2008 Economic Crash

Reckless Endangerment: How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon

How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon

Gretchen Morgenson, Co-Author

Joshua Rosner, Co-Author

In Reckless Endangerment, Gretchen Morgenson exposes how the watchdogs who were supposed to protect the country from financial harm were actually complicit in the actions that finally blew up the American economy.

Drawing on previously untapped sources and building on original research from coauthor Joshua Rosner - who himself raised early warnings with the public and investors, and kept detailed records - Morgenson connects the dots that led to this fiasco.

Morgenson and Rosner draw back the curtain on Fannie Mae, the mortgage-finance giant that grew, with the support of the Clinton administration, through the 1990s, becoming a major opponent of government oversight even as it was benefiting from public subsidies. They expose the role played not only by Fannie Mae executives but also by enablers at Countrywide Financial, Goldman Sachs, the Federal Reserve, HUD, Congress, and the biggest players on Wall Street, to show how greed, aggression, and fear led countless officials to ignore warning signs of an imminent disaster.

Character-rich and definitive in its analysis, and with a new afterword that brings the story up to date, this is the one account of the financial crisis you must read. Read more

Washington and Wall Street: The Revolving Door

NYT Book Review by Robert B. Reich

"Reckless Endangerment’ by

Gretchen Morgenson and Joshua Rosner

The Washington Post

Book Review

by John B. Taylor

In "Reckless Endangerment," Gretchen Morgenson and Joshua Rosner argue that cozy connections between government and the financial industry were the primary cause of the financial crisis. In a series of clearly written narratives with many names, dates and figures, they show that government officials took actions that benefited well-connected individuals, who in turn helped the government officials. This mutual support system thwarted good economic policies and encouraged reckless ones. It thereby brought on the crisis, sending the economy into a tailspin.

While many economists — including this reviewer — have argued that government actions caused the crisis, Morgenson and Rosner use their investigative skills to dig down and explain why those actions were taken. To avoid reckless policies in the future, we need to understand their causes, and the authors’ identification of government-industry links deserves careful consideration by anyone interested in improving the economy.

The book focuses on two agencies of government, Fannie Mae and the Federal Reserve. The mutual support system is better explained and documented in the case of Fannie, the government-sponsored enterprise that supported the home mortgage market by buying mortgages and packaging them into marketable securities which it then guaranteed and sold to investors. The federal government supported Fannie Mae — and the other large government-sponsored enterprise, Freddie Mac — by implicitly backing up those guarantees and by providing favorable regulatory treatment and protection from competition. These benefits enabled Fannie to rake in excess profits — $2 billion in excess, according to a 1995 study by the Congressional Budget Office. Read more

How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon

Democracy NOW!

June 2, 2011

A prominent Wall Street analyst predicted this week that not a single top executive at Goldman Sachs will face criminal prosecution for the company’s role in causing the

financial meltdown of 2008. "I think that there is a genuine sense out there that there are two sets of rules, one for big and powerful institutions that are deemed to be too politically

interconnected or powerful to fail, and the rest of us, Main Street," says our guest Gretchen Morgenson, the Pulitzer Prize-winning business reporter who has written extensively on how the U.S.

government has failed to prosecute any of the top figures who played a role in the economic crash. Morgenson and Joshua Rosner are co-authors of the new book Reckless Endangerment: How Outsized

Ambition, Greed, and Corruption Led to Economic Armageddon. Read more

Naming Culprits in the Financial Crisis

The New York Times

Gretchen Morgenson

Louise Story

April 13, 2011

A voluminous report on the financial crisis by the United States Senate — citing internal documents and private communications of bank executives, regulators, credit ratings agencies and investors —

describes business practices that were rife with conflicts during the mortgage mania and reckless activities that were ignored inside the banks and among their federal

regulators.

