The Federal Reserve System

The Federal Reserve System Online

Board of Governors - Federal Reserve System

Listing of Board Publications

The Federal Reserve System (HTM)

Purposes & Functions (Full PDF)

Federal Reserve Act Board of Governors

12 U.S.C. Chapter 3 Federal Reserve System

ANNUAL REPORTS - Federal Reserve System Board of Governors

- Financial Statements - Federal Reserve System

- Consumer Information - Board of Governors of the FRS

- Independent Foreclosure Review - Consumer Information

- Payment Agreement - Independent Foreclosure Review

Today the Federal Reserve’s duties fall into four general areas:

1. Conducting the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employ-ment, stable prices, and moderate

long-term interest rates.

2. Supervising and regulating banking institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers.

3. Maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.

4. Providing financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation’s payments system. Read more

The Federal Reserve Today, 16th Edition PDF

The Federal Reserve Today, 16th Edition [...]

Adobe Acrobat document [4.9 MB]

Structure and Functions of the Federal Reserve System

Congressional Research Service RS20826

Congressional Research Service RS20826

Congressional Research Service RS20826.p[...]

Adobe Acrobat document [131.5 KB]

Fed Board of Governors - Members of the Board

Janet L. Yellen took office as Chair of the Board of Governors of the Federal Reserve System on February 3, 2014, for a four-year term ending February 3, 2018. Dr. Yellen also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Prior to her appointment as Chair, Dr. Yellen served as Vice Chair of the Board of Governors, taking office in October 2010, when she simultaneously began a 14-year term as a member of the Board that will expire January 31, 2024.

Dr. Yellen is Professor Emeritus at the University of California at Berkeley where she was the Eugene E. and Catherine M. Trefethen Professor of Business and Professor of Economics and has been a faculty member since 1980. Read more

Stanley Fischer took office as a member of the Board of Governors of the Federal Reserve System on May 28, 2014, to fill an unexpired term ending January 31, 2020.

He was sworn in as Vice Chairman of the Board of Governors on June 16, 2014. His term as Vice Chairman expires on June 12, 2018.

Prior to his appointment to the Board, Dr. Fischer was governor of the Bank of Israel from 2005 through 2013.

From February 2002 to April 2005, Dr. Fischer was vice chairman of Citigroup. Dr. Fischer served as the first deputy managing director of the International Monetary Fund from September 1994 through August 2001. From January 1988 to August 1990, he was the chief economist of the World Bank. Read more

Daniel K. Tarullo took office on January 28, 2009, to fill an unexpired term ending January 31, 2022.

Prior to his appointment to the Board, Mr. Tarullo was Professor of Law at Georgetown University Law Center, where he taught courses in international financial regulation, international law, and banking law. Prior to joining the Georgetown Law faculty, Mr. Tarullo held several senior positions in the Clinton administration.

From 1993 to 1998, Mr. Tarullo served, successively, as Assistant Secretary of State for Economic and Business Affairs, Deputy Assistant to the President for Economic Policy, and Assistant to the President for International Economic Policy. He also served as a principal on both the National Economic Council and the National Security Council. From 1995 to 1998, Mr. Tarullo also served as President Clinton's personal representative to the G7/G8 group of industrialized nations. Read more

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. He was reappointed and sworn in on June 16, 2014, for a term ending January 31, 2028.

Prior to his appointment to the Board, Mr. Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C., where he focused on federal and state fiscal issues. From 1997 through 2005, Mr. Powell was a partner at The Carlyle Group.

Mr. Powell served as an Assistant Secretary and as Undersecretary of the Treasury under President George H.W. Bush, with responsibility for policy on financial institutions, the Treasury debt market, and related areas. Prior to joining the Administration, he worked as a lawyer and investment banker in New York City. More

Lael Brainard took office as a member of the Board of Governors of the Federal Reserve System on June 16, 2014, to fill an unexpired term ending January 31, 2026.

