Money laundering

United Nations Office on Drugs and Crime

UNODC on money-laundering and countering the financing of terrorism

The Law Enforcement, Organized Crime and Anti-Money-Laundering Unit of UNODC is responsible for carrying out the Global Programme against Money-Laundering, Proceeds of

Crime and the Financing of Terrorism, which was established in 1997 in response to the mandate given to UNODC through the United Nations Convention against Illicit Traffic in Narcotic Drugs and

Psychotropic Substances of 1988. The Unit's mandate was strengthened in 1998 by the Political Declaration and the measures for countering money-laundering adopted by the General Assembly at its

twentieth special session, which broadened the scope of the mandate to cover all serious crime, not just drug-related offences.

The broad objective of the Global Programme is to strengthen the ability of Member States to implement measures against money-laundering and the financing of terrorism and to assist them in

detecting, seizing and confiscating illicit proceeds, as required pursuant to United Nations instruments and other globally accepted standards, by providing relevant and appropriate technical

assistance upon request.

- Money laundering Wikipedia

- United Nations Office on Drugs and Crime Wikipedia

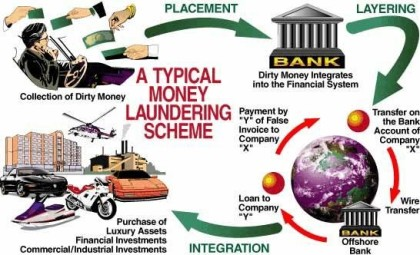

The Money-Laundering Cycle

The Money-Laundering Cycle

Money-laundering is the process that disguises illegal profits without compromising the criminals who wish to benefit from the proceeds. There are two reasons why

criminals - whether drug traffickers, corporate embezzlers or corrupt public officials - have to launder money: the money trail is evidence of their crime and the money itself is vulnerable to

seizure and has to be protected. Regardless of who uses the apparatus of money-laundering, the operational principles are essentially the same. Money-laundering is a dynamic three-stage process that

requires:

1. Placement, moving the funds from direct association with the crime;

2. Layering, disguising the trail to foil pursuit; and,

3. Integration, making the money available to the criminal, once again, with its occupational and geographic origins hidden from view.

These three stages are usually referred to as placement, layering and integration.

ABN AMRO Bank N.V

About We want to be a bank that always puts its clients first and create sustainable

long-term value for all of ABN AMRO's stakeholders – including clients, shareholders, employees and society at large.

ABN AMRO

Wikipedia

ABN AMRO Bank N.V. is a Dutch bank with headquarters in Amsterdam, the Netherlands. It was established, in its current form, in 2009 following the acquisition and break up of ABN AMRO Group by a

banking consortium consisting of Royal Bank of Scotland Group, Santander and Fortis. Following the collapse of Fortis, the acquirer of the Dutch business, it was part nationalized by the Dutch

Government along with Fortis Bank Nederland.

The bank is a product of a long history of mergers and acquisitions that date back to 1765. The original ABN AMRO was created in 1991 when Algemene Bank Nederland (ABN) and Amsterdam and Rotterdam

Bank (AMRO) merged. By 2007 ABN AMRO was the second largest bank in the Netherlands and eighth largest banks in Europe by assets. At that time the magazine The Banker and Fortune Global 500 placed

the bank at number 15th in the list of worlds biggest banks and it had operations in 63 countries, with over 110,000 employees. Read more

ABN Amro Admits Wrong, and Will Pay $500 Million

By BLOOMBERG NEWS for NYT

Published: May 10, 2010

The former ABN Amro Bank agreed to pay $500 million for violating the Bank Secrecy Act, the Justice Department said Monday. The bank has accepted responsibility for its conduct, the department said

in a news release. From 1995 through December 2005, the bank altered payment documents so they did not include references to countries under sanction by the American government, according to the

department. Even after the bank put in controls so the records would not be changed to hide activity, "a limited number" of transactions with such countries occurred in 2006 and 2007, the department

said. Read more

The DOJ press release May 10, 2010 announced "Former ABN AMRO Bank N.V. Agrees to Forfeit $500 Million in Connection with Conspiracy to Defraud the United States and with Violation of the Bank Secrecy Act", Criminal Division, Case No. 10-548

Below is the FBI's Press Release about the DOJ press release

FBI Former ABN AMRO Bank N.V. Agrees to [...]

Adobe Acrobat document [51.0 KB]

Information ABN AMRO Bank Case 1.10-cr-0[...]

Adobe Acrobat document [61.9 KB]

Deferred Prosecution Agreement, ABN AMRO[...]

Adobe Acrobat document [1.8 MB]

White Collar Crime Law Prof Blog

ABN AMRO Bank to Pay $80 Million in Civil Settlement

December 20, 2005

A massive consent order with state, federal, and international parties, has ABN AMRO Bank, N.V. taking remedial measures and also paying "$80 million in penalties to U.S.

federal and state regulators. Read more

The Federal Reserve Board

Press release

December 19, 2005

ABN AMRO Bank, to pay $80 million in penalties to U.S. federal and state regulators

Bank supervisory and penalty actions released Monday will require ABN AMRO Bank, N.V. to undertake remedial action in its worldwide banking operations and to pay $80 million in penalties to U.S. federal and state regulators. Read more

FRB_ Press Release-- ABN AMRO Bank, N.V.[...]