The 650-page report, "Wall Street and the Financial Crisis: Anatomy of a Financial Collapse," was released Wednesday by the Senate Permanent Subcommittee on Investigations, whose cochairmen are Carl

Levin, a Michigan Democrat, and Tom Coburn, a Republican of Oklahoma. The result of two years’ work, the report focuses on an array of institutions with central roles in

the mortgage crisis: Washington Mutual, an aggressive mortgage lender that collapsed in 2008; the Office of Thrift Supervision, a regulator; the credit ratings agencies Standard & Poor’s

and

Moody’s Investors Service; and the investment banks Goldman Sachs and Deutsche Bank.

"The report pulls back the curtain on shoddy, risky, deceptive practices on the part of a lot of major financial institutions," Mr. Levin said in an interview. "The overwhelming evidence is

that those institutions deceived their clients and deceived the public, and they were aided and abetted by deferential regulators and credit ratings agencies who had conflicts of

interest."

On the Financial Crisis, April 13, 2011

Press Release, Levin-Coburn Report On th[...]

Adobe Acrobat document [86.2 KB]

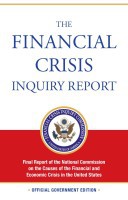

The Financial Crisis Inquiry Commission

The Financial Crisis Inquiry Commission determined that the 2008 financial crisis was an "avoidable" disaster caused by widespread failures in government regulation,

corporate mismanagement and heedless risk-taking by Wall Street, according to a story in the New York Times January 25, 2011 ‘Financial Crisis Was Avoidable, Inquiry Finds’. The Times wrote "[T]he

report is harsh on regulators. It finds that the Securities and Exchange Commission failed to require big banks to hold more capital to cushion potential losses and halt risky practices, and that the

Fed "neglected its mission." Read more

Financial Crisis Was Avoidable, Inquiry Finds

Financial Crisis Was Avoidable, Inquiry Finds

The New York Times

By SEWELL CHAN

January 25, 2011

WASHINGTON — The 2008 financial crisis was an "avoidable" disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according

to the conclusions of a federal inquiry.

The commission that investigated the crisis casts a wide net of blame, faulting two administrations, the Federal Reserve and other regulators for permitting a calamitous concoction: shoddy mortgage

lending, the excessive packaging and sale of loans to investors and risky bets on securities backed by the loans.

"The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done," the panel wrote in the report’s conclusions, which were read by

The New York Times. "If we accept this notion, it will happen again."

While the panel, the Financial Crisis Inquiry Commission, accuses several

financial institutions of greed, ineptitude or both, some of its gravest conclusions concern government failings, with embarrassing implications for both parties. But the panel was itself divided

along partisan lines, which could blunt the impact of its findings.

Many of the conclusions have been widely described, but the synthesis of interviews, documents and testimony, along with its government imprimatur, give the report - to be released on Thursday as a

576-page book - a conclusive sweep and authority.

The commission held 19 days of hearings and interviews with more than 700 witnesses; it has pledged to release a trove of transcripts and other raw material online.

Of the 10 commission members, the six appointed by Democrats endorsed the final report. Three Republican members have prepared a dissent focusing on a narrower set of causes; a fourth Republican,

Peter J. Wallison, has his own dissent, calling policies to promote homeownership the major culprit. The panel was hobbled repeatedly by internal divisions and staff turnover.

How did lawyers enable the meltdown?

In the game of blame that followed the deepest financial implosion since the Great Depression, bankers and money managers have borne their share of attention. But how

much blame should lawyers bear? Plenty.

As legislators, they helped remove restrictions on commercial banks that allowed them to get involved with subprime mortgage-backed securities.

As regulators, they allowed leverage at investment banks to increase largely unchecked. As judges, they made it harder for shareholders to bring suits to stop the financial shenanigans.

As counsel, their legal opinions gave sanction to deals that, in the words of the analysts behind them, "could have been structured by cows."

There were also lawyers who did their jobs, only to find their voices lost in torrents of money, rationalization or plainspoken hostility toward the rule of regulation.

Continue reading this article in the January ABA Journal.

"We rate every deal," came the response. "It could be structured by cows and we would rate it."

They’re

Shocked, Shocked, About the Mess

New York Times

By GRETCHEN MORGENSON

October 26, 2008

MY hypocrisy meter konked out last week.