Prior to her appointment to the Board, Dr. Brainard served as Undersecretary of the U.S. Department of Treasury from 2010 to 2013 and Counselor to the Secretary of the Treasury in 2009. During this time, she was the U.S. Representative to the G-20 Finance Deputies and G-7 Deputies and was a member of the Financial Stability Board. She received the Alexander Hamilton Award for her service.

From 2001 to 2008, Dr. Brainard was Vice President and the Founding Director of the Global Economy and Development Program and held the Bernard L. Schwartz Chair at the Brookings Institution, where she built a new research program to address global economic challenges. Read more

Regulatory capture

Wikipedia

Regulatory capture is a form of political corruption that occurs when a regulatory agency, created to act in the public interest, instead advances the commercial or political concerns of special interest groups that dominate the industry or sector it is charged with regulating.[1] Regulatory capture is a form of government failure; it creates an opening for firms or political groups to behave in ways injurious to the public (e.g., producing negative externalities). The agencies are called "captured agencies". Read more

Wikipedia

The Federal Reserve System (also known as the Federal Reserve, and informally as the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907.[2][3][4][5][6][7] Over time, the roles and responsibilities of the Federal Reserve System have expanded, and its structure has evolved.[3][8] Events such as the Great Depression in the 1930s were major factors leading to changes in the system. Read more

Structure of the Federal Reserve System

Wikipedia

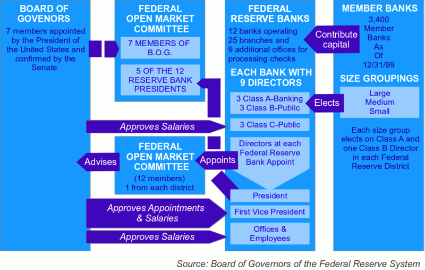

The Federal Reserve System is composed of five parts:[1][2]

- The presidentially appointed Board of Governors (or Federal Reserve Board), an independent federal government agency located in Washington, D.C.

- The Federal Open Market Committee (FOMC), composed of the seven members of the Federal Reserve Board and five of the twelve Federal Reserve Bank presidents, which oversees open market operations, the principal tool of U.S. monetary policy.

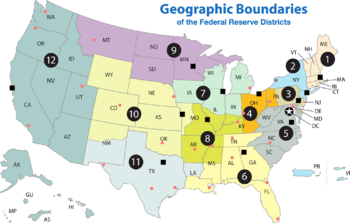

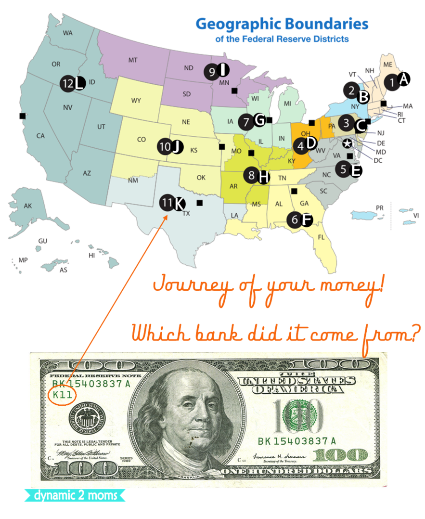

- Twelve regional Federal Reserve Banks located in major cities throughout the nation, which divide the nation into twelve Federal Reserve district. The Federal Reserve Banks act as fiscal agents for the U.S. Treasury, and each has its own nine-member board of directors.

- Numerous other private U.S. member banks, which own required amounts of non-transferable stock in their regional Federal Reserve Banks.

- Various advisory councils.[3] Read more

According to the board of governors of the Federal Reserve, "It is not 'owned' by anyone and is 'not a private, profit-making institution'. Instead, it is an independent entity within the government, having both public purposes and private aspects."[4] The U.S. Government does not own shares in the Federal Reserve System or its component banks, but does receive all of the system's annual profits after a statutory dividend of 6% on their capital investment is paid to member banks and a capital account surplus is maintained. The government also exercises some control over the Federal Reserve by appointing and setting the salaries of the system's highest-level employees.

