two big

losers: Ted's dad, legendary car dealer Ed Morse, who was swindled for big money, and longtime Rothstein law partner Howard Kusnick, who expects to be indicted by the feds. In all, Scherer said that

$1.4 billion ran through the Rothstein Rosenfeldt Adler firm's Ponzi trust accounts and a little over $1.2 billion went back out to investors, the difference of which is $168 million that Rothstein

personally pocketed to buy property, businesses, jewelry, a yacht, and a fleet of luxury automobiles including a pair of $1 million-plus Bugattis. He also sank millions of the stolen money into

political campaigns and charities. Read more

Ponzi schemer Rothstein questioned by more than 30 attorneys inside

Miami federal courtroom

The Palm Beach Post News

by Jon Burstein, Sun-Sentinel Staff Writer

December 13, 2011

The Ponzi schemer who was once the toast of Fort Lauderdale reappeared this morning from the shadow of federal protective custody, offering closed-door testimony to how

he pulled off the $1.4 billion fraud.

A graying Scott Rothstein - wearing T-shirt, jeans and sneakers - took the witness stand in a Miami federal courtroom, "naming names, situations and various illegal

activity," said William Scherer, the Fort Lauderdale attorney representing investors alleging losses of more than $100 million.

"The corruption that went on there was bigger than I knew," said Scherer after the first morning session of what's been called "The Big Deposition"- two weeks of

Rothstein answering questions from more than 30 attorneys involved in the swirl of civil litigation resulting from the fraud.

While not going into detail about the testimony, Scherer said the now-disbarred attorney named three other law firms that had helped fuel the Ponzi scheme by agreeing to

go along with Rothstein's lies.

Rothstein's appearance at the James Lawrence King Federal Justice Building came with U.S. Marshals standing watch outside the courtroom. Reporters are banned from the

proceedings, with a Tuesday hearing in Fort Lauderdale bankruptcy court potentially determining when transcripts of Rothstein's testimony will be made public.

Rothstein has been in a federal witness program within prison, authorities keeping his whereabouts secret after it was revealed he helped them nab a reputed Sicilian

Mafioso.

Scherer described Rothstein's testimony as conversational and cordial, with the disbarred attorney vowing he's telling the truth because he doesn't want to jeopardize

his chances of getting out of prison alive. Rothstein, 49, is serving a 50-year sentence, but hopes to get it reduced by cooperating with federal prosecutors and the attorneys handling the bankruptcy

of his now-defunct law firm, Rothstein Rosenfeldt Adler.

Rothstein's return comes amid increasing buzz in the South Florida legal community of more people being charged related to his case. Five Rothstein associates have cut

deals with federal prosecutors and another two - his uncle and his administrative assistant - were charged earlier this month. Read more

Steven Lippman, Ex-Partner of Scott Rothstein, Is

Indicted in Alleged Bank Fraud Conspiracy

ABA Journal Law News Now

by Martha Neil

April 9, 2012

A former partner of a disbarred South Florida lawyer who is now serving a hefty prison term has been federally indicted in an alleged conspiracy to commit bank fraud and

break election laws.

Steven Lippman, 49, is also accused of having defrauded the Internal Revenue Service by conspiring with Rothstein to reimburse Lippman for personal expenses from law

firm funds, under the pretext that they were business expenses, thus reducing Lippman's taxable income, according to CBS Miami and Bob Norman's Blog on WPLG.

The articles don't include any comment from Lippman or his legal counsel. However, a subsequent Bloomberg story says Lippman's lawyer, Bruce Zimet, told the news

agency that "the charges speak for themselves" and emphasized that his client was not a participant in the $1.2 billion Ponzi scheme for which Rothstein is now serving a 50-year prison

sentence.

The government contends that Lippman, a nonequity partner in the now-shuttered Rothstein Rosenfeldt Adler, helped the Fort Lauderdale law firm increase its influence by

serving as a straw donor for political funding for which he was then illegally reimbursed. He allegedly received not only money in return but other things of value, including home renovations and a

Maserati.

"The breadth, scope, and sheer complexity of Rothstein’s $1.2 billion Ponzi scheme is mind-boggling," said U.S. Attorney Wifredo Ferrer in a written statement on Monday.

"Its success depended, in no small part, on the complicity of his colleagues and associates, like Steven Lippman."

An Orlando

Sentinel article provides additional details. Read more

The case is U.S.A. v. Lippman, 12-cr-60078, U.S. District Court, Southern District of Florida (Fort Lauderdale).

USA v. Lippman, 12-cr-60078, Information[...]

Adobe Acrobat document [663.5 KB]

Imprisoned Ex-Attorney Says Cash Bribes, Call Girls at Law Firm Condo Aided $1.2B Ponzi Scheme

ABA Journal Law News Now

by Martha Neil

January 9, 2012

Cash bribes totaling at least $1 million and call girls helped him pull off a $1.2 billion Ponzi scheme, a disbarred Florida lawyer said during a 10-day deposition in a

federal courtroom in Miami last month.

Now serving a 50-year prison term, Scott Rothstein said he hoped to win a sentence reduction by telling the truth about what happened. He pointed the finger at bankers,

law partners, law enforcement officers, politicians, unidentified judges and others, claiming that cash bribes and a chance to participate in a "rock-star lifestyle" featuring private jets, sports

events, strip clubs and call girls helped grease the wheels for his scheme, according to the Associated Press and the Pulp blog of the Broward/Palm Beach New Times.

Rothstein, 49, said a condo across the street from his now-bankrupt Fort Lauderdale law firm served as a convenient spot for himself and his law partners to meet call

girls during the work day, the Pulp recounts. He estimated that he sometimes spent as much as $50,000 to $60,000 per month on prostitutes, and claimed that one of his partners was racking up a

$5,000-a-week call girl bill.

Lawyers representing law partners of Rothstein who he claimed used the prostitutes called his allegations ridiculous and argued that he is a known liar who would say

anything to try to win a sentence reduction, according to the Orlando

Sentinel.

Although Rothstein did not claim that all of those he identified knew of the scheme, the perception of his power and a chance to participate in his luxurious lifestyle

apparently convinced some not to look too closely into what might be fueling the money flow, according to a Miami Herald op-ed.

"In its simplest terms, it is the ability to do whatever you want, whenever you want, wherever you want, by whatever means you can think of," Rothstein explained during

the deposition.

"Chartering jets. Not waiting in lines at any restaurant or any club. Wearing the most expensive clothes. Having access to the best clothiers, the best shoemakers,

having access to the finest jewelry.