It started acting up on Wednesday, spinning wildly as executives from the nation’s leading credit-rating agencies testified before Congress about their nonroles in the credit crisis…. Still, there were those pesky e-mail messages cited by the House Committee on Oversight and Government Reform that showed two analysts at S.& P. speaking frankly about a deal they were being asked to examine.

"Btw — that deal is ridiculous," one wrote. "We should not be rating it."

"We rate every deal," came the response. "It could be structured by cows and we would rate it."

Asked to explain the cow reference, Deven Sharma, S.& P.’s president, told the committee: "The unfortunate and inappropriate language used in these e-mails does

not reflect the core culture of the organization I am committed to leading."

Maybe so, but that was a lot for my malarkey meter to absorb.

Then, on Thursday, my meter sputtered as Alan Greenspan, former "Maestro" of the Federal Reserve, testified before the same Congressional questioners. He defended years of regulatory inaction in the

face of predatory lending and said he was "in a state of shocked disbelief" that financial institutions did not rein themselves in when there were billions to be made by relaxing their lending

practices and trafficking in exotic derivatives.

Mr. Greenspan was shocked, shocked to find that there was gambling going on in the casino. Read more

BigLaw Aided ‘March of Dunces’ That Destroyed Economy, Yale Law Grad Says

BigLaw Aided ‘March of Dunces’ That Destroyed Economy, Yale Law Grad Says

ABA Journal Law News Now

By Martha Neil

April 9, 2009

Amidst all the fingerpointing over the dismal state of the economy, excessive executive bonuses and the billable hour, the obvious hasn't yet been stated, a

well-known Yale law grad writes.

"The whole system is warped," says Elizabeth Wurtzel in an op-ed piece in the Wall Street Journal.

In addition to the 12 years of wealth that have been lost in a matter of months in the stock market's plummet, millions of hours of work by investment bankers and the lawyers who supported them in

their fundamentally flawed endeavors have been wasted, she states. Rather than working the killer hours for which Wall Street is known, "corporate lawyers could have been sunning in St. Bart's and

ended up with the exact same result, plus a tan."

Now, unless the all-out emergency-room-like work ethic that treats corporate deals with the same seriousness as the fate of nations is reevaluated, the same "march of dunces" likely will continue in

the future, she says.

Wurtzel, who wrote Prozac Nation before graduating from Yale Law School, works at Boies Schiller & Flexner, writes the Wall Street Journal Law Blog, adding "we couldn’t help fall for the brazen

chutzpah of the piece." Read more

Twelve Years Down the Drain

Twelve Years Down the Drain

Wall Street Journal

By ELIZABETH WURTZEL

April 9, 2009

The credit crisis has cost us a dozen years' wealth in a matter of months

Anyone who toils in the legal-industrial complex -- better known as Big Law -- should be able to tell you how we got here. Corporate attorneys like me, even those with the eyesight and insight of

Mr. Magoo, all should have been able to see this financial collapse coming.

The market has lost a dozen years worth of wealth in a matter of months. Millions of hours of manpower put in by investment bankers on Wall Street and the lawyers who enabled them -- the kind that brought home those bright shiny bonuses that are now causing a populist uprising in the hinterlands -- have been wasted away by what is kindly called the credit crisis. And whatever lessons the powers that be might learn from this adjustment -- that salary structure should change, or that the billable hour is an anachronism -- it seems no one has stated the obvious: The whole system is warped. Read more

SEC lawyer watched 8 hours of porn a day amid financial crisis

ABA Journal Law News Now

by Molly McDonough

April 23, 2010

Republican criticism of the Securities and Exchange Commission has heated up after allegations that senior staff, including a senior attorney in the SEC's Washington,

D.C., office, spent hours surfing porn sites from their government computers.

California Rep. Darrell Issa, the top Republican on the House Oversight and Government Reform Committee, told the Associated Press that it's "disturbing that high-ranking officials within the SEC

were spending more time looking at porn than taking action to help stave off the events that put our nation's economy on the brink of collapse."