The division of the responsibilities of a central bank into several separate and independent parts, some private and some public, results in a structure that is considered unique among central banks. It is also unusual in that an entity outside of the central bank – the U.S. Department of the Treasury – creates the currency used.[5] Read more

United States Department of the Treasury

Wikipedia

The Department of the Treasury (DoT) is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue.[1] The Department is administered by the Secretary of the Treasury, who is a member of the Cabinet. Jacob J. Lew is the current Secretary of the Treasury; he was sworn in on February 28, 2013.

The first Secretary of the Treasury was Alexander Hamilton, who was sworn into office on September 11, 1789. Hamilton was asked by President George Washington to serve after first having asked Robert Morris (who declined, recommending Hamilton instead). Hamilton almost single-handedly worked out the nation's early financial system, and for several years was a major presence in Washington's administration as well. His portrait is on the obverse of the U.S. ten-dollar bill while the Treasury Department building is shown on the reverse.

Besides the Secretary, one of the best-known Treasury officials is the Treasurer of the United States whose signature, along with the Treasury Secretary's, appears on all Federal Reserve notes.

The Treasury prints and mints all paper currency and coins in circulation through the Bureau of Engraving and Printing and the United States Mint. The Department also collects all federal taxes through the Internal Revenue Service, and manages U.S. government debt instruments. Read more

U.S. Department of the Treasury, Official Website

Treasury promotes economic growth through policies to support job creation, investment, and economic stability. Treasury also oversees the production of coins and currency, the disbursement of payments to the public, revenue collection, and the funds to run the federal government. Read more. Annual budget $14 billion (2013) PDF

TREASURY BUDGET FOR FISCAL YEAR 2013.pdf

Adobe Acrobat document [613.3 KB]

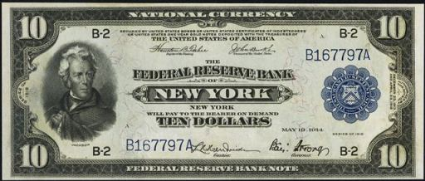

Federal Reserve Bank

Wikipedia

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913.[1] The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

- Federal Reserve Bank of Atlanta Wikipedia

- Federal Reserve Bank of Boston Wikipedia

- Federal Reserve Bank of Chicago Wikipedia

- Federal Reserve Bank of Cleveland Wikipedia

- Federal Reserve Bank of Dallas Wikipedia

- Federal Reserve Bank of Kansas City Wikipedia

- Federal Reserve Bank of Minneapolis Wikipedia

- Federal Reserve Bank of New York Wikipedia

- Federal Reserve Bank of Philadelphia Wiklipedia

- Federal Reserve Bank of Richmond Wikipedia

- Federal Reserve Bank of San Francisco Wikipedia

- Federal Reserve Bank of St. Louis Wikipedia

Federal Open Market Committee

Wikipedia

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under the United States law with overseeing the nation's open market operations (i.e., the Fed's buying and selling of United States Treasury securities).[1] This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply.[2]

The FOMC is the principal organ of United States national monetary policy. The Committee sets monetary policy by specifying the short-term objective for the Fed's open market operations, which is usually a target level for the federal funds rate (the rate that commercial banks charge between themselves for overnight loans).

The FOMC also directs operations undertaken by the Federal Reserve System in foreign exchange markets, although any intervention in foreign exchange markets is coordinated with the U.S. Treasury, which has responsibility for formulating U.S. policies regarding the exchange value of the dollar. Read more

Federal Reserve and related legal authorities

Federal government of the United States Wikipedia

Independent agencies of the United States government Wikipedia

- The Federal Reserve System

1913 The Federal Reserve System

- History of the Federal Reserve System Wikipedia

- Federal Reserve Act (1913) Signed by President Wilson

- Federal Reserve Act (1913) Board of Governors

- Federal Reserve Act (1913) Wikipedia

- Federal Reserve System Board of Governors

- Federal Reserve System Wikipedia

- What is the Fed: Structure FRB San Francisco

- Structure of the Federal Reserve System Wikipedia

- Federal Reserve Bank Wikipedia

- Federal Open Market Committee Wikipedia

1933 Banking Act - Glass-Steagall

- Glass–Steagall Legislation Wikipedia

- Glass–Steagall Act of 1932 Wikipedia

- 1933 Banking Act Wikipedia

- 1999 Gramm–Leach–Bliley Act Repealed Glass-Steagall

- H.R. 1489 (112th) Return to Prudent Banking Act of 2011

Introduced: Apr 12, 2011 112th Congress, 2011–2013

Status: Died in a previous Congress

This bill was introduced on April 12, 2011, in a previous session of Congress, but was not enacted.