"Being able to shut down a store and bring your friends in and jewelry shop. And at concerts having backstage passes, being in the first row, first three rows of

concerts, being on the floor at Heat games." Read

more

Imprisoned Ponzi-Schemer Ex-Lawyer Explodes at Murder

Insinuation

ABA Journal Law News Now

by Debra Cassens Weiss

January 4, 2012

Convicted Ponzi schemer Scott Rothstein told a lawyer questioning him that she was "disgusting" for insinuating he was involved in the murder of a partner at his

one-time Florida law firm, Rothstein Rosenfeldt Adler.

The exchange occurred in a Dec. 22 deposition that was released on Tuesday. The Sun Sentinel, the South Florida Business Journal and the Broward Palm Beach New Times

blog the Pulp covered the testimony.

Disbarred lawyer Rothstein exploded in anger when lawyer Mary Barzee Flores, who is representing Gibraltar Private Bank & Trust, asked Rothstein about the murder of

partner Melissa Britt Lewis.

Tony Villegas, the former husband of the law firm’s chief operating officer, Debra Villegas, has been charged in the murder. Tony Villegas reportedly blamed Lewis for

the break-up with his wife.

But Barzee Flores suggested a different scenario for the death of Lewis:

Barzee-Flores: She was murdered because she knew too much, right?

Rothstein: Excuse me? Are you attempting to insinuate that I had something to do with that poor girl's death? Have you lost your mind?

Barzee Flores: You would deny that?

Rothstein: I would deny it? You're disgusting. Everyone knows that I wasn't involved in it. That's disgusting.

Rothstein has acknowledged an affair with Lewis when he taught her in law school.

Gilbraltar Private Bank & Trust is a defendant in a suit claiming it should have known about illegal transfers made by Rothstein. Read more

Convicted in $1.2B Ponzi Scheme, Scott Rothstein Said in Depo That 2 Law Firm Partners Benefited

ABA Journal Law News Now

by Martha Neil

December 21, 2011

Disbarred attorney Scott Rothstein pointed the finger at two ex-partners of his bankrupt South Florida law firm during a deposition, the Associated Press and South Florida Business Journal report.

Convicted of running a $1.2 billion Ponzi scheme while at the helm of the Rothstein Rosenfeldt Adler law firm and sentenced to 50 years, Rothstein said on the first day

of the deposition, Dec. 12, that partners Russell Adler and Stuart Rosenfeldt knew about and benefited from the scheme, according to a transcript released today. He said he is cooperating with

lawyers involved in bankruptcy litigation and civil claims in the hope of winning a sentence reduction.

"They knew that we were moving money illegally in and out the of the law firm. At various points in time, they came to know that there was a Ponzi scheme going on,

although the word Ponzi was never utilized," said Rothstein, according to the transcript, as published by the Business Journal.

Adler and Rosenfeldt have previously said they had no knowledge of Rothstein's scheme, which involved selling purported investments in fake legal settlements to

well-to-do individuals. And, in response to Rothstein's allegations, their lawyers reiterated those denials, reports the AP:

"Mr. Rosenfeldt knew nothing of the illegal activities by Mr. Rothstein," said Rosenfeldt's attorney, Bruce Lehr.

"We would expect Mr. Rothstein to say whatever he has to say to get out of prison in his lifetime," said attorney Fred Haddad, who represents Adler.

Rothstein estimated during the deposition that he himself personally spent $200 million, in a crime that he said was motivated not by a desire for material things but a

desire for power.

"We were living like rock stars ... We had more than enough money to fuel our lifestyles," he said. "It was that power that got ahold of us and kept pulling this

forward; the more power, the more money, the more money the more power, it kept going back and forth until [it] exploded."

Scott Rothstein Transcripts Day 1

South Florida Business Journal

by Paul Brinkmann

December 21, 2011

Scott Rothstein, South Florida’s flamboyant and corrupt Ponzi schemer, says in newly released depositions that the other two named partners in his law firm knew he was

"moving money illegally in and out of the law firm."

Stuart Rosenfeldt and Russell Adler, the other names in Rothstein Rosenfeldt Adler, have denied knowing that Rothstein was doing anything illegal. Rosenfeldt's attorney

recently said he expects Rosenfeldt to be indicted, but will fight the accusations.

"They knew that we were moving money illegally in and out the of the law firm. At various points in time, they came to know that there was a Ponzi scheme going on,

although the word Ponzi was never utilized," Rothstein said. Read more

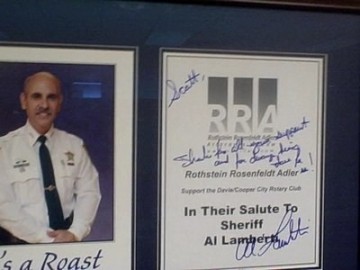

Sunshine State News: Ponzi King Courted Charlie Crist Aide

Here's another key piece of memorabilia from the law firm's office wall. It's Broward Sheriff Al Lamberti and it concerns a roast for Lamberti at the Davie/Cooper City Rotary Club that was apparently attended by Rothstein. Lamberti writes: "Scott, thanks for all your support and for always being there for me!" Read more

Talking Points Memo Muckraker

by Justin Elliot

November 19, 2009

Bill McCollum, the likely GOP nominee in the Florida gubernatorial race, is calling on the Republican Governors Association to give back a $200,000 donation from accused

fraudster attorney Scott Rothstein, whose political support has become a hot issue in the race.

The statement from McCollum, who is in Austin for the RGA conference this week, comes on the heels of a demand from the Democratic Governors Association that McCollum

ask the RGA to give the money back. Read more

Fort Lauderdale, FL - South Florida just can’t catch a break. First Bernie Madoff, now an alleged Ponzi scheme by Fort Lauderdale attorney Scott Rothstein—what gives? Read more

Scott Rothstein To The Rescue

BrowardBeat.com

by Buddy Nevins

Scott may be a tad eccentric. The bodyguards are a bit much...But who cares about Rothstein’s idiosyncrasies when he is so generous. Broward is a better place

because of Scott and Kimberly.

If the recession has hit your charity, you might want to invite superlawyer Scott Rothstein and his wife, Kimberly Rothstein.

The Rothsteins are single-handedly keeping a number of Broward County’s charities in the black with their philanthropy.

Since the first of the year the Rothsteins have:

- Given between $500,000 and $1 million to the Boys & Girls Club of Broward County. Charity sources say they haven’t totaled up yet the take from two big events where Rothstein and his firm gave money. But at just one event at the Boca Raton Resort and Club, Rothstein was a $50,000 sponsor and kicked in "six figures" more for auction goodies, according to an official of the club. Read more

Broward-Palm Beach New Times

The Daily Pulp

Bob Norman’s Blog

November 2 2009

A federal investigation into Rothstein's investment scheme is under way. Rothstein's whereabouts are still unknown, though rumors persist that he is in Morocco, which has no extradition treaty with

the United States.