Issa was responding to an SEC inspector general memo obtained by the AP. The memo, which was requested by Sen. Charles Grassley, R-Iowa, reported on probes of 33 employees who looked at explicit

images over the past five years. Most of the reported probes were during the last 2½ years, during the heart of the nation's financial crisis.

SEC lawyers referenced in summary report (PDF) were:

A Washington, D.C.,-based senior attorney who "admitted accessing Internet pornography and downloading pornographic images to his SEC computer during work hours so frequently that, on some days, he spent eight hours accessing Internet pornography. In fact, this attorney downloaded so much pornography to his government computer that he exhausted the available space on the computer hard drive and downloaded pornography to CDs or DVDs that he accumulated in boxes in his office." The AP reports that this individual has since resigned.

Did Porn Cause the Financial Crisis?

Did Porn Cause the Financial Crisis?

The Atlantic

The above headline might seem like a joke. It isn't. Senior staffers at the Securities and Exchange Commission were surfing Internet pornography when they should have been policing the financial system. Read more

Washington Post: SEC porn investigation nets dozens

SEC porn investigation nets dozens

By Ed O’Keefe, Washington Post

Dozens of Securities and Exchange Commission staffers used government computers to access and download explicit images and many of the incidents have occurred since

the global financial meltdown began, according to a new watchdog investigation.

Several of employees held senior positions, earning between $99,300 and $222,418 per year, the inspector general's summary said. Three of the incidents occurred this year, ten in 2009, 16 in 2008,

two in 2007 and one each in 2006 and 2005. Read more

Must SEC Disclose IDs & Discipline for

Porn-Watching Lawyers?

ABA Journal Law News Now

By Martha Neil

June 10, 2010

The Securities and Exchange Commission nixed a newspaper's Freedom of Information Act request for the names of some 33 employees and contractors—many of them attorneys—determined by an Office of

Inspector General report to have been watching porn on their government computers, on government time.

But now a Colorado lawyer has taken the issue to federal court in Denver. Kevin Evans of Steese Evans & Frankel filed suit last month seeking both the names and the discipline, if any, meted out by the SEC to the 33 porn-watchers, reports the Denver Post. At least one of those concerned filed a John Doe response under seal this week seeking to prevent disclosure of the personnel records.

The Glass-Steagall Act (1933) was a 34-page document

Glass–Steagall Act, Wikipedia

The Banking Act of 1933 was a law that established the Federal Deposit Insurance Corporation (FDIC) in the United States and introduced banking reforms, some of which

were designed to control speculation. It is most commonly known as the Glass–Steagall Act, after its legislative sponsors, Sen. Carter Glass and Rep. Henry B. Steagall. Read more

PL 73-66, 48 Stat. 162 (1933)

Banking_Act_of_1933.pdf

Adobe Acrobat document [164.3 KB]

Gramm–Leach–Bliley Act Repealed Glass-Steagall, 1999

The Gramm–Leach–Bliley Act, Wikipedia

The Gramm–Leach–Bliley Act (GLB), also known as the Financial Services Modernization Act of 1999, (Pub.L. 106-102, 113 Stat. 1338, enacted November 12, 1999) is an act

of the 106th United States Congress (1999–2001). It was signed into law by President Bill Clinton and it repealed part of the Glass–Steagall Act of 1933, opening up he market among banking companies,

securities companies and insurance companies. The Glass–Steagall Act prohibited any one institution from acting as any combination of an investment bank, a commercial bank, and an insurance

company.

The Gramm–Leach–Bliley Act allowed commercial banks, investment banks, securities firms, and insurance companies to consolidate. For example, Citicorp (a commercial bank

holding company) merged with Travelers Group (an insurance company) in 1998 to form the conglomerate Citigroup, a corporation combining banking, securities and insurance services under a house of

brands that included Citibank, Smith Barney, Primerica, and Travelers. This combination, announced in 1998, would have violated the Glass–Steagall Act and the Bank Holding Company Act of 1956 by

combining securities, insurance, and banking, if not for a temporary waiver process. The law was passed to legalize these mergers on a permanent basis. GLB also repealed Glass–Steagall's conflict of

interest prohibitions "against simultaneous service by any officer, director, or employee of a securities firm as an officer, director, or employee of any member bank. Read more

Visit msnbc.com for breaking news, world news, and news about the economy

Return to Glass-Steagall, 2011

Rep. Marcy Kaptur [D-OH9]

U.S. Representative, Ohio’s 9th District

Rep. Kaptur has sponsored H.R. 1489: Return to Prudent Banking Act of 2011 which would reinstate Glass-Steagal.