Criticism of the Federal Reserve System

- Criticism of the Federal Reserve Wikipedia

- Regulatory capture Wikipedia

- Who Owns The Federal Reserve? Global Research

- Is the Fed government or private owned? Monetary.org

- Is the Fed a privately owned corporation FRB San Francisco

BANKS AND BANKING - MONEY AND FINANCE - U.S. law

- Title 12 U.S.C. Banks and Banking GPO PDF or HTM

- Title 31 U.S. Code Money and Finance (GPO) PDF

Title 12 U.S. Code BANKS AND BANKING (Cornell/LII)

- 12 U.S. Code Chapter 3 FEDERAL RESERVE SYSTEM

- 12 U.S. Code § 226 "Federal Reserve Act"

- 12 U.S. Code § 305 "Federal reserve agent"

- 12 U.S. Code § 391 FRB as Government depositaries

- 12 U.S. Code § 531 Exemption from taxation

- 12 U.S. Code § 3105 Authority of Federal Reserve System

12 CFR 265.11 Functions delegated to Federal Reserve Banks

2010 THE DODD-FRANK ACT

Wall Street Reform And Consumer Protection

- H.R.4173 - 111th Congress (2009-2010) Dodd-Frank Act

- Public Law 111-203 July 21, 2010 Dodd-Frank Act (PDF)

12 U.S.C. Chapter 53 Wall Street Reform Consumer Protection

- 12 U.S. Code § 5301 Definitions

- 12 U.S. Code § 5302 Severability

- 12 U.S. Code § 5303 Antitrust savings clause

12 U.S. Code Subchapter I Financial Stability

12 U.S. Code Subchapter II Orderly Liquidation Authority

12 U.S. Code Subchapter III Transfers of Powers to Comptroller

of the Currency, the Corporation, and Board of Governors

12 U.S. Code Subchapter IV Payment, Clearing, and Supervision

12 U.S. Code Subchapter V Consumer Financial Protection

12 U.S. Code Subchapter VI Federal Reserve Provisions

12 U.S. Code Subchapter VII Improving Access To Mainstream

Financial Institutions

12 U.S. Code Subchapter VIII Miscellaneous

My letter emailed February 18, 2016 to the OIG Hotline BOG Fed

OIGHotline Re CFPB Board of Governors of the Federal Reserve

OIGHotline-Re-CFPB-to-Board-of-Governors[...]

Adobe Acrobat document [3.9 MB]

The Federal Reserve System has a two-part structure: a central authority called the Board of Governors in Washington, D.C., and a decentralized network of 12 Federal Reserve Banks located throughout the country. Monetary policy is set by the FOMC, which includes members of the Board of Governors and presidents of the Reserve Banks.

The Fed has been set up to ensure that monetary policy is insulated from political pressure. It is shielded from interference from other arms of the federal government. Policy and operational decisions do not require congressional or Presidential approval. The Fed’s operations are financed through its own resources rather than through congressional appropriations. Still, Congress has the power to change the laws governing the Fed. In addition, the Fed regularly reports to Congress on monetary policy and other matters. As such, the Fed is commonly described as "independent within the government."

Board of Governors

The Board is an independent governmental agency that oversees the Federal Reserve System.