I'm not sure we'll know for sure anytime soon, but I can say that when I briefly reached him on his cell phone yesterday morning, I heard foreign voices that I couldn't identify in the background. Also, one of my numerous calls to his cell phone came to what appeared to be a recording of a woman speaking in a French dialect. (French is the common language of commerce in Morocco.) It was very bizarre, and subsequent calls have connected to his regular voice mail. Even his attorney, Marc Nurik, who has said Rothstein left town to "clear his head," claims not to know where he is. Read more

Cell similar to where Scott Rothstein was held in Miami at the Federal

Detention Center

Federal Detention Center, Miami (FDC Miami) is a prison operated by the Federal Bureau of Prisons. It is located east of Miami International Airport at the corner of NE. 4th Street and N. Miami Avenue. The administrative facility employed 311 staff as of 2002 and housed 1,512 male and female inmates as of July 15, 2010. Read more

Florida Law Firm Rothstein, Rosenfeldt, Adler

Lawyer Crashes After a Life in the Fast Lane

The Wall Street Journal

By NATHAN KOPPEL and MIKE ESTERL

November 19, 2009

FORT LAUDERDALE, Fla. -- No one ever accused Florida attorney Scott Rothstein of being subtle -- or of skimping.

At an Eagles concert this year, Don Henley, the band's drummer, singled out Mr. Rothstein and his wife, Kimberly. "I don't normally do this, but this goes out to Scott and Princess Kimmy on their

one-year wedding anniversary," Mr. Henley told the audience as the band ripped into "Life in the Fast Lane," its paean to the perils of excess. Mr. Rothstein paid $100,000 to one of Mr. Henley's

charities for the dedication. Read more

Florida Lawyer Scott Rothstein, Alex Sink

Do Rothstein-like Scandals Change the Perception of Lawyers?

Wall Street Journal Law Blog

December 10, 2009

They say one bad apple spoils the bunch. But when it comes to one lawyer in a legal community, to what degree is that really true?We ask the question in light of a post we saw today over at Overlawyered, which links to a story from the Daily Business Review on our favorite alleged South Florida Ponzi-scheming lawyer, Scott Rothstein.

According to the story, some members of the south Florida bar are worrying about “how the Fort Lauderdale powerbroker’s spectacular downfall might affect the public trust in the profession, which is implicitly relied upon as an honest broker in business and policy matters in both the public and private sector.”

Ex-Law Firm COO Faces Money-Laundering Conspiracy Case in Rothstein $1.2 Billion Ponzi Scheme

ABA Journal Law News Now

by Martha Neil

April 27, 2010

The chief operating officer of the former Rothstein Rosenfeldt Adler law firm has been federally charged with conspiracy to commit money laundering concerning the $1.2 billion Ponzi scheme that now-disbarred attorney Scott Rothstein ran from his South Florida law office. Once described by Rothstein as his right-hand woman, Debra Villegas, 42, is the second person to be charged in the case after Rothstein himself. She is accused of helping him fabricate and market bogus litigation settlements to investors in the Ponzi scheme, according to the Miami Herald and the South Florida Business Journal.

Others formerly at the now-bankrupt 70-attorney Fort Lauderdale-based law firm are also expected to face charges in the case, the Herald reports, citing anonymous sources. If convicted, Villegas could be sentenced to a decade in prison and a fine of $250,000 or double the amount she made from the scheme. The feds are also seeking forfeiture of $1.2 million, her Weston, Fla., home and her 2009 Maserati.

The Wall Street Journal Law Blog provides a link to the federal information (PDF) in which Villegas is charged. Read more

Florida Lawyer David Boden paid $500,000 by Rothstein

Teary Ex-GC for Ponzi Schemer Rothstein: 'I Didn't Know the Guy Was a Criminal'

ABA Journal Law New Now

by Debra Cassens Weiss

April 30, 2010

The former general counsel in the law firm of convicted Ponzi schemer Scott Rothstein cried several times during a deposition yesterday, saying he had trusted the lawyer who lured him to a job that eventually paid $500,000 a year.

David Boden testified in a deposition taken in the bankruptcy of Rothstein's law firm, Rothstein Rosenfeldt Adler, report the Daily Business Review and the South Florida Sun Sentinel. At one point Boden stopped the deposition to compose himself, the story says, as he detailed his discovery that hundreds of millions of dollars were missing from law firm trust accounts. Read more

Rothstein associate Debra Villegas pleads guilty to money-laundering

Miami Herald

by Jay Weaver

April 28, 2010

One of Scott Rothstein's closest confidantes at his defunct Fort Lauderdale law firm pleaded not guilty Wednesday to a money-laundering conspiracy charge alleging she helped him engineer his $1.2 billion Ponzi scheme. Debra Villegas, former chief operating officer of Rothstein's law firm, was granted a $250,000 bond by U.S. Magistrate Robin Rosenbaum after federal prosecutors said she has been assisting them with the investigation into South Florida's biggest financial fraud scheme since it crashed last fall. Assistant U.S. Attorney Lawrence LaVecchio said Villegas has been cooperating "with no conditions'' and that she has been "truthful and candid'' not only about her own "culpability'' in Rothstein's investment racket but also about others suspected of playing roles in the scam. Read more

Did friendship cost Rothstein lawyer Melissa Lewis her

life?

Miami New Times

By Lisa Rab

Thursday, Apr 29 2010

The last day Debra Villegas saw her best friend alive, Melissa Britt Lewis came into Debra's office to ask about her outfit. It was a new suit, just purchased that

weekend, chocolate brown with pinstripes.

But it was a size 8, and Melissa was afraid it was too big. She was just five-foot-three, with a sensible honey-brown haircut and an easy Southern smile. As a rising

star in the Rothstein Rosenfeldt Adler law firm, Melissa, 39, took her appearance seriously. She carried a red Prada purse and wore a Judith Ripka ring.

Melissa stepped on a ladder to study herself in the tall mirror that Debra, chief operating officer at the firm, kept in her office. She twirled around. "Do you think I

should have worn this shirt?" Debra remembered her saying, according to a sworn police interview. read more

Sun-Sentinel

By Peter Franceschina

May 9, 2010

One of the lawyers who goes way back with Ponzi schemer Scott Rothstein is a target of a federal investigation and expects to be indicted, the former partner's attorney told a judge during a Friday

court hearing.

Howard Kusnick, who first practiced years ago with Rothstein in their small firm in Plantation and later joined the Rothstein Rosenfeldt Adler law firm in downtown Fort Lauderdale, is a target of the

federal investigation that brought down Rothstein, said Kusnick's civil attorney, Rachel Kelman.