The bill is currently in committee.

May 2, 2011: House Committee on Financial Services: Referred to the Subcommittee on Capital Markets and Government Sponsored Enterprises.

The bill has 39 cosponsors; 35 Democrats and 4 Republicans.

The UK Is Preparing To Return To "Glass-Steagall"

Zero Hedge, June 16, 2011, read more

3,000 Pages of Financial Reform, but Still Not Enough

3,000 Pages of Financial Reform, but Still Not Enough

The New York Times

By Gretchen Morgenson

May 29, 2010

"The two bills that the Senate and the House are currently chewing over as part of what may be a momentous financial reordering weigh in at a whopping 3,000

pages, combined."

FOR decades, until Congress did away with it 11 years ago, a Depression-era law known as Glass-Steagall ably protected bank customers, individual investors and the

financial system as a whole from the kind of outright destruction we’ve witnessed over the last few years.

Glass-Steagall was a 34-page document. The two bills that the Senate and the House are currently chewing over as part of what may be a momentous financial reordering weigh in at a whopping 3,000

pages, combined.

Yet despite all that verbiage, there are flaws in both bills that would let Wall Street continue devising financial black boxes that have the potential to go nuclear. And even if the best of both bills becomes law, investors, taxpayers and the economy will remain vulnerable to banking crises.

Some will argue that these bills, at around 1,500 pages each, have to be weighty and complex if they are to curb the ill effects of convoluted and inscrutable financial instruments. That makes it

doubly disappointing that the bills don’t go far enough in bringing greater transparency and better oversight of everyone’s favorite multisyllabic wonderment these days: derivatives.

Read more

Basically, It's Over

Slate

By Charles Munger

February 21, 2010

A parable about how one nation came to financial ruin

In the early 1700s, Europeans discovered in the Pacific Ocean a large, unpopulated island with a temperate climate, rich in all nature's bounty except coal, oil, and natural gas. Reflecting its lack of civilization, they named this island "Basicland."

The Europeans rapidly repopulated Basicland, creating a new nation. They installed a system of government like that of the early United States. There was much

encouragement of trade, and no internal tariff or other impediment to such trade. Property rights were greatly respected and strongly enforced. The banking system was simple. It adapted to a national

ethos that sought to provide a sound currency, efficient trade, and ample loans for credit-worthy businesses while strongly discouraging loans to the incompetent or for ordinary daily purchases.

Read more

Charlie Munger is a lawyer and right-hand man to Warren Buffett.

Charles Thomas Munger (born January 1, 1924 in Omaha, Nebraska) is Vice-Chairman of Berkshire Hathaway Corporation, the

diversified investment corporation chaired by investor Warren Buffett. Like Buffett, Munger is a native of Omaha, Nebraska. After studies in mathematics at the University of Michigan, and service in

the U.S. Army Air Corps as a meteorologist, trained at Caltech, he entered Harvard Law School without an undergraduate degree. Graduating in 1948 with a Juris Doctor magna cum laude, he founded and

worked as a real estate attorney at Munger, Tolles & Olson LLP until 1965. He then gave up the practice of law to concentrate on managing investments. Read more

KABOOOM: BERKSHIRE HATHAWAY INC OUTLOOK TO NEGATIVE FROM STABLE BY S&P

KABOOOM: BERKSHIRE HATHAWAY INC OUTLOOK TO NEGATIVE FROM STABLE BY

S&P

Zero Hedge

by Tyler Durden

August 8, 2011

On Aug. 8, 2011, Standard & Poor's Ratings Services lowered to 'AA+' from 'AAA' its long-term counterparty credit and financial strength ratings on the member

companies of five U.S. insurance groups: Knights of Columbus, New York Life, Northwestern Mutual, Teachers Insurance & Annuity Assoc. of America (TIAA), and United Services Automobile Assoc.