At the center of the Federal Reserve structure is the Board of Governors in Washington, D.C. The seven-member Board and its staff constitute an independent government agency charged with overseeing the Federal Reserve System. Board members are appointed by the President and confirmed by the Senate, serving staggered 14-year terms that expire in every even-numbered year. Board members are appointed for long terms in order to shield them from political pressures. The President designates a chairman and vice chairman of the Board, each of whom serve four-year terms. These appointments are subject to Senate approval and may be renewed.

Federal Reserve Banks

Twelve regional Federal Reserve Banks conduct much of the Federal Reserve System’s day-to-day operations.

The Fed includes 12 regional Federal Reserve Banks which carry out much of the System’s day-to-day operations. The Reserve Banks, also known as district banks, are nongovernmental organizations, set up similarly to private corporations, but operated in the public interest. The districts are headquartered in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco. Reserve Bank branches are located in 24 other cities.

Federal Open Market Committee

The FOMC is the Fed’s monetary policymaking body.

The Federal Open Market Committee is the Fed’s monetary policymaking body. The FOMC has 12 voting members, including the seven members of the Board of Governors and a rotating group of five Reserve Bank presidents. The Board of Governors chairman serves also as chairman of the FOMC. The Federal Reserve Bank of New York is directly involved in carrying out monetary policy operations, so its president serves as a permanent voting member and vice chairman of the FOMC. The 11 other Reserve Bank presidents serve one-year terms as voting members on a rotating basis. All 12 presidents participate in FOMC meetings, whether or not they are current voting members.

The FOMC holds eight regularly scheduled meetings a year in Washington, D.C. For each session, economists at the Board of Governors and the Reserve Banks analyze regional, national, and international economic and financial conditions. On the final day of each meeting, monetary policy is put to a vote. Following the meeting, the FOMC issues a written statement describing its assessment of economic conditions, risks to the outlook, and policy actions.

Financial Regulatory Reform

The Dodd-Frank Act of 2010 has implications

for the structure of the Fed.

The recently passed Dodd-Frank Act contains a number of provisions that affect the Fed’s structure. The legislation adds a second vice chairman position within the Board of Governors to oversee the Fed’s supervision and regulation responsibilities. In addition, Dodd-Frank modifies the procedure for appointing presidents of the 12 Reserve Banks by excluding directors representing commercial banks from the selection process. The Government Accountability Office will also audit Reserve Bank governance within the next year (2011). These measures are designed to increase the Fed’s transparency and accountability without jeopardizing its independence.

The Dodd-Frank Act also establishes new entities within the Fed. A Consumer Financial Protection Bureau will operate autonomously within the Fed to write and enforce rules that protect consumers in financial matters. In addition, the Reserve Banks and Board of Governors will establish an Office of Minority and Women Inclusion charged with increasing workforce diversity, enhancing involvement with minority- and women-owned businesses, and assessing the diversity policies of the financial institutions the Fed oversees.

What is the Fed: Structure Read more

FRB SanFranscisco Education What is the [...]

Adobe Acrobat document [66.8 KB]

Is the Federal Reserve a privately owned corporation?

Is the Federal Reserve a privately owned corporation?

FRB of San Francisco

Education Portal, Dr. Econ

Yes and no. The Federal Reserve (the Fed) enjoys a unique public/private structure that operates within the government, but is still relatively independent of government to isolate the Fed from day-to-day political pressures in fulfilling its varying roles. As stated in The Federal Reserve System Purposes & Functions:

The Federal Reserve System is considered to be an independent central bank. It is so, however, only in the sense that its decisions do not have to be ratified by the President or anyone else in the executive branch of the government. The entire System is subject to oversight by the U.S. Congress….the Federal Reserve must work within the framework of the overall objectives of economic and financial policy established by the government.

History

Prior to the Fed’s formation, the United States experienced a number of economic downturns and financial panics. To help alleviate the problems associated with these swings in the economy, President Woodrow Wilson signed the Federal Reserve Act on December 23, 1913. The act’s opening paragraph outlines its varying functions:

An Act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.

Since 1913, legislation has passed to augment some of the act’s original purposes and to clarify the varying roles of the Fed.