The revelation came during a bid to put a malpractice suit against Kusnick on hold. Kusnick and other members of Rothstein's firm are being sued by auto magnate Ed Morse. One of the criminal

allegations that Rothstein admitted to in January was defrauding Ed and Carol Morse of $57 million, using fictional court orders involving a Palm Beach County case the couple had filed against a

kitchen designer. Read more

Man Accused of Murdering Rothstein Firm Partner Is

Incompetent for Trial

ABA Journal Law News Now

by Martha Neil

May 3, 2010

The man accused of murdering a Florida attorney from a now-notorious law firm is incompetent to stand trial. Tony Villegas was declared incompetent last month by Broward Circuit Judge Michael Gates, after the prosecution and defense team agreed on medical findings by two forensic psychologists, defense attorney Al Milian tells the South Florida Sun-Sentinel.

The 46-year-old defendant is accused of strangling partner Melissa Britt Lewis, 39, of Rothstein Rosenfeldt Adler on March 5, 2008 and dumping her body in a canal in Plantation. Lewis' best friend was reportedly the suspect's ex-wife, Debra Villegas, who served as chief operating officer of the Rothstein firm.

Debra Villegas told Plantation police that her ex had threatened to kill her, and the couple's teenage son said his father had blamed Lewis for the break-up with his wife that preceeded Lewis' death.

The former head of the RRA, Scott Rothstein, is now awaiting sentencing after pleading guilty to criminal charges concerning his role in operating an alleged $1.2 billion Ponzi scheme and Debra Villegas was federally charged late last month in a related money-laundering conspiracy case. Read more

New hire: I was fancy check collector at Rothstein firm

The Miami Herald

by AMY SHERMAN

May 9, 2010

When Cheryl Seinfeld was laid off from the Republican Party of Florida, the politically connected attorney Scott Rothstein scooped her up in a matter of days in 2008.

His offer: $100,000 a year to serve as the director of governmental relations for his Rothstein Rosenfeldt Adler firm in Fort Lauderdale.

``There was no specific job description,'' Seinfeld said in a deposition by Berger Singerman lawyer Stefanie Moon, whose firm is working for the trustee in the bankruptcy case. ``I was a fancy check collector.''

Seinfeld -- not part of the criminal case nor a bankruptcy case defendant -- testified that she traveled with Rothstein on a chartered airplane to the 2008 Republican National Convention in Minnesota with lawyers at the firm, including Stuart Rosenfeldt, Carlos Reyes and Grant Smith.

Also on the plane, she said: political operative Roger Stone, Shane Strum, who worked for Gov. Charlie Crist and is now his chief of staff, and Crist's attorney Jason

Gonzalez. Also, Rothstein's bodyguard Bob Scandiffio. Read more

Scott Rothstein's exotic autos go on display

Sun Sentinel

by Robert Nolin

May 10, 2010

Millions worth of forfeited cars are now up for auction

There was enough horsepower to stampede a thousand stallions, more gull wings than in a beachside parking lot, and the kind of exotic steel and leather that fuels any gearhead's dream of an open road and a snazzy sports car.

The Rothstein Collection went on display in full glory Monday outside a Miami warehouse. Ten top-end autos once belonging to the acquisitive Scott Rothstein, South Florida's notorious Ponzi schemer, were open for inspection by prospective bidders in a multi-million-dollar government auction.

"You look at that Bugatti, or that Lamborghini," said Rick Levin, whose Chicago company is running the auction for the U.S. Treasury. "They are like works of art."

The cars, like their former owner, were all flash and color: blinding yellow, deep red, ominous black. Upswung doors — the gull wings — made some cars appear ready for flight. Another, a 2009 Bentley in staid white, bespoke money and restraint. Read more

Win a Piece of a Convicted Ponzi Schemer’s Spoils

The New York Times

Edited by Andrew Ross Sorkin

May 10, 2010

If you have a yearning for high-powered sports cars — say, a 2008 Bugatti Veyron (above) or a Ferrari F430 Spyder — consider booking a ticket to Fort Lauderdale, Fla., for early June.

There, auctioneers will sell off vehicles belonging to Scott Rothstein (above), the South Florida lawyer convicted of running a $1.2 billion Ponzi scheme. The sale of the vehicles is being conducted on behalf of the Treasury Department. Going up on the block are 10 sports cars, two Yamaha Waverunners and four boats, including an 87-foot Warren yacht.

- 1967 Corvette Convertible

- 2007 Ford Expedition Limo

- 2008 Cadillac Escalade

- 2008 Mercedes Benz SLR

- 2007 Rolls-Royce Phantom

- 2009 Bentley Continental GTC

- 2008 Bugatti Veyron

- 2010 Lamborghini LP-670SV

- 2009 Maserati GT

- 2008 Ferrari 430 Spyder

- Two 2009 Yamaha Waverunners

- 1998 ‘55 SeaRay Sundancer

- 2005 ‘33 Riva Aquariva Super

- 2007 ‘87 Warren Yacht

- 2006 Nor-Tech Supercat

31163675-Brochure-for-Auction-of-Scott-R[...]

Adobe Acrobat document [6.8 MB]

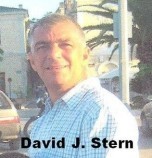

David J. Stern: The man behind the

crumbling foreclosure empire

Sun Sentinel

by Diane C. Lade

March 15, 2011

Attorney David J. Stern has spent much of the past year in the spotlight, as reports of legal troubles plaguing Florida's home foreclosure system continue to

emerge.

Stern's Plantation-based foreclosure practice is one of eight under investigation by the Florida attorney general for allegations of fabricating documents, slipshod

paperwork and questionable fees.

The mortgage lenders who once loved him have severed their business ties with him. DJSP Enterprises, a company he created to handle nonlegal foreclosure work, has been

sued by former employees who claim the company violated layoff notification laws as it slashed its staff to about 50. Last week, Stern announced that he will cease the law firm's home repossession

operations

March 31.

The details of the lifestyle Stern, 50, built from the hundreds of millions his law firm and DJSP made repossessing people's homes are legend: an armada of luxury

vehicles that includes Porsches and Ferraris, two private jets, an 8,300-foot, $7.2 million vacation cabin near Vail. Read more

Attorney David J. Stern, whose law firm was once known as Florida’s top foreclosure "mill," owns this $16 million Fort Lauderdale home. Now, as Stern himself faces financial difficulties, some of his property and other assets are up for sale.

Also see, Filed in 2000, the David J. Stern Class Action Lawsuit, Bryant v. Stern, 4:99-CV-00317, US District Ct, ND FL

Collapse of David J. Stern law firm throws

foreclosure courts into disarray

St. Petersburg Times

by Susan Taylor Martin

March 9, 2011

As many as 20,000 foreclosure cases in the Tampa Bay area have been left in limbo by the virtual collapse of the David J. Stern Law Firm, once Florida's most prolific

foreclosure "mill.''