Adobe Acrobat document [21.7 KB]

Illinois Signs Consent Orders Against ABN AMRO

Illinois Department of Financial and Professional Regulation

News Release

December 19, 2005

Chicago – A $15 million fine paid to the State of Illinois by ABN AMRO Bank N.V., head-quartered in the Netherlands, is the largest penalty ever imposed against an

Illinois regulated bank. The fine is part of the $80 million settlement against the bank announced today to settle persistent problems with ABN AMRO’s compliance of federal and state laws and

regulations.

ABN AMRO has offices in Chicago with assets of more than $31.4 billion. It is regulated by the Illinois Department of Financial and Professional Regulation (IDFPR), under its International Bank

Supervision section, which participated in the examination and investigation of the bank’s business practices. Read

more

Illinois Signs Consent Orders Against AB[...]

Adobe Acrobat document [44.2 KB]

ABN Amro to Pay $80 Million Fine Over Iran, Libya

Wall Street Journal

December 20, 2005

Federal authorities fined Dutch bank ABN Amro Holding NV $80 million, one of the largest banking fines in U.S. history, for violating U.S. money-laundering laws and

sanctions against Iran and Libya.

The move, by the U.S. Federal Reserve and the Treasury Department financial crime- and sanctions-control units, came in response to nearly a decade of violations involving billions of dollars in

transactions that passed through the bank's offices in New York and Dubai, United Arab Emirates. Read more

October 19, 2005

Order of Assessment of a Civil Money Pen[...]

Adobe Acrobat document [669.5 KB]

December 19, 2005

Assessment of Civil Money Penalty, US v [...]

Adobe Acrobat document [1.4 MB]

December 19, 2005

Cease and Desist Upon Consent Order Dec-[...]

Adobe Acrobat document [950.8 KB]

News Release, December 19, 2005

Illinois Department of Financial and Professional Regulation

Illinois Signs Consent Orders Against ABN AMRO

Joint Press release, December 19, 2005

The Federal Reserve Board, New York State Banking Dept

ABN AMRO Bank, to pay $80 million in penalties

Catherine Austin Fitts

The fastest way to kick-start the shift away from a centralized economy is to stop financing the big banks - and through them, the activities they are financing - and to switch your bank deposits to

a well-managed, community bank or credit union. In fact, it's the single greatest point of leverage you have as a consumer.

"How the Money Works" in the Illicit Drug Trade

Catherine Austin Fitts, Mercato Libero News

Background of Catherine Austin Fitts

Narco-Dollars for Beginners: "How the Money Works" in the Illicit Drug Trade

by Catherine Austin Fitts

narcoDollars.pdf

Adobe Acrobat document [206.0 KB]

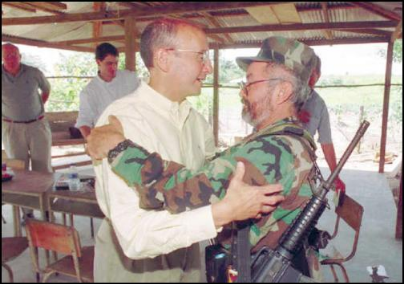

"The recent departure of New York Stock Exchange Chairman Richard Grasso makes this article, first published in 2001, very prescient, especially in the light of Mr. Grasso's trip to Colombia where he met FARC commanders responsible for providing security for narco-traffickers.

Was Grasso making an in person sales call to negotiate with the drug cartel which was threatening to pull their investments from the stock

exchange?

That might be worth a $140 million pay package."

– Uri Dowbenko

The Real Deal:

Narco-Dollars For Beginners

Column: Catherine Austin Fitts

The Real Deal with Catherine Austin Fitts

Narco-Dollars For Beginners

How The Money Works In The Illicit Drug Trade

a 13 Part Series

By Catherine Austin Fitts

First published by Narco News

A Simple Framework:

The Solari Index and the Dow Jones Index

The Solari Index is my way of estimating how well a place is doing. It is based upon the percentage of people in a place who believe that a child can leave their home and go to the nearest place to buy a popsicle and come home alone safely.

When I was a child growing up in the 1950's at 48th and Larchwood in West Philadelphia, the Solari Index was 100 percent. It was unthinkable that a child was not safe running up to the stores on Spruce Street for a popsicle and some pin ball. The Dow Jones was about 500, the Solari Index was 100 percent and our debt per person was very low. Of course I did not think about it that way at the time. All I knew was that life on the street with my buddies was sweet.

Today, the Dow Jones is over 9,000, debt per person is over $100,000 and my favorite hairdresser in Philadelphia ...

[ click here for full text of article ]