Structure

Congress set up the Federal Reserve System to make it autonomous and to isolate it from day-to-day political pressures. For example, the members of the Board of Governors are appointed to serve 14-year terms that do not coincide with presidential terms. Key components of the Federal Reserve System are:

- The Board of Governors—Located in Washington, D.C., Board members are appointed by the U.S. President and confirmed by the U.S. Senate. Board members and staff are civil service employees.

- The 12 regional Reserve Banks—Located around the country, the 12 Federal Reserve Banks are chartered as private corporations. Employees are not civil service.

- The Federal Open Market Committee (FOMC)—Composed of the Federal Reserve Governors and the Federal Reserve Bank presidents, the FOMC is charged with conducting monetary policy.

The 12 Federal Reserve Banks operate like other businesses; each has its own board of directors that selects the Reserve Bank president and first vice president, with approval from the Board of Governors. Each Branch of a Reserve Bank has its own board of directors. A majority of these directors are appointed by the Branch’s Reserve Bank; the others are appointed by the Board of Governors.

Boards of directors of the Reserve Banks and their Branches provide the Federal Reserve System with a wealth of information on economic conditions in every corner of the nation. The information, along with other sources, is used by the FOMC and the Board of Governors when reaching decisions about monetary policy.

Key Responsibilities

While Congress establishes key objectives the Fed must follow, the Fed generally works independently of the federal government to administer its core responsibilities.

Those duties include:

- Conducting monetary policy

- Supervising and regulating banking and financial institutions

- Providing payments services to financial institutions

The 12 Federal Reserve Banks have "independent" research staffs that advise their Reserve Bank presidents on monetary policy and the economy. Each Reserve Bank also has regulatory responsibilities including the supervision and regulation of financial institutions. The Reserve Banks also handle the Federal Reserve System’s business operations—it is in this area that Reserve Banks operate more like private businesses, selling services like electronic funds transfers, check processing, and coin and currency services to financial institutions.

Funding

Congress also created the Federal Reserve System to be self-funding. The Fed earns interest on the interest-bearing government securities it holds in its portfolio and sells financial services to banks. This amount is reported each year in its annual report. The Fed’s earnings typically far exceed its expenses. However, unlike for profit corporations, the Fed distributes any profit (after costs) to the U.S. Treasury...

FRB San Francisco Read more

FRB SanFranscisco Education Is the Feder[...]

Adobe Acrobat document [83.5 KB]

Students of our monetary system quickly encounter this important question, normally phrased as whether the Federal Reserve System is part of the U.S. Government or is a private organization.

The Federal Reserve System CATO Institute 100 Years Later, Was the Federal Reserve a Good Idea? By Gerald P. O'Driscoll Jr. This article appeared on Forbes.com on November 13, 2013. Read more

A History of the Federal Reserve, Volume 2, Book 1, 1951-1969 Link

to 25 page review

Allan H. Meltzer, Author

Also see A History of the Federal Reserve, Volume 2, Book 2, 1970-1986

Allan H. Meltzer’s critically acclaimed history of the Federal Reserve is the most ambitious, most intensive, and most revealing investigation of the subject ever conducted. Its first volume,

published to widespread critical acclaim in 2003, spanned the period from the institution’s founding in 1913 to the restoration of its independence in 1951. This two-part second volume of the history

chronicles the evolution and development of this institution from the Treasury–Federal Reserve accord in 1951 to the mid-1980s, when the great inflation ended. It reveals the inner workings of the

Fed during a period of rapid and extensive change. An epilogue discusses the role of the Fed in resolving our current economic crisis and the needed reforms of the financial system.

- The University of Chicago Press Books

A History of the Federal Reserve-Vol.2-R[...]

Adobe Acrobat document [110.4 KB]

U.S. Senator Elizabeth Warren queries Federal Reserve Chair Yellen about the Fed's duty and authority to break-up Too Big To Fail banks that lack a plan for Orderly Liquidation under Dodd-Frank.

