Banking Page Archives

S&P Downgrades US To AA+, Outlook Negative - Full Text Zero Hedge

by Tyler Durden

August 5, 2011

United States of America Long-Term Rating Lowered To 'AA+' On Political Risks And Rising Debt Burden; Outlook Negative. We have

lowered our long-term sovereign credit rating on the United States of America to 'AA+' from 'AAA' and affirmed the 'A-1+' short-term rating.

We have also removed both the short- and long-term ratings from CreditWatch negative. The downgrade reflects our opinion that the

fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics.

Read more

Federal Reserve Press Release, credit rating downgrade Aug-05-11

Federal Reserve press release, AA+ downg[...]

Adobe Acrobat document [28.3 KB]

Announcement August 5, 2011, 8 page report

Standard Poor’s AA+ downgrade, Aug-05-1[...]

Adobe Acrobat document [396.9 KB]

Dagong Global Credit Rating Co. Ltd. ("Dagong") is a specialized credit rating and risk analysis research institution founded in 1994 upon the joint approval of People‘s Bank of China and the former State Economic & Trade Commission, People’s Republic of China, and is also a key credit information and credit solution service provider in China. Read more

- Dagong Global Credit Rating Wikipedia

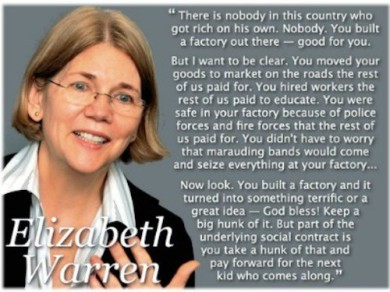

Elizabeth Warren Out as Possible Head of

Consumer Financial Protection Bureau

Naked Capitalism

by Yves Smith

July 16, 2011

We have said for some time Warren was not going to get head the new consumer financial protection agency. Obama was not willing to ruffle the banks, and Geithner, who is

is most powerful Cabinet member, would not stand for it). Nevertheless, we are disappointed by this outcome. And it seems a bit churlish for this news to be leaked the day after she ran the gauntlet

with the House Oversight Panel. From Bloomberg:

President Barack Obama has chosen a candidate other than Elizabeth Warren as director of the new Consumer Financial Protection Bureau, according to a person

briefed on the matter.

The president’s choice is a person who already works at the consumer agency, the person said today. Obama may make the nomination as soon as next week, another

person briefed on the administration’s plans said.

The choice is presumably Raj Date, a former McKinsey staffer and banking industry executive (Capital One and Deutsche Banka) whose name was floated a month ago. Read more

- Elizabeth Warren Wikipedia

- More about Elizabeth Warren Sense on Cents

The Dow Zero Insurgency

New York Magazine, by Joe Hagan

September 27, 2009

The nothing-can-be-believed chaos of the financial crisis created a golden opportunity for a blog run by a mysterious ex-hedge-funder with a dodgy past and conspiracy

theories to burn.

Last spring, in a far corner of the Internet, an unknown blogger began to piece together a conspiracy theory: The investment bank Goldman Sachs was using sophisticated,

high-speed computers to siphon hundreds of millions of dollars in illegitimate trading profits from the New York Stock Exchange, invisibly undercutting the market and sidestepping the regulatory

reach of the Securities and Exchange Commission.

Only a few loyal readers paid attention to the blog called Zero Hedge, a no-frills site full of arcane analysis

decipherable only by finance professionals. But when a former Goldman Sachs computer programmer was arrested for allegedly stealing software codes used for the firm’s electronic trading arm, and a

federal prosecutor was quoted saying the codes could be used to "manipulate markets in unfair ways," the once-obscure blog ignited a chain reaction. While on a golf outing, an editor at the New York

Times learned from a friend who worked on Wall Street that the Zero Hedge allegation was the talk of the industry, and an assignment ensued. On July 24, the Times published a front-page article on

so-called high-frequency trading and its potential abuses, which in turn prompted Chuck Schumer, a member of the Senate Finance Committee, to draft a letter to the SEC that same day. Twelve days

later, the SEC signaled that it was considering a ban on the very computerized trading that Zero Hedge had attacked. Read

more

- Zero Hedge Wikipedia

Florida Bank's Collapse To Cost FDIC $4.9B

CBS News Business

Washington, May 22, 2009

BankUnited FSB Seized By Feds After Posting $1.2B In Losses; 2nd Largest Hit To FDIC Of Financial Crisis

(CBS/AP) The federal seizure of struggling Florida thrift BankUnited FSB is expected to cost

the Federal Deposit Insurance Corp. $4.9 billion, representing the second-largest hit to the FDIC's insurance fund since the financial crisis began felling banks last year. The costliest was last

year's seizure of California lender IndyMac Bank, on which the bank insurance fund is estimated to have lost $10.7 billion.

The Office of Thrift Supervision, a Treasury Department agency, said Thursday that BankUnited FSB reported $1.2 billion in losses last year as defaults on loans piled up. The thrift "was critically

undercapitalized and in an unsafe condition to conduct business," the agency said in a statement.

Coral Gables, Fla.-based BankUnited FSB is the 34th federally insured institution to be closed this year, and the biggest. Florida's largest banking institution with about $13 billion in assets as of

May 2 was sold for $900 million to an investor group led by former North Fork Bancorp Chairman and CEO John Kanas. It will reopen as a newly chartered savings bank called BankUnited on Friday, with

Kanas at the helm.

The investor group includes several prominent firms: the Blackstone Group, the Carlyle Group, Centerbridge Partners and WL Ross

& Co., the private-equity firm run by billionaire investor Wilbur Ross. The new bank will assume $12.7 billion in assets and

$8.3 billion of its total $8.6 billion in deposits. In addition, the FDIC and the new bank agreed to share losses on about $10.7 billion in assets. Read more

- FDIC Press Release

- LA Times story 2009

- Dealbook NYT BankUnited aquires New York Bank 2011