Page under construction

Bank Failure: The Park Avenue Bank, Valdosta, Georgia

FDIC Press Release PR-79-2011

April 29, 2011

Bank of the Ozarks, Little Rock, Arkansas, Acquires All the Deposits of Two Georgia Banks First Choice Community Bank, Dallas and The Park Avenue Bank, Valdosta

Bank of the Ozarks, Little Rock, Arkansas, acquired the banking operations, including all the deposits, of two Georgia-based banks. To protect

depositors, the Federal Deposit Insurance Corporation (FDIC) entered into purchase and assumption agreements with Bank of the Ozarks. First Choice Community Bank, Dallas, Georgia, and The Park Avenue Bank, Valdosta, Georgia, were closed today by the Georgia Department of Banking and Finance, which

appointed the FDIC as receiver.

The FDIC and Bank of the Ozarks entered into loss-share transactions on the failed banks' assets. The loss-share transaction for First Choice Community Bank was $260.7 million; and the loss-share

transaction for The Park Avenue Bank was $514.1 million. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First Choice Community Bank will be $92.4 million; and for The Park

Avenue Bank, $306.1 million. Bank of the Ozarks' acquisition of all the deposits of the two institutions was the "least costly" option for the DIF compared to all alternatives.

FDIC Failed Bank Information for The Park Avenue Bank, Valdosta, GA

On Friday, April 29, 2011, The Park Avenue Bank, Valdosta, GA was closed by

the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is

closed.

Loss-Share Questions and Answers

What is loss sharing?

A Borrower's Guide to an FDIC Insured Bank Failure

Park Avenue Bankshares,

Inc.

3250 North Valdosta Road

Valdosta, GA 31604-3460

Attention: Donald J. Torbert, Jr.

1-229-241-2775

Link to The Park Avenue Bank Yahoo Finance

The books and records of The Park Avenue Bank reflect that it issued $20,000,000 in FDIC-guaranteed debt under the Debt Guarantee Program component of the FDIC's Temporary Liquidity Guarantee Program. Deutsche Bank Trust Company Americas was designated as the duly authorized representative for the purpose of making claims and taking other permitted or required actions under the Debt Guarantee Program. For more information on the FDIC's Temporary Liquidity Guarantee Program, please refer to the FDIC's web site at: www.fdic.gov/regulations/resources/TLGP.

Form 10-Q, PAB Bankshares, Inc..pdf

Adobe Acrobat document [367.4 KB]

Form 10-Q (short) PAB Bankshares, Inc..p[...]

Adobe Acrobat document [22.2 KB]

Georgia Department of Banking and Finance

The Park Avenue Bank, Valdosta, Georgia

Atlanta, Georgia - The Georgia Department of

Banking and Finance ("Department") took possession of The Park Avenue Bank, Valdosta, Georgia on April 29, 2011. The Superior Court of Lowndes County issued an Order appointing the Federal

Deposit Insurance Corporation ("FDIC") as Receiver of the Bank effective upon the Department taking possession of The Park Avenue Bank.

Georgia Department of Banking - Took Pos[...]

Adobe Acrobat document [270.0 KB]

Bank of the Ozarks acquires Valdosta bank; FDIC assures deposits safe

The Valdosta Daily Times

by Dean Poling, April 30, 2011

VALDOSTA — After more than 50 years of business, Park Avenue Bank closed its doors Friday afternoon. It is

scheduled to reopen today as part of Bank of the Ozarks, which is headquartered out of Little Rock, Ark. The Federal Deposit Insurance Corporation has insured all deposits and all Park Avenue Bank

depositors automatically become depositors of the Bank of the Ozarks, according to the FDIC.

__________________________________________________________________

Sophisticated Bank Robbery, or

Legitimate Executive Compensation?

The Park Avenue Bank failed April 29, 2011. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for bank’s failure is $306.1 million.

However R. Bradford Burnette did much better, he walked away with at least $1,422,831 from the bank’s holding company in 2009 at a time when the bank was losing

millions.

Is this sophisticated bank robbery, or legitimate bank executive compensation? See my letter to Allen Stanley, Assistant Vice President of the Federal Reserve Bank of Atlanta, and the response

by Fed Counsel Rebecca F. Wasserman January 26, 2011.

2011, 01-26-11, FED response to NJG, Reb[...]