Senator Warren cited Dodd-Frank, SEC. 165 of Public Law 111-203 July 21, 2010, which is the same text as 12 U.S. Code § 5325

Joint Press Release

Board of Governors of the Federal Reserve System

Federal Deposit Insurance Corporation

April 13, 2016

The Federal Deposit Insurance Corporation and the Federal Reserve Board on Wednesday jointly announced determinations and provided firm-specific feedback on the 2015 resolution plans of eight systemically important, domestic banking institutions.

The agencies have jointly determined that each of the 2015 resolution plans of Bank of America, Bank of New York Mellon, JP Morgan Chase, State Street, and Wells Fargo was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code, the statutory standard established in the Dodd-Frank Wall Street Reform and Consumer Protection Act. The agencies have issued joint notices of deficiencies to these five firms detailing the deficiencies in their plans and the actions the firms must take to address them. Each firm must remediate its deficiencies by October 1, 2016. If a firm has not done so, it may be subject to more stringent prudential requirements.

The agencies jointly identified weaknesses in the 2015 resolution plans of Goldman Sachs and Morgan Stanley that the firms must address, but did not make joint determinations regarding the plans and their deficiencies. The FDIC determined that the plan submitted by Goldman Sachs was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code, and identified deficiencies. The Federal Reserve Board identified a deficiency in Morgan Stanley's plan and found that the plan was not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code. Read more

Quantitative Easing Wikipedia

Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of financial assets from commercial banks and other private institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the monetary base.[4][5] This differs from the more usual policy of buying or selling short-term government bonds in order to keep interbank interest rates at a specified target value.[6][7][8][9] Read more

[NOTE, This is an earlier definition of QE found on Wikipedia: "Quantitative easing (QE) is an unconventional monetary policy tool used by some central banks to stimulate the national economy when conventional monetary policy has become ineffective. A central bank implements quantitative easing by purchasing financial assets from banks and other private sector businesses with new money that it creates electronically. This action increases the excess reserves of the banks, and also raises the prices of the financial assets bought, which lowers their yield."]

Federal Reserve Bank of New York

Gold Custody

Gold custody is one of several financial services the Federal Reserve Bank of New York provides to central banks, governments and official international organizations on behalf of the Federal Reserve System.

The New York Fed’s gold vault is on the basement floor of its main office building in Manhattan. Built during the construction of the building in the early 1920s, the vault provides account holders with a secure location to store their monetary gold reserves.

None of the gold stored in the vault belongs to the New York Fed or the Federal Reserve System. The New York Fed acts as the guardian and custodian of the gold on behalf of account holders, which include the U.S. government, foreign governments, other central banks, and official international organizations.

No individuals or private sector entities are permitted to store gold in the vault. Read more

Standard & Poor's US credit downgrade to AA+ Announcement August 5, 2011.

Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial

Foreclosure Crisis Triggers S&P Credit Downgrade

Housing Predictor, by Kevin Chiu, April 19, 2011

Standard and Poor’s long term credit downgrade of the U.S. economy is directly impacted by the foreclosure crisis, which has cost tax payers $148-billion to bail-out Freddie Mac and Fannie Mae so far. But S&P analysts expect "extraordinary official assistance to large players in the U.S. financial sector" to be made to fix the housing market and the economy at large. Read more

- Standard & Poor's Wikipedia

Federal Reserve Press Release, credit rating downgrade Aug-05-11

Federal Reserve press release, AA+ downg[...]

Adobe Acrobat document [28.3 KB]

Announcement August 5, 2011, 8 page report

Standard Poor’s AA+ downgrade, Aug-05-1[...]

Adobe Acrobat document [396.9 KB]

The Creature from Jekyll Island : A Second Look at the Federal

Reserve Barnes&Nobel

G. Edward Griffin, Author (Wikipedia)

Where does money come from? Where does it go? Who makes it? The money magicians' secrets are unveiled. We get a close look at their mirrors and smoke machines, their pulleys, cogs, and wheels that

create the grand illusion called money. A dry and boring subject? Just wait!

You'll be hooked in five minutes. Reads like a detective story - which it really is. But it's all true. This book is about the most blatant scam of all history. It's all here: the cause of wars,

boom-bust cycles, inflation, depression, prosperity.