The firm's implosion gives many borrowers at least a temporary reprieve from foreclosure and means that thousands of cases could be dismissed unless lenders quickly hire

other attorneys.

"It's a mess,'' Pinellas-Pasco Chief Judge Thomas McGrady said Tuesday.

In a letter dated March 4, Stern notified McGrady and other chief judges that as of March 31 the firm will end its involvement in all 100,000 foreclosure cases statewide

in which it is still listed as attorney of record. Bank of America and other Stern clients jettisoned the firm last year because of its allegedly sloppy, fraudulent practices, but in many cases have

yet to hire anyone to replace him.

"It's just put the brakes on being able to move forward in these thousands of cases we have, and so they either get counsel or get rid of the case,'' McGrady

said.

In his letter to the judges, Stern acknowledged that his firm is basically out of business.

"We have been forced to drastically reduce our attorney and paralegal staff to the point where we no longer have the financial or personnel resources to continue to file

motions to withdraw in the tens of thousand of cases that we still remain as counsel of record,'' he wrote. "Therefore it is with great regret that we will be ceasing the servicing of clients'' by

month's end.

Attached to each letter was a list of Stern cases in that particular judicial circuit. In Pinellas-Pasco, the list is 251 pages with a total of about 10,000 cases - a

third of all pending foreclosures.

McGrady said his staff is working on orders requiring banks to show cause why their foreclosure suits should not be dismissed if they fail to get timely substitute

counsel. In some cases, McGrady said, a new attorney has appeared but without proper legal authority. In other cases, more than one law firm has claimed to represent the same bank.

"Then what do we do?'' he asked.

In Hillsborough County, Stern is still attorney of record in just under 10,000 cases, of a total of 25,000 pending foreclosure suits.

Chief Judge Manuel Menendez Jr. said he doubts that Stern's letter frees him from the responsibility of legally withdrawing from the cases.

"You can't just walk away,'' Menendez said. "I think he's written the letter in attempt to circumvent the rules of judicial administration.''

For much of his legal career, the 50-year-old Stern has been dogged by allegations of improper and unethical conduct.

In 1999, he agreed to pay $2.1 million to borrowers who said in a federal lawsuit that his firm overcharged them for title searches, postage and other expenses, then

submitted "false and fraudulent'' invoices to support the charges.

In 2002, the Florida Bar publicly reprimanded Stern over similar allegations involving title insurance.

"Actions such as yours reduce respect for the legal profession and diminish the effectiveness of our system of justice,'' the Bar said.

Nonetheless, Stern's Broward County foreclosure practice grew into the state's largest, eventually handling one in every five foreclosure suits filed in

Florida.

Early last year, Stern netted nearly $60 million when he sold his back-office operations to a new public company, DJSP Enterprises. He lived an extravagant lifestyle,

with yachts, high-end cars and luxury properties, including a $16 million waterfront home with tennis court in Fort Lauderdale.

But in August, the Florida Attorney General's Office announced it was opening criminal investigations of Stern's firm and two others for filing "improper documentation''

designed to speed up the foreclosure process. Defense attorneys said Stern cases were riddled with fraud and errors, and Bill Warner, a Sarasota private investigator, said the firm started

foreclosing on him even though it had the wrong Bill Warner.

"They are the sloppiest, most disorganized bunch you've ever seen in your life,'' said Warner, who is among several homeowners and shareholders suing Stern in various

courts.

As lenders began removing their files, Stern laid off hundreds of employees, including attorneys. Some of Stern's property and other assets are up for sale.

The collapse of the firm also means that court-ordered mediations are on hold for more than 100 Pinellas and Pasco homeowners hoping to negotiate with their

lenders.

"The problem is that there's not a new attorney in a lot of the cases so there's not much we can do but wait on them,'' said Dick Rahter, president of Mediation Managers

in Clearwater.

"Some program managers around the state are just closing the cases, but we don't want to do that because that's taking away the borrower's right to have mediation,''

Rahter said. "It's not their fault, it's because of the problem with Stern.'' Read more

Foreclosure lawyers' misdeeds ignored in

Florida?

Herald-Tribune

by Todd Ruger

January 18, 2011

Despite complaints, ethics breaches slip past discipline system

Florida courthouses are rife with evidence of errors and fabrications made by attorneys handling foreclosure cases, and yet so far no lawyers have been

disciplined.

With pressure mounting to police its own members, the Florida Bar established a special category of complaints listed as "foreclosure fraud."

But in 20 complaints investigated in that category, the Bar has not found cause to discipline anyone -- even lawyers who admitted to breaking ethical rules.

Some observers say that early track record of ignoring misdeeds by its members raises questions about whether the system of self-policing for lawyers can handle the

depth of wrongdoing in the foreclosure crisis.

The complaints have been filed by judges, lawyers, homeowners and the Florida Bar itself, and reflect the issues seen in courtrooms almost daily for the past two years,

including forged signatures and backdated documents used to improperly seize homes in foreclosures. Read more

Foreclosure Firm Collapse Creates Court Chaos; Stern Lacks Staff to Move

to Withdraw from Cases

ABA Journal Law News Now

by Martha Neil,

March 8, 2011

Courts that oversee the thousands of foreclosure cases being pursued by the Law Offices of David J. Stern are reportedly in chaos, following news this week that the firm

is suddenly shutting down. His firm is handling some 10,000 cases in Hillsborough County alone, not to mention another 10,000 cases or so in neighboring Pinellas-Pasco, reports the St. Petersburg

Times.

Stern notified Pinellas-Pasco Chief Judge Thomas McGrady and his counterparts throughout the state in letters sent earlier this month that he won't be able to do any

further work on some 100,000 foreclosure cases, due to of a lack of staff following massive layoffs, according to the article.

"We have been forced to drastically reduce our attorney and paralegal staff to the point where we no longer have the financial or personnel resources to continue to file

motions to withdraw in the tens of thousand of cases that we still remain as counsel of record,'' he wrote in a 251-page letter to McGrady dated March 4 that listed all of the Pinellas-Pasco cases.

"Therefore it is with great regret that we will be ceasing the servicing of clients," apparently by the end of the month.

Calling the situation "a mess,'' McGrady says court employees are working to put together orders requiring the lending institutions that brought the cases to show cause

why they should not be dismissed. Meanwhile, some attorneys reportedly may be seeking to take over the cases without a paper trail clearly authorizing them to do so.

But, Chief Judge Manuel Menendez Jr. of Hillsborough tells the Times, "you can't just walk away. I think he's written the letter in attempt to circumvent the rules of

judicial administration."