(USAA). The outlooks on the ratings on all of these companies are negative. In addition, Standard & Poor's lowered the ratings on approximately $17 billion of securities issued by New York Life,

Northwestern Mutual, TIAA, USAA, and their affiliates.

At the same time, Standard & Poor's affirmed the 'AA+' ratings on the members of five other insurance groups--Assured Guaranty, Berkshire Hathaway, Guardian,

Massachusetts Mutual, and Western & Southern--and revised the outlooks on ratings on these companies to negative from stable. Read more

Buffett Hauled Before US Financial Crisis Commission

Warren Buffett Hauled Before US Financial

Crisis Commission

Guardian

by Graeme Wearden

June 2, 2010

Buffett initially declined the Financial Crisis Inquiry Commission's invitation to appear, so it issued him with a subpoena

Being the third-wealthiest person in the world has many perks, but it has not allowed Warren Buffett to wriggle out of an unwelcome date today with a top US committee

investigating the causes of the financial crisis.

Buffett is due to appear before the Financial Crisis Inquiry Commission (FCIC) at around 11.30am Eastern Time (4.30pm BST). Officially, he has been summoned because his

company, Berkshire Hathaway, is a major investor in the Moody's ratings agency. It is likely, though, that the committee will seek Buffett's views on a wider range of topics.

Buffett has built up an unrivalled back catalogue of wise and witty comments on the world of investing and finance during his long career. The prospect of the Sage of

Omaha swapping folksy bon mots with the committee means that the event is a sellout, with the general public and the media alike being warned that every seat at the hearing has already been

reserved.

But the man who dubbed derivatives "financial weapons of mass destruction", and who joked that in an earlier age he'd have been "some animal's lunch", was curiously

unwilling to attend today's hearing at all. Buffett initially declined the commission's invitation to appear, with his assistant explaining that while he was "flattered", he was also too busy running

Berkshire Hathaway and, anyway, did not feel he had much to contribute.

The 10-strong commission, set up by President Barack Obama a year ago, disagreed. Buffett was pressed to appear but, following a further exchange of messages, remained

reluctant and so it issued him with a subpoena. Read more

Downgrade the Ratings Agencies

The New York Times

By KATHLEEN CASEY and

FRANK PARTNOY

June 4, 2010

WARREN BUFFETT may be the Oracle of Omaha, but even he is hamstrung by credit ratings agencies. Appearing on Wednesday before the Financial Crisis Inquiry Commission, he said that as the chairman of

Berkshire Hathaway, he has "no negotiating power" with Moody’s and Standard & Poor’s, the two major agencies, because ratings were "required in many cases by the rules."

This wouldn’t be so bad if the agencies had performed well in the financial crisis. Instead, by giving undeservedly high ratings, they helped create it. If the

government outsourced drivers’ licenses, and the roads filled with accidents caused by bad drivers, it would stop using those companies. Congress should do the same with the credit ratings

agencies.

From our different perspectives, as a law professor writing about financial markets and a commissioner of the Securities and Exchange Commission (whose views are her own and not those of the

commission), we see such a move as the single most important piece of the reform puzzle, removing many of the incentives that led banks and ratings agencies to create thousands of dubious AAA-rated,

subprime-mortgage-backed securities.

Reliance on ratings has grown significantly since the 1970s, when the S.E.C. first referenced them in a rule governing brokerage firms. Instead of assessing the safety of brokers itself, the

commission deferred to the ratings agencies. Other regulators followed suit, and within a few decades the government had essentially outsourced its oversight role. Read more

Lawyer Is Accused in Massive Hedge Fund Fraud

How attorney Marc Dreier allegedly sold worthless forged paper for $113M

ABA Journal Law News Now

by Martha Neil

December 9, 2008

In an era of high-tech fraud, the founder of the Drier law firm is accused of doing it the old-fashioned way. Using little more than his position and skills as a prominent and seasoned attorney, Marc

Dreier allegedly tricked sophisticated investors into paying more than $100 million for worthless forged debt instruments supported by faked financial documents.