Creature from Jekyll Island is a "must read." Your world view will definitely change. You'll never trust a politician again - or a banker.

End the Fed - book by Ron Paul, Author

End the Fed - Ron Paul, Author

Publisher Comments: During the 2008 presidential campaign, over 4,000 students gathered at the University of Michigan to hear Republican Party candidate Ron Paul speak.

As he began to address the topics of monetary policy and the coming depression, a chant came from the crowd, End the Fed End the Fed As dollar bills were lit on fire and thrown into the night skies,

it became clearer than ever that the real problem, one that nobody in the media was talking about, was the central bank-an unconstitutional entity and a political, economic, and moral

disaster.

Most people think of the Federal Reserve as an institution that has always been there (it hasn't) and isn't going anywhere. But in END THE FED, Ron Paul draws on American

history, economics, and fascinating stories from his own long political life to argue that the Federal Reserve is both corrupt and unconstitutional. It is inflating currency today at nearly a Weimar

or Zimbabwe level, a practice that threatens to put us into an inflationary depression where $100 bills are worthless. What most people don't realize is that the Fed — created by the Morgans and

Rockefellers at a private club off the coast of Georgia — is actually working against their own personal interests. Ron Paul's urgent appeal to all citizens and officials tells us where we went wrong

and what we need to do fix America's economic policy for future generations.

BookTV: End the Fed, Ron Paul

C-Span2 September 18, 2009

Valley Forge Convention Center

King of Prussia, PA

Representative Ron Paul talked about his book, End the Fed (Grand Central Publishing; September 16,

2009). In the book, Representative Paul looks at the history of the Federal Reserve and argues that the institution should be held accountable for the economic crisis being experienced by Americans.

He responded to questions from members of the audience. Ron Paul, a physician, has represented Texas' 14th congressional district for 11 terms. He is the author of

The Revolution: A Manifesto. Read

more

An Advocate Who Scares Republicans

The New York Times

By JOE NOCERA

March 18, 2011

The piñata sat alone at the witness table, facing the members of the House subcommittee on financial institutions and consumer credit.

The Wednesday morning hearing was titled "Oversight of the Consumer Financial Protection Bureau." The only witness was the piñata, otherwise known as Elizabeth Warren, the Harvard law professor hired last year by President Obama to get the new bureau — the only new agency created by the Dodd-Frank financial reform law — up and running. She may or may not be nominated by the president to serve as its first director when it goes live in July, but in the here and now she’s clearly running the joint.

And thus the real purpose of the hearing: to allow the Republicans who now run the House to box Ms. Warren about the ears. The big banks loathe Ms. Warren, who has made a career out of pointing out all the ways they gouge financial consumers — and whose primary goal is to make such gouging more difficult. So, naturally, the Republicans loathe her too. That she might someday run this bureau terrifies the banks. So, naturally, it terrifies the Republicans.

The banks and their Congressional allies have another, more recent gripe. Rather than waiting until July to start helping financial consumers, Ms. Warren has been trying to help them now. Can you believe the nerve of that woman?

At the request of the states’ attorneys general, all 50 of whom have banded together to investigate the mortgage servicing industry in the wake of the foreclosure crisis, she has fed them ideas that have become part of a settlement proposal they are putting together. Recently, a 27-page outline of the settlement terms was given to banks — terms that included basic rules about how mortgage servicers must treat defaulting homeowners, as well as a requirement that banks look to modify mortgages before they begin foreclosure proceedings. The modifications would be paid for with $20 billion or so in penalties that would be levied on the big banks.

Naturally, the banks hate these ideas, too. So the Republican members of the subcommittee had another purpose as well: to use the hearing to serve as a rear-guard action against the proposed settlement.

"Under what statutory authority are you currently acting?" demanded Representative Patrick McHenry, a Republican from North Carolina, questioning the legitimacy of her role in setting up the consumer bureau. He also questioned whether the government had the right to impose a $20 billion penalty on the banks — and then use that money for (heaven forbid) mortgage modifications. Read more