Although some delinquent borrowers apparently will benefit from the delay that's bound to ensue, others seeking to come to terms with their lenders will potentially be

hurt by not being permitted to mediate their cases in a timely manner. Read

more

Florida Foreclosures are in ‘Total Disarray’

ABA Journal Law News Now

by Martha Neil

January 11, 2011

An associate state attorney general is expected to tell state lawmakers today that the state's foreclosure system is in "total disarray." According to her prepared

testimony, Patricia Conners will tell the Senate Banking Committee of a "virtual morass" of fake and faulty documents, to which so-called "foreclosure mill" have contributed significantly, reports

the South Florida Sun-Sentinel.

Among the remedies that Conners is expected to recommend:

Loan servicers should be required to "get the paperwork right" before filing for foreclosure.

Incentives should be changed to make loan modifications, rather than foreclosing, a financially attractive option for lenders and real estate investors.

The short sale process should be streamlined. Read

more

For Plantation attorney, Florida's mortgage meltdown spelled big opportunity -

then trouble

South Florida Sun-Sentinel.com

by Peter Franceschina

March 13, 2011

Two announcements last week appear to have doomed Plantation foreclosure attorney David J. Stern's ambitions to become a national player in the repossession of homes

lost by Americans during the economic downturn.

It was only a little over a year ago that Stern jumped at the opportunity to push his business and wealth to a whole new level. The underlying plan was to take the legal

and financial model that had made Stern rich and successful, and reproduce it in other states.

In January 2010, the Plantation-based lawyer consummated a deal under which he took a key piece of his law firm's operations public, with Wall Street backers agreeing to

buy him out for a staggering $145 million, plus reams of stock in the newly minted corporation.

The last hopes for that grand venture appear to have vanished. Read more

Demise of 'foreclosure king' Florida firm could cost courts

Bradenton Herald

by Duane Marsteller

March 13, 2011

MANATEE -- The demise of Florida’s "foreclosure king" and the free-fall in foreclosure filings could turn the state’s court system into a pauper.

The Law Offices of David J. Stern P.A. announced it will cease foreclosure operations this month, leaving as many as 100,000 Florida foreclosure cases in limbo. Court

officials and attorneys say the ensuing delays will further strain a legal system that is running low on operating money because of declining revenue from filing fees.

"I’m not sure how it’s all going to shake out," said Christopher Forrest, a foreclosure defense attorney in Sarasota. "I’m anticipating it’s going to be a big

mess."

Stern’s Plantation-based law firm was among the most prolific foreclosure filers in Florida, accounting for nearly a third of the state’s 350,000-case backlog. That

earned Stern a fortune -- he reportedly has an $18 million yacht docked at his $16 million Fort Lauderdale mansion -- and the "foreclosure king" nickname and led critics to derisively call his law

practice a "foreclosure mill." Read more

Tampa Law Firm Probed Over 'False' Documents Filed in Foreclosure Cases - from LAW.COM

The Florida attorney general is investigating one of the nation's largest foreclosure law firms over allegations it falsified legal documents to expedite foreclosure

cases filed by its lender clients.

Tampa-based Florida Default Law Group "appears to be fabricating and/or

presenting false and misleading documents in foreclosure cases," according to the attorney general's Economic Crimes Division in Fort Lauderdale, which is leading the investigation.

The office of Attorney General Bill McCollum is reviewing consumer complaints, taking depositions and researching the company's business practices to determine whether

Florida Default has violated any state laws. Read

more

‘Like Hamsters in a

Cage’: Foreclosure Firm Cut Corners to Make Money

ABA Journal Law News Now

by Martha Neil

Aug 4, 2010

Junk fees, corner-cutting and an indifference to human misery helped a Florida lawyer make a mint in a high-volume foreclosure practice, reports Mother Jones in an unflattering profile of the legal

industry enforcing bank mortgage rights. Read

more

Lawyer, Ex-Mortgage Broker Husband Charged in Alleged $8.8M Mortgage Fraud Racketeering Conspiracy

ABA Journal Law News Now

By Martha Neil

April 22, 2011

A Tampa., Fla., lawyer and her husband, who is a former mortgage broker, are being held in lieu of $700,000 bail in the Hillsborough County jail after being arrested earlier this week in an alleged

$8.8 million mortgage fraud conspiracy in which other defendants also have been charged.

Stephanie Bolton and her husband, William, are charged with conspiracy to commit racketeering, racketeering and

grand theft, the St. Petersburg Times reported.

Admitted to practice in 2004 after her graduation from Stetson University College of Law, Stephanie Bolton worked in the construction litigation department of Carlton Fields from 2006 to 2010. Read more

Tampa lawyer, husband accused of

racketeering in alleged mortgage conspiracy

St. Petersburg Times

By Robbyn Mitchell

April 22, 2011

TAMPA — Another couple was arrested Wednesday and accused of taking part in a wide-reaching mortgage fraud conspiracy.

William and Stephanie Bolton, both 33, of Tampa were held in a Hillsborough County jail on

$700,000 bail Thursday.

The Florida Department of Law Enforcement said the Boltons were part of a group that

falsified documents to get 50 mortgages worth $8.8 million from 2003 to 2007. Twenty-two of the properties scattered across Pinellas, Pasco, Hillsborough, Hernando, Osceola, Seminole and Orange

counties went into foreclosure.

Stephanie Bolton was admitted to the Florida Bar in 2004 following her graduation from Stetson University College of Law.

Bolton worked for Carlton Fields from 2006 to January 2010 in the firm's construction

litigation group, said Elizabeth Zabak, a spokeswoman for the firm. Zabak would not say why Bolton left the firm. Read more

Well-Known Lawyer Gets 8 Years in Fiduciary Fraud Involving Millions of Dollars

ABA Journal, Law News Now

by Marth Neil

July 26, 2010

A well-known South Florida forensic accountant and attorney made a tearful apology in federal court in Miami on Friday before being sentenced to eight years for stealing

millions, much of it from the accounts of individuals he oversaw as a court-appointed fiduciary.

Lewis Freeman, 61, received 270 letters of support, and his lawyers painted a picture of a man known for charitable work. They also noted that he had significant expenses for a sick child, home

improvements and a bad investment, reports the South Florida Business Journal. Read more

St. Petersburg attorney, wife arrested on drug charge

St. Petersburg Times

By Curtis Krueger and

Rita Farlow

July 8, 2010

ST. PETERSBURG — A local criminal defense attorney is accused of accepting prescription pain pills in lieu of

money to satisfy a business debt, authorities said. Aaron J. Slavin and his wife, Eryn L. Slavin, both 32, were each arrested by deputies with the Pinellas County Sheriff's Office on a felony charge

of trafficking oxycodone or a similar drug.