Federal prosecutors and securities regulators contend that Dreier has stolen $113 million since October by falsely claiming that a real estate developer—apparently

former client Solow Realty, in at least one attempted transaction, according to the New York Times—wanted to sell debt at a deep discount. Then he allegedly closed the fraudulent deals by charming

his way into the offices and conference rooms of unwitting accounting, pension fund and real estate offices linked to the transactions by faked documents, recounts the newspaper's DealBook

blog.

The $113 million, which was deposited into an account in the law firm's name, according to the Wall Street Journal, reportedly hasn't yet been recovered.

Meanwhile, Dreier allegedly was trying to get another $33 million when he was arrested last week in Toronto at the office of a pension fund there and charged with criminal impersonation, according to

DealBook.

He has since been charged with wire and securities fraud by federal prosecutors in New York and is also facing separate civil litigation by the Securities and Exchange Commission and Wachovia Corp.,

as discussed in an earlier ABAJournal.com post.

In October, Dreier allegedly held an unauthorized meeting in a conference room at Solow's offices in New York after telling the receptionist there that he had an appointment to meet with the real

estate developer's chief executive, the Wall Street Journal reports.

A similar episode allegedly followed in Toronto last week, according to police in Canada, the WSJ article recounts: "People familiar with the matter say Mr. Dreier attempted to secure money from

Fortress, a New York asset-management firm, by impersonating an Ontario Teachers' Pension Plan attorney. When Fortress wanted to meet with Ontario Teachers' representatives in person, Mr. Dreier flew

to Canada, the people say, and posed as an in-house counsel for Ontario Teachers' in a meeting with a Fortress executive." more

Criminal Complaint

United States of America vs. Marc Dreier[...]

Adobe Acrobat document [60.5 KB]

Lawyer accused in massive hedge fund fraud

The New York Times

by WILLIAM R. RASHBAUM and

ALISON LEIGH COWAN

December 8, 2008

His legal lineage was impeccable. A Yale man with a law degree from Harvard, he was a litigation powerhouse, a leader at some of the more prominent firms at the New York bar who then started a

top-shelf practice of his own.

But when the lawyer, Marc S. Dreier, stepped off a flight from Canada on Sunday night, federal authorities in New York arrested him in a $100 million fraud scheme,

portraying his recent undertakings as more high-stakes grifting than high-end lawyering.

In brazen and carefully choreographed scams here and in Canada, Mr. Dreier, who in 1996 founded a 250-lawyer firm that bears his name, is said to have tried to take advantage of the current financial

crisis by selling phony debt to hungry hedge funds looking for deals.

But in an era when high-tech frauds and inside information seem to dominate the world of white-collar crime, the square-jawed lawyer, known for his forceful personality and his penchant for high

living, apparently did it the old-fashioned way.

Using little more than his position, poise and a kind of reckless bravado, he cajoled his way into accounting, real estate and pension fund offices where he had no real business, according to a

criminal complaint unsealed on Monday. Read more

Lawyer Accused of $100 Million Swindle

Lawyer accused in $100 million swindle

The Wall Street Journal

by NATHAN KOPPEL and ASHBY JONES

December 9, 2008

Marc Dreier, the owner of a prominent New York law firm who was arrested last week, was hit Monday with criminal charges and civil complaints alleging he defrauded investors of about $100 million by

selling them phony financial instruments.

Federal prosecutors on Monday unsealed charges of one count each of securities and wire fraud, describing a bizarre scheme to bilk hedge funds. The Securities and

Exchange Commission filed a civil suit making largely the same allegations against the 58-year-old Mr. Dreier.

After an initial hearing Monday, New York attorney Gerald Shargel, who represents Mr. Dreier in the U.S., declined to comment beyond saying, "This is a complicated matter and the facts are beyond the

reach of sound bite."