Adobe Acrobat document [79.9 KB]

Ms. Wasserman wrote "Regulatory information that the Federal Reserve receives about the institutions that it examines is legally protected by the bank examiner privilege. This privilege extends to the information you have requested concerning the Federal Reserve's reasoning behind certain supervisory actions and consideration of possible future supervisory actions. Therefore, the Federal Reserve cannot respond to the questions posed in your letter."

The Park Avenue Bank was loosing millions of dollars in July 2009 when the Federal Reserve and the Georgia Banking Commissioner entered into a Written Agreement with Park Avenue Bank, PAB Bankshares, and their institution-affiliated parties to strengthen credit risk management practices and improve assets, etc., Docket Nos. 09-084-WA/RB-HC and 09-084-WA/RB-SM. See the Written Agreement below in PDF.

2009, 07-20-09, FED, GA Banking, Written[...]

Adobe Acrobat document [108.5 KB]

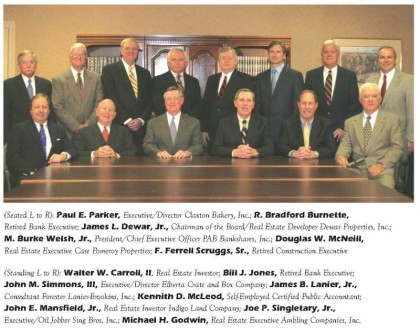

Reuters reported that R. Bradford Burnette was paid $1,809,870 in 2009 by PAB Bankshares, Inc., the bank’s holding company. Mr. Burnette is described in PAB Bankshares’ Annual Report as a Retired Bank Executive. According to the 2009 Director Compensation Table, Mr. Burnette was paid $202,292, as follows: Fees earned $32,556; Option awards $4,649; all other $165,087. The 2009 Director Compensation Table is below in PDF, and is page 127 in the 2009 Annual Report.

According to the 2009 Director Compensation Table, the Company entered into a salary continuation agreement with Mr. Burnette while he was employed as an executive of the Company that would provide Burnette with $165,087 per year for 15 years commencing when he turned age 65. At December 31, 2009, the net present value of the remaining payments due to Mr. Burnette was $1,220,539 using a discount rate of 6.36%. Still, that leaves $387,039 not accounted for from the Reuters story:

___________________________________________________

As of December 30, 2009

Reuters, Bradford Burnette, $1.8M compen[...]

Adobe Acrobat document [102.2 KB]

Salary continuation agreement with Mr. Burnette

2009 Director Compensation, salary conti[...]

Adobe Acrobat document [186.4 KB]

On December 13, 2010 the Federal Reserve found the bank was significantly undercapitalized and ordered it to raise investor cash or sell itself within 90 days. See the Federal Reserve Prompt Corrective Action Directive (Docket No. 10-231-PCA-SM), especially paragraphs 2, 4 and 5 restricting payments.

Park Avenue Bank, December 13, 2010

2010, 12-13-10, FED, Prompt Corrective A[...]

Adobe Acrobat document [14.0 KB]

Once again, the FDIC estimates the cost to the Deposit Insurance Fund for failure the of The Park Avenue Bank is $306.1 million. Below is the board of PAB Bankshares, Inc.

PAB Board, Executive, Senior Management [...]

Adobe Acrobat document [344.6 KB]

2002 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [983.5 KB]

2003 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [514.6 KB]

2004 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [361.2 KB]

2005 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [2.7 MB]

2006 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [4.4 MB]

2007 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [3.4 MB]

2007 Investor Presentation, PAB Bankshar[...]

Adobe Acrobat document [877.1 KB]

2007, PAB Bankshares, Inc. conference pr[...]

Adobe Acrobat document [264.8 KB]

2008 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [1.5 MB]

2009 Annual Report, PAB Bankshares, Inc.[...]

Adobe Acrobat document [7.1 MB]

2009 Director Compensation, salary conti[...]

Adobe Acrobat document [184.8 KB]

The Best Way to Rob a Bank Is to Own One

The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians

Looted the S&L Industry

William K, Black, author

Persons interested in the economics of fraud, the S&L debacle, the problems of financial regulation, and microeconomics more broadly will find this book to be very important. It is a marvelous

combination of insider experiences, well-grounded generalizations, and the foundations of a broader research agenda. It merits a wide readership and, one hopes, sustained reflection on its arguments

and conclusions. (Robert E. Prasch Journal of Economic Issues )

Bill Black has detailed an alarming story about financial and political corruption….the lessons are as fresh as the morning newspaper. One of those lessons really sticks out: one brave man with a

conscience could stand up for us all. (Paul Volcker, former chairman of the Federal Reserve ) Read more