Aaron J. Slavin and his wife, Eryn L. Slavin, both 32, were arrested Wednesday night at his Largo law office on a felony charge of trafficking oxycodone or a similar drug.

They are accused of accepting 251 30-milligram pills "to satisfy a debt owed by a confidential informant," according to an arrest report.

The arrest was part of an undercover operation by the Pinellas County Sheriff's Office.

"We received a tip back in June that the suspect would be willing to accept a controlled substance as a form of payment," said Sheriff's Office spokeswoman Cecilia Barreda.

Slavin, now a private defense attorney, previously worked as a prosecutor for the Pinellas-Pasco State Attorney's Office, but left in July 2008, said Pinellas Pasco Chief Assistant State Attorney Bruce Bartlett. Read more

ABA Journal Law News Now

by Martha Neil, May 7, 2010

Last month, when a Florida judge delayed sentencing ex-attorney Jessica Miller in a client theft case, he offered a hint about what she might do in the meantime to win a more lenient punishment: Pay back some of the money. Today, when the 32-year-old Miller showed up in court again, her attorney announced that she did indeed have money in hand—a total of $250 from a recent garage sale, reports the St. Petersburg Times. Pinellas-Pasco Circuit Judge Michael Andrews sentenced her to four-and-a-half years in prison, followed by 10 years of probation. She also must repay $70,000. Read more

As Attorney Went on Trust Account-funded Spending

Spree, Client Slept in Car, He Tells Judge

ABA Journal Law News Now

by Martha Neil, April 6, 2010

While she was still in practice, attorney Jessica Miller intended to repay the money she stole from clients, a prosecutor told a Florida judge at her sentencing hearing. But what he described as Miller's plan to start an exotic animal sales business and borrow against her home to replace the $60,000 she and her office manager and paralegal, Kristen Collins (now Kristen Lausburg), used for a personal spending spree was derailed when the Florida Bar closed her Pasco County law office down in 2007, according to a Tampa Tribune article today. She has since been disbarred.

Miller pleaded guilty last month, on the verge of trial, to four counts of grand theft, without any agreement concerning the sentence she would get, the Tribune reports in an earlier article. Sentencing guidelines call for a prison term of a little under two years in the Pasco County case, reports the St. Petersburg Times, but the maximum sentence is 40 years. Read more

Florida lawyer John Yanchek Pleads in $83M Loan Fraud Case

ABA Journal Law News Now

by Martha Neil, February 5, 2009

A Sarasota, Fla., lawyer pleaded guilty yesterday in federal court in Tampa to charges that could result in a sentence of eight to 10 years for his role in an almost $83 million loan fraud scheme from which he reportedly received about $7.6 million. Read more

According to the plea agreement, John Yanchek, now 49, while serving as the closing attorney, "made false statements regarding the financial resources of the borrower, the equity contributed by the borrower, compliance with the seller's obligation to provide marketable title to the property, and distribution of the loan proceeds," writes the Tampa Tribune.

Florida lawyer Stephen Silkowski was

sentenced to six years in prison

The Florida Times Union

by Paul Pinkham

June 25, 2010

Disbarred Jacksonville lawyer Stephen Silkowski was sentenced to six years in prison this afternoon for grand theft.

Silkowski had pleaded guilty before Circuit Judge Elizabeth Senterfitt in February to stealing $220,000 in client funds. He was arrested in October after investigators

found he took proceeds from a condemnation settlement, then altered trust account records to try to cover up the crime.

The Florida Supreme Court disbarred him in December and ordered him to pay restitution. Silkowski had been a lawyer since 1991.

He had previously been admonished by the Supreme Court in 2005 for taking $2,000 from a client to handle a divorce then never filing the case. Read more

Former Name Partner at Collapsed Miami Law Firm Gets Three-Year Suspension

ABA Journal Law News Now

By Debra Cassens Weiss

April 22, 2011

Corrected: The Florida Supreme Court ordered a three-year suspension for Miami lawyer Henry "Hank" Adorno, the one-time name partner at Adorno & Yoss before it disbanded.

The troubled Florida law firm announced its dissolution in March after Adorno resigned from the firm following disclosure of his ethics troubles. His departure came

after he was suspended from law practice last year and ordered to show cause why he should not be suspended for up to three years or disbarred for his role in negotiating a $7 million settlement that

was later vacated.

The court rejected a referee’s recommendation that Adorno receive a public reprimand, report the Legal Profession Blog and

the National Law Journal.

The three-year suspension is the most severe sanction short of disbarment, according to the opinion (PDF).

Adorno had negotiated a $7 million settlement that would compensate only seven plaintiffs out of several thousand potential claimants in a lawsuit that challenged Miami's fire fees. The law firm was to get $2 million of that amount. Read more

Supreme Court of Florida, Case No. SC09-1012

sc09-1012.pdf

Adobe Acrobat document [252.0 KB]

Disbarred attorney expected to plead guilty in fraud

case

The Palm Beach Post

By Jane Musgrave, Staff Writer

April 18, 2011

WEST PALM BEACH — Disbarred West Palm Beach attorney A. Clark Cone will plead guilty to charges stemming from allegations that he bilked clients out of more than $600,000, his court-appointed lawyer

said Monday.

A jury trial, scheduled to begin Monday morning, was canceled.

Attorney Genevieve Hall said Cone planned to plead guilty once a restitution agreement was finalized. While he is supposed to appear before Palm Beach County Circuit Judge Stephen Rapp again in early

June, his plea could come before that, she said.

Cone, 56, was disbarred in 2009 after Florida Bar investigators found he had taken more than $600,000 awarded to three clients. He was charged with larceny and fraud in connection with the clients'

missing money.

His arrest caused tremors in the legal community because he is the son of the late Al Cone, a legendary lawyer who schooled some of the top legal minds in the state at his prestigious West Palm Beach

firm.

The younger Cone's arrest also prompted old-timers to reveal a long-hidden secret. Al Cone adopted Clark Cone after Clark's biological father was sentenced to life in prison for committing one of the

most heinous crimes in Palm Beach County history.

His biological father, Joe Peel, masterminded the 1955 murders of Palm Beach County Circuit Judge Curtis Chillingworth and his wife, Marjorie.

A. Clark Cone shed the Peel name when his mother divorced Peel and married Al Cone.

LAWYER'S FALL STIRS GRUESOME

MEMORIES

The Palm Beach Post

By Jane Musgrave

September 6, 2009

The West Palm Beach attorney won a prestigious award from the state trial lawyers association that his father founded. He was involved in charitable work. He represented those who were killed or

injured by penny-pinching corporations, heartless doctors or careless drivers.

Then, this month the 54-year-old was arrested on two felonies, charged with bilking clients out of more than $600,000 -- the same allegations that prompted the Florida Bar to disbar him in May.