Mr. Dreier surrendered to authorities Sunday night after returning from Canada, where he was charged last week with impersonating another person to complete a business transaction. A bail hearing is

scheduled for Thursday; Mr. Dreier remains in custody in New York.

Partners at Dreier LLP say the charges in the U.S. likely mark the fall of the law firm, which Mr. Dreier founded as the sole equity partner in 1996. On Monday, the firm was issued a grand-jury

subpoena, ordering it to produce documents related to Solow Realty and about two dozen other firms, including Fortress Investment Group LLP, Perella Weinberg Partners LLP and Paulson & Co. The

subpoena didn't state the reason for requesting the documents. Read

more

Marc Dreier's $400M Scam, The Inside Story

60 Minutes, CBS News

September 20, 2010

If it hadn't been for Bernie Madoff, the most famous white collar criminal in America right now would probably be Marc Dreier. If that name is not ringing a bell, it's

because Dreier's $400 million Ponzi scheme was blown off the front pages by Madoff's arrest just a few days later.

But the case is no less fascinating.

The highly respected attorney who ran a big Park Avenue law firm was initially arrested in Toronto for impersonating an officer in a pension fund, in what has been

described as perhaps the most bizarre arrest in the history of white collar crime.

But unlike Bernie Madoff, Marc Dreier agreed to talk to Vanity Fair magazine and to 60 Minutes, his only television interview.

Marc Stuart Dreier, Wikipedia

Former Colleague’s ‘Unraveled’ Doc Film Focuses on

Ex-Attorney Marc Dreier’s Spectacular Downfall

ABA Journal Law News Now

by Martha Neil

March 16, 2012

When Marc Dreier's 250-attorney law firm collapsed at the end of 2008, as news began to come out that the powerful partner had been running a $400 million Ponzi scheme,

his downfall was a personal tragedy for Marc H. Simon.

Simon had worked at the firm, on Park Avenue in New York City, for six years, and Dreier, a 1975 graduate of Harvard Law School, had been a mentor to him as the junior

lawyer built an entertainment law practice, according to the New York Law

Journal.

Like others there, Simon also suffered a "significant financial impact" when guaranteed bonuses weren't paid, along with the loss of his job. (He is now a partner of

Cowan DeBaets Abrahams & Sheppard in New York.)

But Simon, who is also a part-time filmmaker, eventually decided his experience put him in a unique position to develop a documentary about the now-disbarred Dreier, who

is serving a 20-year federal prison term.

The movie, Unraveled, is the third the 38-year-old Simon has produced. It has been shown at film festivals, and is scheduled to premiere in New York's Village East

Cinema on April 13. Showings are also expected in Los Angeles and, possibly, the nation's capital, the article reports. A website for the film has the theater dates.

Simon interviewed Dreier, now 61, for nearly 50 hours in 2009, before he went to prison, to obtain the material that forms the basis of Unraveled. The film allows Dreier

to tell his side of the story to the audience, which can then form its own opinion of him.

Dreier offers various explanations and excuses for selling bogus paper to sophisticated investors to raise cash to fuel his law firm operations and lavish

lifestyle.

The movie says that his crimes began in 2003, at a time when he was dissatisfied with both his marriage and his career, and he explains that he initially intended only

to use a client's credit to borrow money he couldn't get on his own, the New York Law Journal recounts. Then, as his expenses grew, a "domino effect" required him to spend more and more time faking

paperwork and handling inquiries as he sought to cover up his wrongdoing and keep the financial situation from imploding.

The only time Dreier shows emotion, tearing up, is when he talks briefly of his mother's disappointment in him.

Creditors of the law firm have sought some $500 million in its bankruptcy case, but most reportedly have gotten nothing and are not likely to see anything more down the

road. Lawyers representing them question whether the film did anything other than stoke Dreier's ego.

The film intercuts interview footage with other material and news clips, ending with Dreier's sentencing.

"As much as Dreier wants to put his spin and or rationalization on his actions, when an individual such as Dreier crosses the line, he is held accountable and ultimately

silenced by the judicial system. The arc of the film is a countdown to the sentencing order," Simon told the legal publication by e-mail. "That's the proper ending." Read more