Still, old-timers insisted, Cone may be the proverbial chip off the old block after all.

His birth father, it turns out, wasn't Al Cone, a legendary lawyer who schooled some of the top legal minds in the state at his prestigious West Palm Beach law firm.

Instead, Cone's biological father is Joe Peel, one of the most notorious criminals in Palm Beach County history. A lawyer-turned- judge, Peel masterminded the 1955 murders of Palm Beach County

Circuit Judge Curtis Chillingworth and his wife, Marjorie.

Although a half-century has passed, the drownings still stand as the most shocking crime in county history. It was unsolved for five years. Peel was charged when two career criminals told police he

paid them $2,500 to take the couple offshore and throw them overboard. Peel wanted to silence Chillingworth because the respected jurist was about to blow the whistle on his lucrative bolita and

numbers rackets and strip him of his ability to practice law. Read more

Ex-Lawyer from Well-Known Palm Beach Family Expected to Plead Guilty in $600K Client Theft Case

ABA Journal Law News Now

By Martha Neil

April 18, 2011

A disbarred Florida lawyer whose biological and adoptive fathers were both well-known in Palm Beach County has reportedly decided to plead guilty as his trial was about to begin today for allegedly

stealing over $600,000 from three clients.

A. Clark Cone will plead guilty in the Palm Beach Circuit Court case after a restitution agreement is finalized, his lawyer, Genevieve Hall, tells the Palm Beach Post.

He is the adoptive son of the late Al Cone, a legendary West Palm Beach lawyer, and the biological son of Joe Peel, who was convicted of masterminding the 1955 murders of Palm Beach County Circuit

Judge Curtis Chillingworth and his wife.

Cone's connection to the Chillingworth slayings wasn't public knowledge until after he was accused of stealing from clients, when the family connection made the news along with the alleged theft, the

article notes. He was charged with larceny and fraud; the article doesn't say what charge or charges will be involved in the expected plea. Read more

Fla. Lawyer Disbarred; Alternative Sex-for-Legal-Fees

Billing a Factor

ABA Journal Law News Now

by Martha Neil

May 1, 2009

A Florida lawyer has been disbarred for a pattern of misconduct, including an alternative billing arrangement under which an 18-year-old client reportedly paid her

$2,300 legal bill with sexual favors.

James Harvey Tipler, 58, discounted the client's bill by $200 when she had sex with him, and $400 when she arranged for another woman to have sex with him, according to

a Florida Supreme Court opinion (PDF) yesterday that ordered his disbarment.

"He satisfied his own sexual appetite with a client as a sex-for-fees arrangement," writes Chief Justice Peggy Quince, summing up the evidence that persuaded the court

it had no alternative but to disbar Tipler:

"He altered evidence and caused a witness to unknowingly give false testimony. He has charged his clients excessive fees and stolen their money. He has failed to

maintain a trust account," she continues.

"He has broken public confidence in the profession of the practice of law by neglecting his clients and failing to prosecute their cases. He has prejudiced the

administration of justice by misrepresenting facts to multiple courts. And, through the disciplinary process in these cases, he has been dilatory, deceitful and evasive." more

Florida Supreme Court opinion (PDF)

Supreme Court of Florida, Case No. SC03-149

sc03-149.pdf

Adobe Acrobat document [83.3 KB]

A former Andalusia attorney James Harvey Tipler has been rearrested in Okaloosa County, Fla., on new racketeering charges and for allegedly practicing law while disbarred or suspended. Read more

BSO: Female Traffic Lawyer Took Pictures of Man at Urinal,

Attempted to Bite Cop

Broward-Palm Beach New Times

by Matthew Hendley

July 6, 2011

In Rhonda Hollander's train of thought, taking pictures of a man about to relieve himself at a courthouse urinal isn't a crime because it's "a public restroom," the cops

say.

According to an arrest report obtained by New Times, Hollander -- a 47-year-old attorney and traffic magistrate -- was busted last week trying to take pictures of a

man's package inside the men's room at the West Regional Courthouse, located at 100 N. Pine Island Road in Plantation.

The man told police he was "getting ready to urinate" while Hollander was next to him snapping some photos, the report says.

Continuing the men's-room fetish, she then took pictures of another man entering the bathroom, police say. Read more

__________________________________________________________________

Female Magistrate Accused of Taking

Restroom Photo, Trying to Bite Officer’s Finger

ABA Journal Law News Now, by Martha Neil, July 5,

2011

A traffic magistrate with no history of attorney discipline in Florida has been arrested and charged with obstruction with violence after allegedly following a man into

a courthouse restroom last week and photographing him with her cellphone as he stood at a urinal. Read more

Florida Lawyer Suicide After Arrest in Pedophile Case

John Atchison

Wikipedia

John David R. Atchison (August, 1954 – October 5, 2007) was an assistant U.S. Attorney in Florida's northern district who gained notoriety when he was arrested for

suspicion of soliciting sex from a 5-year old girl.

Atchison held both a bachelor's degree from the University of Florida and a law degree from Cumberland Law School at Samford University in Birmingham, Alabama. He was

admitted to the Florida Bar in June 1984 and the Georgia Bar in June 1985. Since the late 1980s, he worked in the U.S. Attorney's office in Pensacola, Florida, working on tax and financial crime

cases. He was married to and had three children with Barbara Atchison and lived in Gulf Breeze, near Pensacola.

On September 16, 2007, Atchison was arrested at the Detroit Metropolitan Airport in a sex crime sting operation undertaken by the Macomb County Sheriff's department. He

was charged with "enticement of a minor to engage in sexual activity using the Internet", "aggravated sexual abuse" and "traveling across state lines to have sex with someone under the age of 12". At

the time of his arrest, he was carrying presents for his intended victim, including a doll and a pair of earrings. Also in his possession was a jar of petroleum jelly. Following his arrest, he tried

to commit suicide via hanging in his jail cell on September 20, 2007. Atchison had been removed from a suicide watch the previous day after assuring his lawyer and a judge that he would not harm

himself. He was not injured in the suicide attempt, which another inmate reported about 4 a.m. On October 5, 2007, Atchison committed suicide in his prison cell. Read more

_________________________________________________________________

Prosecutor Tries to Kill Himself After Arrest in Pedophile Case

The New York Times, by Nick Bunkley, September 21,

2007

DETROIT, Sept. 20 — A federal prosecutor from Florida who is accused of traveling to Michigan with the intention of having sex with a 5-year-old girl tried to hang

himself on Thursday in his jail cell, the police here said. Read more

Atchison Arrest History, Nov-28-2007

Macomb County Sheriff's Office, Atchison[...]

Adobe Acrobat document [1.1 MB]